Tutorial Pengisian e-SPT PPh Pasal 21/26

Summary

TLDRThis tutorial guides users through calculating and reporting Indonesian Income Tax (PPh) Article 21 using the ISP PPh 21 application. It covers preparing a computer, installing the latest version of the app, logging in as an administrator, entering taxpayer data, creating and filling out SPT forms for both permanent employees above and below the tax threshold, and non-employees. It also explains how to input transaction data, make payments, save and verify information, and finally, how to report SPT PPh 21 by uploading a CSV file through the official tax website.

Takeaways

- 💻 Ensure your computer or laptop meets the necessary specifications and has the required software installed before starting.

- 🌐 Make sure your device is connected to the internet to download the latest version of the e-SPT PPh Pasal 21 application from www.pajak.co.id.

- 🔑 Log in to the ISP PPh Pasal 21 application with 'administrator' as the username and '123' as the password for first-time use.

- 🧾 Input your NPWP and tax profile data as the tax withholder for PPh Pasal 21 when prompted.

- 📄 To create a new SPT, go to the menu, select 'SPT,' and click 'Create New SPT,' entering the correct tax period.

- 🧑💼 For employees with income above the non-taxable income (PTKP) threshold, enter their NPWP, income details, and the amount of tax withheld.

- 👥 For employees with income below the PTKP, input the number of employees and their gross income in section B.

- 🏢 For non-permanent employees, choose 'Non-final 1721' and fill in the relevant details for the tax code and gross income.

- 💰 After calculating the owed tax, ensure the payment is made to receive a transaction receipt (NTPN), which will be needed for the next steps.

- 📤 Complete the SPT filing by creating a CSV file for submission through e-filing, using the 'Lapor' menu at www.pajak.co.id and verifying the submission with a code sent via email or SMS.

Q & A

What is the purpose of the tutorial?

-The tutorial is for calculating, creating proof, compiling, and reporting SPT (Surat Pemberitahuan Potong) for PPh pasal 21 using the ISP pasal 21 application.

What are the minimum requirements to use the ISP pasal 21 application?

-You need a computer or laptop with internet connection and the latest version of the ISP pasal 21 application installed.

How do you download the ISP pasal 21 application?

-You can download the application from the official website www.pajak.co.id after logging into your browser.

What are the login credentials for the ISP pasal 21 application?

-The default username is 'administrator' and the password is '123'.

What information is required to fill out for the first time use of the ISP pasal 21 application?

-You need to input your NPWP (Nomor Pokok Wajib Pajak) and the tax profile data of the withholding agent.

How do you create a new SPT in the ISP pasal 21 application?

-Select 'SPT' from the menu, then choose 'Create New SPT', enter the SPT period, and click 'Create SPT'.

What are the two parts of the SPT form in the application?

-The SPT form is divided into Part A for employees with income above the tax threshold (PTKP) and Part B for employees with income below PTKP.

How do you input data for employees with income above PTKP?

-Click 'Add', fill in the data such as NPWP number, name, tax object code, gross income, and the calculated withheld tax, then click 'Save'.

What is the process for inputting transactions for non-employees?

-Select 'Fill SPT', then choose 'List of Withholding' and select 'Not Final 17212'. Add the transaction data by clicking 'New' and filling in the required fields such as NPWP number, name, population and family registration number, and address.

How do you report the SPT after filling it out?

-After completing the SPT filling, select 'Create SPT' from the menu, choose the reporting period, and click 'Create' to generate a CSV file for reporting.

What is the process for importing CSV data for employees' salary and PPh pasal 21 calculations?

-Prepare the required data such as the employee salary list and PPh pasal 21 calculations for each employee, input this data into a CSV file using Microsoft Excel, change the NPWP column format from 'General' to 'Number', and then use the 'Import CSV' menu option in the application to import the data.

How do you verify the reported SPT PPh pasal 21 data?

