Cara Lapor SPT PPh 21 Desember Tahun 2024

Summary

TLDRThis video provides a detailed guide on how to report PPh 21 for December 2024, specifically focusing on the A1 tax slip (annual report). It walks through the steps to input tax data on the DJP online portal, detailing how to handle December's PPh 21 and annual income. The script emphasizes the importance of keeping accurate records, using a pre-made worksheet to calculate tax for multiple employees, and utilizing an import format to streamline the process. Viewers are encouraged to access an Excel tool that helps simplify tax reporting, available through a link in the description.

Takeaways

- 😀 The process of reporting PPH 21 for December 2024 requires a different approach compared to previous years, where both December and the annual A1 were typically combined.

- 😀 For 2024, the process is simplified, and you only need to report the A1 form directly without combining it with the December PPH 21.

- 😀 The DJP Online platform is used for submitting the tax report, and it's assumed that users are familiar with how to log in and navigate the platform.

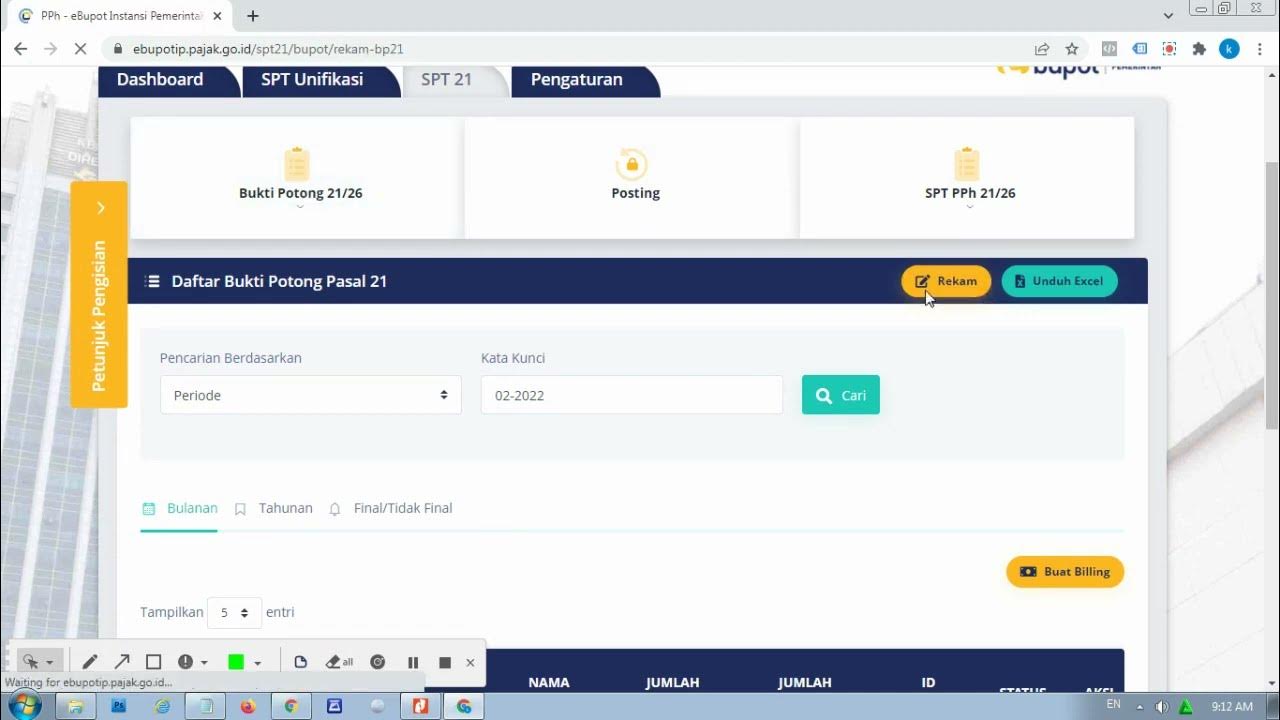

- 😀 To create the December PPH 21 report, users can access the 'Bukti Potong' section and then select the 'Rekam' option for creating the A1 form.

- 😀 When inputting data, users must provide either the NPWP or NIK, with NPWP automatically filling in relevant information like name and address, while NIK requires manual input.

- 😀 The report should include the gross income for December and the total income for the entire year, from January to December, along with other relevant data.

- 😀 A key tool for preparing the report is the 'kertas kerja' (work paper) that helps track total income and deductions throughout the year, preventing confusion.

- 😀 An example of how the 'kertas kerja' helps in organizing monthly data (January to December) is provided, which prevents errors when calculating the total for the year.

- 😀 The PPH 21 report data, including gross income, pension salary, and deductions, should be copied into the provided Excel template for easier input into the DJP Online system.

- 😀 A link to download an Excel format for the work paper is provided, and users can access it for a one-time fee, with lifetime updates and support from a tax group.

Q & A

What is the main topic of the video script?

-The video script discusses how to report PPh 21 for December 2024, specifically focusing on the process of creating proof of tax deduction for December and annual A1 tax forms.

What is the confusion faced by tax staff regarding the PPh 21 reporting for December?

-Tax staff are confused about whether to report the December PPh 21 deductions as separate from the annual A1 tax form or if they should combine them as was done in previous years.

How has the process of reporting PPh 21 changed in 2024 compared to previous years?

-In 2024, the reporting of PPh 21 is simplified by directly filing the A1 tax form for the annual report, rather than separating the December deductions from the yearly total as done in the past.

What is the first step in creating a proof of tax deduction for PPh 21 in the DJP online system?

-The first step is to log into the DJP online system and navigate to the 'Bukti Potong' (Proof of Tax Deduction) section under the dashboard menu.

How do you input data for a December PPh 21 deduction in the DJP online system?

-You need to select 'Rekam' (Record) and then choose 'Bupot Tahunan A1' for December. Input the necessary information such as NPWP (Taxpayer ID), or Nik (if applicable), and ensure that the year is set to 2024 with the month range from 1 to 12.

What should be entered as the gross income for the December PPh 21 deduction?

-For the December PPh 21 deduction, you need to input the gross income for the month of December as well as the total income for the entire year (January to December).

Why is it important to have a 'Kertas Kerja' (working paper) for the PPh 21 calculation?

-Having a 'Kertas Kerja' (working paper) is important because it helps to track and verify the annual income, deductions, and other tax-related details, making it easier to fill out the PPh 21 forms without confusion.

What can be used to simplify the process of inputting the PPh 21 data?

-To simplify the process, you can use an Excel template that automatically formats the necessary data for input into the PPh 21 form, such as the gross income, pension, and bonuses.

What additional resources are offered to help with the PPh 21 reporting process?

-The video provides access to an Excel template for PPh 21 calculations and offers updates whenever there are changes. There is also a paid investment for long-term use and access to a group for tax-related discussions.

How can one access the Excel template for PPh 21 calculations?

-The Excel template for PPh 21 calculations can be accessed through a link in the video description, with a one-time payment of IDR 99,000 for lifetime access and updates.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Membuat Bukti Potong PPh 21 Karyawan Tahun 2025 Coretax

Tata Cara input PPh 21 di E-Bupot dan Pelaporannya

Angsuran PPh Pasal 25: Cara Menghitung dan Melaporkannya

CARA BUAT BUKTI POTONG PPH 21 KARYAWAN DAN LAPOR SPT MASA PPH 21 DI CORETAX MULAI 2025

Tutorial Pengisian e-SPT PPh Pasal 21/26

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

5.0 / 5 (0 votes)