How To Understand Market Structure | FOREX | SMC (Part 1)

Summary

TLDRThis video delves into price action trading strategies, focusing on identifying changes in market structure, including bullish and bearish changes of character (CHoC), break of structure (BoS), and pullbacks. The speaker explains how to spot reversals and continuations using swing highs, lows, and minor structure changes to align trades with the broader trend. Emphasizing the importance of internal structure and weak points, the tutorial also covers multi-timeframe analysis for more precise entries. Aimed at traders of all levels, the content encourages applying learned concepts through practical exercises and analysis.

Takeaways

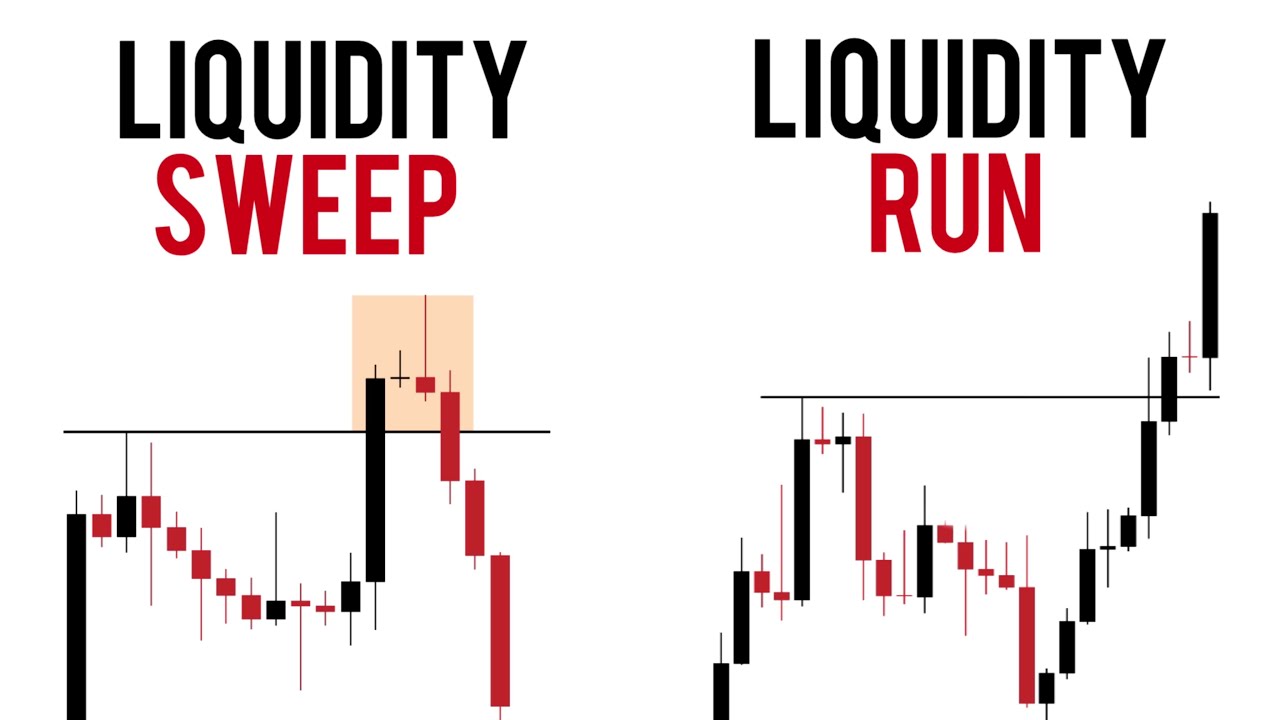

- 😀 Identifying 'Change of Character' (CHoC) is crucial for recognizing trend reversals. A bullish CHoC happens when a previous low is taken out, signaling a shift to a bullish trend, while a bearish CHoC occurs when a high is taken out, suggesting a bearish trend change.

- 😀 After a CHoC, price often pulls back to key areas like swing highs (for bullish trends) or swing lows (for bearish trends), providing opportunities for counter-trend trades.

- 😀 Internal price structure should align with the larger trend before confirming trend reversals or continuations. If internal structure switches direction, it is a sign that a trend might change.

- 😀 Weak highs and lows are significant for entry points. A weak high fails to take out a low, while a weak low fails to break a swing high. These points are potential areas to target for trades.

- 😀 After identifying a trend change or reversal, one must confirm the pullback by waiting for a 'Change of Character' to align with the structure, ensuring a higher probability of success in the trade.

- 😀 For reversals, after a price breaker structure, wait for the internal structure to realign with the larger trend. This is necessary to ensure the pullback is over and the trend continuation is ready to start.

