ICT Market Structure Simplified!

Summary

TLDRThis video delves into the concept of market structure in trading, explaining bullish and bearish trends, break of structure (BoS), and the significance of trend changes. It covers practical scenarios for both long and short trades, emphasizing how to identify these patterns through higher and lower time frame analysis. The video also outlines a high-probability approach to trading market structure, combining strategic use of news events and trend analysis. Additionally, it introduces an alternate range and trend strategy for ranging and trending markets, offering a comprehensive guide to navigating various market conditions.

Takeaways

- 😀 Bullish market structure is characterized by higher highs and higher lows, indicating an uptrend.

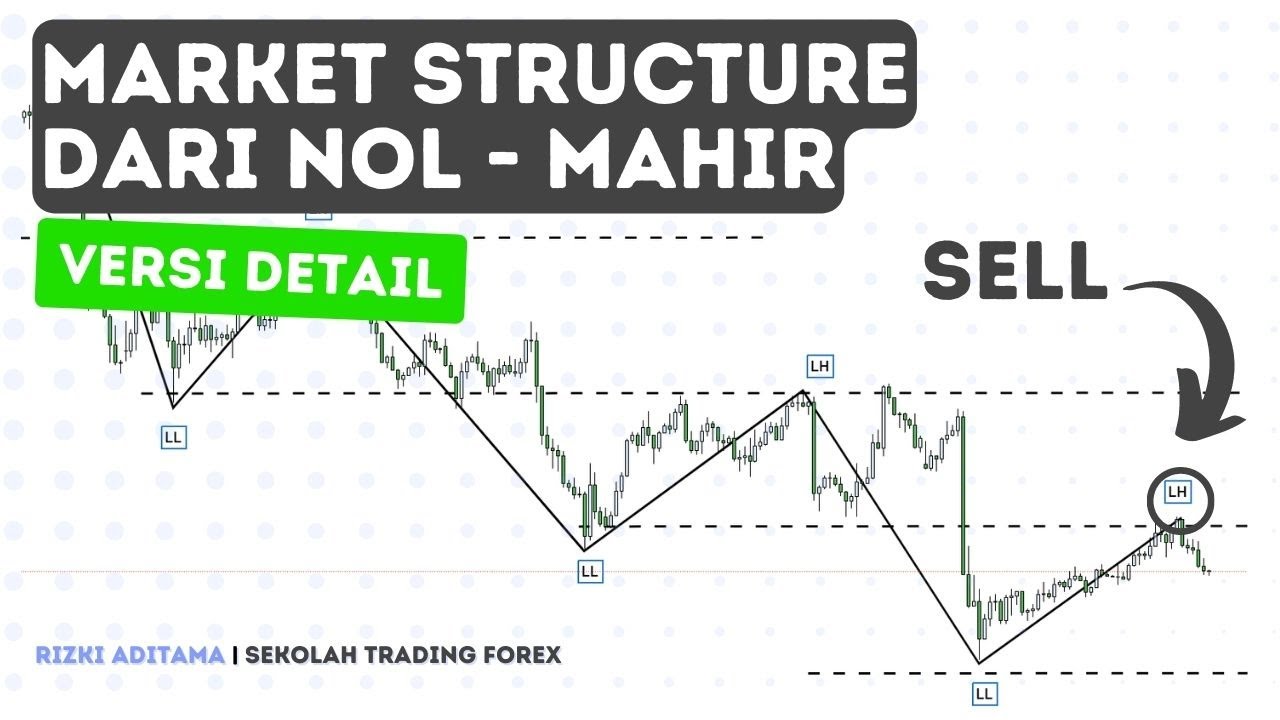

- 😀 Bearish market structure is defined by lower highs and lower lows, signaling a downtrend.

- 😀 The higher timeframes (e.g., 4H) provide more reliable market structure signals, while lower timeframes (e.g., 1M, 15M) are useful for entries.

- 😀 Break of Structure (BoS) occurs when price creates a higher high in a bullish trend or a lower low in a bearish trend, confirming a market shift.

- 😀 Trend changes happen when the market fails to respect the previous high or low, often confirmed by displacement and candle closures.

- 😀 Displacement is crucial for confirming trend changes; without it, the trend might not reverse.

- 😀 For long trades, two common scenarios are: price taps into a higher timeframe order block without breaking the low, or it takes liquidity and moves upwards.

- 😀 For short trades, price either fails to break the previous high in a downtrend or takes out buy-side liquidity before moving down.

- 😀 High probability trading involves identifying key price levels on a higher timeframe, confirming the scenario (long or short), waiting for news or key moves, and executing on a lower timeframe.