-After uploading the CSV file on www.pajak.co.id, you will be directed to a verification page where you should ensure the reported SPT PPh pasal 21 data is accurate.

How do you receive the verification code for the reported SPT?

-The verification code can be sent via email or SMS to the phone number registered in the system. The tutorial suggests selecting email to receive the verification code.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Cara Mudah: Buat Bukti Potong dan Lapor SPT Masa PPh 21/26 dengan e-Bupot (Tutorial Lengkap)

Aspek Pajak Koperasi (Part 2)

Cara Lapor SPT PPh 21 Desember Tahun 2024

Cara Menghitung dan Melaporkan PPh 21 Di Dalam Core Tax

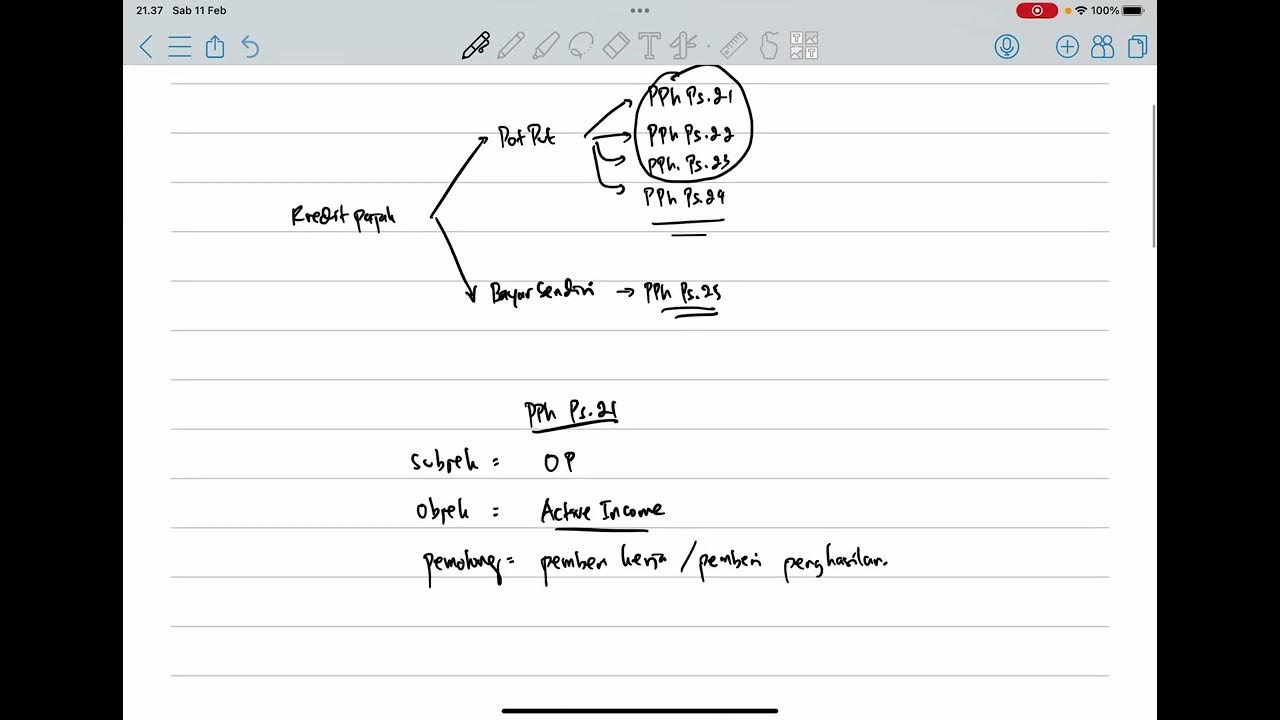

PPh Orang Pribadi (Update 2023) - 5. Kredit Pajak

Menghitung Pajak Penghasilan Pasal 21 || Materi Ekonomi Kelas XI

5.0 / 5 (0 votes)