- 😀 In cases of trend failure at the top of the range, a change of character can signal that the price is likely to move higher, even when the previous trend structure suggested a downturn.

- 😀 Breaker structures mark key price movements where the trend has shifted. After a breaker structure, a pullback into a supply or demand zone can offer an opportunity for trades aligned with the new trend.

- 😀 Multi-timeframe analysis can enhance predictions of pullback depth and trend continuation, but it's not always possible to predict exactly how far the price will go.

- 😀 The key to successful trading in this strategy lies in observing swing highs and lows, using price action to determine whether to trade in the direction of the trend or counter-trend.

- 😀 The speaker offers a comprehensive course that provides a full trading plan and strategy, from beginner to advanced techniques, with practical examples of applying concepts to live market conditions.

Q & A

What is a 'change of character' (COC) in trading, and how is it used to identify trend reversals?

-A 'change of character' (COC) refers to a shift in market structure where price moves in a way that suggests a potential reversal in trend. A bullish COC occurs when a swing high is taken out, indicating a shift from bearish to bullish momentum. A bearish COC happens when a swing low is taken out, signaling a potential shift from bullish to bearish momentum. Traders use these changes to anticipate future price movements and adjust their positions accordingly.

How does the speaker use the concept of weak highs and lows in trend analysis?

-The speaker mentions that weak highs and lows are points in price structure that fail to create new opposing highs or lows, making them significant for identifying potential reversals. A weak high fails to take out a low, and a weak low fails to take out a high. These weak points can act as targets for trades, as price is likely to reverse or continue in the direction of the underlying trend after reaching these points.

What does the speaker mean by 'internal structure' aligning with 'swing structure' in price analysis?

-The 'internal structure' refers to smaller, short-term price movements within a larger trend. The 'swing structure' is the broader market trend characterized by higher highs and higher lows in bullish markets, or lower highs and lower lows in bearish markets. The speaker suggests that for a trend reversal to be confirmed, the internal structure must align with the swing structure, meaning that the smaller price movements should reflect the broader market trend.

How does the speaker anticipate when a pullback has ended and the next trend is about to begin?

-The speaker looks for a change of character in the internal structure after a pullback. When the internal structure forms a new lower high or higher high in line with the broader trend (depending on whether the trend is bullish or bearish), it indicates that the pullback has likely ended, and the new trend is beginning. This is confirmed by a subsequent move in the direction of the trend after the pullback.

What role does multi-timeframe analysis play in the speaker’s trading approach?

-Multi-timeframe analysis allows traders to confirm trends and reversals across different timeframes, offering a broader perspective of market conditions. The speaker uses this method to align trades with the larger market trend, increasing the probability of success. By analyzing multiple timeframes, traders can spot high-probability entry points and validate their setups.

Why is the concept of 'breaker structure' important in the analysis of trend changes?

-The 'breaker structure' refers to the price action that breaks through previous levels of support or resistance, indicating a shift in market sentiment. In the context of trend changes, a breaker structure helps confirm that the market has shifted from one trend to another, such as from bearish to bullish or vice versa. This break often signals the end of a trend and the start of a new one, making it a critical component of the speaker's analysis.

What is the significance of supply and demand zones in this trading strategy?

-Supply and demand zones are key areas where price is likely to reverse or consolidate. These zones represent levels where buyers (demand) or sellers (supply) have historically shown strong reactions. The speaker uses these zones to identify potential areas for price pullbacks, where traders can enter trades in anticipation of a trend reversal or continuation.

How does the speaker manage risk and target price levels when entering a trade?

-The speaker manages risk by identifying weak highs and lows in the market, which are areas where price is likely to reverse. Traders can set their stop-loss orders just beyond these weak points. Target price levels are typically set at previous swing highs or lows, with an emphasis on weak points of structure that failed to reach new highs or lows. This approach helps traders manage their risk while targeting high-probability price levels.

What does the speaker suggest for traders who are new to the concepts discussed in the video?

-For new traders, the speaker suggests watching the video multiple times to reinforce the concepts and gain a deeper understanding. They emphasize the importance of practice and applying the strategies to real price action. The speaker also recommends using their course and mentoring program for a more structured learning experience, with a combination of theory and practical exercises.

What is the purpose of the speaker’s course, and how does it help traders improve their skills?

-The speaker’s course aims to teach traders both the theory and practical application of the concepts discussed in the video, from beginner to advanced levels. The course includes lessons on price action, trend analysis, and a mechanical trading strategy. It is designed to help traders understand how to analyze the market, manage trades, and develop a personalized trading plan. Additionally, the course offers real-time walkthroughs, allowing students to compare their analysis with the speaker’s to improve their skills.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)