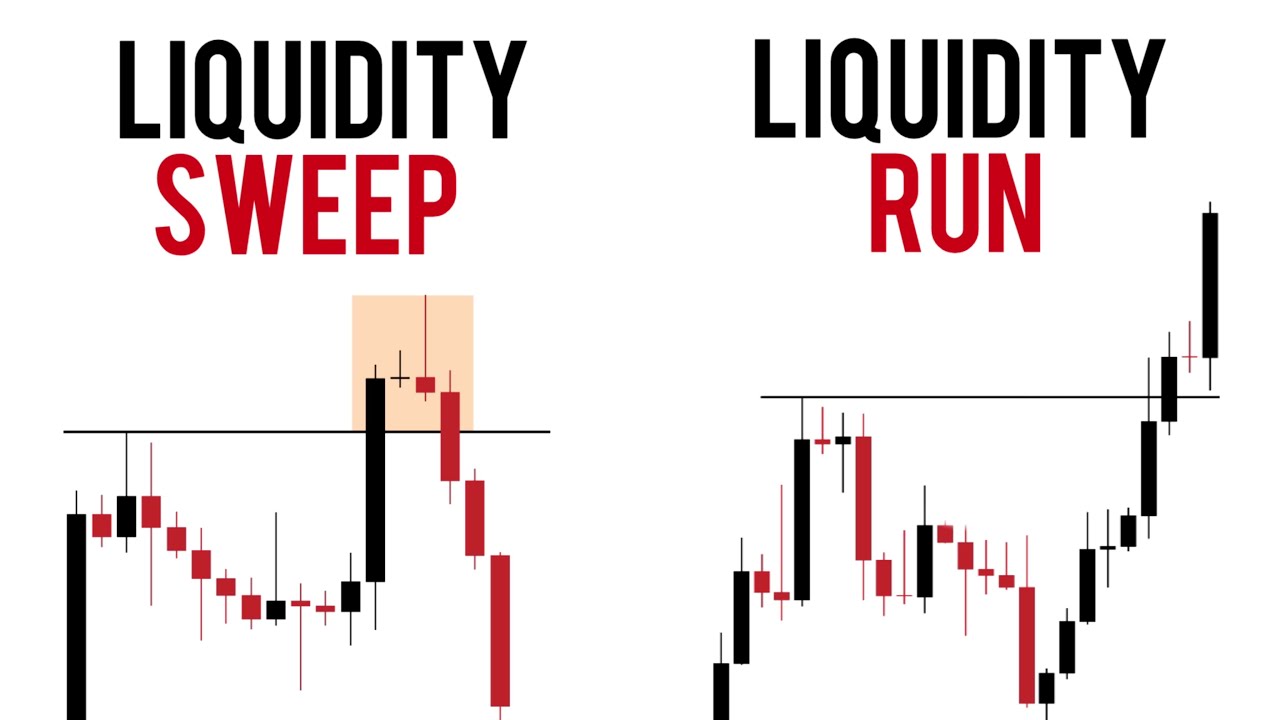

- 😀 Range and trend trading strategies are an alternative approach, focusing on shorting at the sweep of highs in ranging markets and long trades at the sweep of lows.

- 😀 In trending markets, wait for a lower timeframe range to form and then trade the breakout or retracement based on the market direction.

Q & A

What is the difference between bullish and bearish market structure?

-Bullish market structure is characterized by higher highs and higher lows, indicating an uptrend, while bearish market structure involves lower highs and lower lows, showing a downtrend.

Why is higher timeframe market structure more reliable?

-Higher timeframe market structure, such as the 4-hour or greater, provides clearer signals and is more reliable because it reflects broader trends, reducing the noise present in lower timeframes.

What is a break of structure (BOS)?

-A break of structure occurs when the market creates a new high or low that breaches previous highs or lows, signaling a potential change in trend direction.

How do you confirm a break of structure?

-A break of structure is confirmed when there is a candle closure above the previous high in an uptrend or below the previous low in a downtrend.

What is a trend change, and how does it occur?

-A trend change occurs when the market fails to respect previous highs and lows. It is confirmed by a failure to make higher highs in a bullish market or lower lows in a bearish market, often accompanied by displacement and candle closures.

What role does displacement play in trend changes?

-Displacement is the key factor in confirming a trend change. It occurs when the market breaks a previous high or low with significant movement, often seen through large price movements or closed candles in the opposite direction.

What is the difference between 'front running' and 'taking liquidity' in a market structure context?

-'Front running' refers to entering a position before the market reaches a significant level (like an order block) without taking out previous liquidity, while 'taking liquidity' involves triggering stop orders or taking liquidity from previous market levels before moving in the intended direction.

How can you trade using the high probability way of trading market structure?

-To trade with a high probability, first identify the higher timeframe market structure (like daily or 4-hour PD), then observe the lower timeframe for trend changes or reversals, ensuring displacement occurs and waiting for confirmation via candle closures.

What is the alternate strategy to market structure discussed in the video?

-The alternate strategy is the range and trend trading system, which involves identifying whether the market is ranging or trending. In a ranging market, short positions are taken at the sweep of the highs, and long positions at the sweep of the lows. In trending markets, positions are taken when a lower timeframe range forms above or below swing highs or lows.

What is the significance of fair value gaps in trading market structure?

-Fair value gaps, or order blocks, represent key price levels where price imbalance occurs. They act as support or resistance zones. In a bullish trend, price should respect these gaps on pullbacks, while in bearish trends, they may provide points for shorting.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Understand Market Structure | FOREX | SMC (Part 1)

Advanced Market Structure Course (step by step) SMC

Liquidity Run Or Liquidity Sweep ( Purge Or Bos )

Ultimate Market Structure Course - Smart Money Concepts

1. Market Structure | Full Forex course you will ever need [Free]

Trading Cepat dan Mudah dengan Market Structure (Detail)

5.0 / 5 (0 votes)