Rasio Keuangan, PPT Rasio Keuangan

Summary

TLDRThis video explains the importance of financial ratios in assessing a company's performance, focusing on liquidity, profitability, solvency, and activity ratios. It provides an overview of key ratios, including the current ratio, quick ratio, gross profit margin, net profit margin, and return on investment. The speaker demonstrates how these ratios are used in practice with an example from Semen Indonesia, showing the company's financial trends from 2013 to 2015. The explanation emphasizes how financial ratios help evaluate a company's ability to meet short-term obligations, generate profit, and manage assets and equity.

Takeaways

- 😀 Financial ratios are tools used to measure a company's performance based on data from financial statements such as balance sheets, income statements, and cash flow statements over a specific period.

- 😀 There are four main types of financial ratios: liquidity ratios, profitability ratios, solvency ratios, and activity ratios.

- 😀 Liquidity ratios assess a company's ability to meet short-term financial obligations, with examples including the current ratio, quick ratio, and cash ratio.

- 😀 Profitability ratios evaluate a company's ability to generate profit, including gross profit margin, net profit margin, and return on investment (ROI).

- 😀 Solvency ratios measure a company's ability to meet long-term financial obligations, such as the debt-to-assets ratio and the debt-to-equity ratio.

- 😀 Activity ratios examine how efficiently a company uses its assets, with examples like accounts receivable turnover, inventory turnover, fixed asset turnover, and total asset turnover.

- 😀 The current ratio helps assess a company's ability to pay its short-term debts with current assets.

- 😀 The quick ratio measures the ability to pay short-term debts without relying on inventory.

- 😀 Gross profit margin reflects the percentage of revenue left after paying the cost of goods sold, while net profit margin includes all expenses.

- 😀 The return on investment (ROI) ratio shows how effectively a company uses its investments to generate profit, measured as net profit after taxes divided by the total investment.

- 😀 The script provides an example of financial ratio application at Semen Indonesia, demonstrating how profitability ratios, such as gross profit margin and net profit margin, can show trends in company performance over the years.

Q & A

What is financial ratio analysis?

-Financial ratio analysis is a tool used to measure a company's performance based on comparative data found in financial statements, such as balance sheets, income statements, and cash flow reports, within a specific period.

Why is financial ratio analysis important?

-It is important because it helps assess a company's performance, allows comparisons between companies, and evaluates the company's performance over time.

What are the four main types of financial ratios?

-The four main types of financial ratios are liquidity ratios, profitability ratios, solvency ratios, and activity ratios.

What does liquidity ratio measure?

-Liquidity ratios measure a company's ability to meet its short-term financial obligations, focusing on its liquid assets relative to its liabilities.

What are the different types of liquidity ratios?

-The different types of liquidity ratios include the current ratio, quick ratio, and cash ratio. The current ratio measures the ability to pay short-term debts with current assets, the quick ratio excludes inventory to measure the ability to pay with more liquid assets, and the cash ratio compares cash and cash equivalents to short-term liabilities.

What is the significance of profitability ratios?

-Profitability ratios measure a company's ability to generate profit from its sales or investments. They help assess how efficiently the company is managing its operations to produce a return.

What is the difference between gross profit margin and net profit margin?

-The gross profit margin measures the percentage of sales left after covering the cost of goods sold, while the net profit margin reflects the percentage of sales remaining after all expenses, including taxes and interest, have been deducted.

How does return on investment (ROI) function as a profitability ratio?

-ROI calculates a company's ability to generate returns on investments made. It is derived from the net profit after tax divided by the investment amount, and it helps assess the efficiency of investments.

What do solvency ratios measure?

-Solvency ratios measure a company's ability to meet its long-term obligations. They assess the company's financial stability and the degree to which its assets are financed through debt.

What is the role of activity ratios in financial analysis?

-Activity ratios measure how effectively a company utilizes its assets to generate sales. These ratios, including receivables turnover, inventory turnover, asset turnover, and total asset turnover, assess operational efficiency.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Ratio Analysis (Introduction) | A-Level, IB & BTEC Business

Mata Kuliah: Analisa Laporan Keuangan - Menganalisa Laporan Keuangan

mgt201 short lectures || mgt201 guess paper || mgt201 module 5

Ratio Analysis Part 1

Rasio-rasio Penting dalam Laporan Keuangan | feat. Brenda Andrina

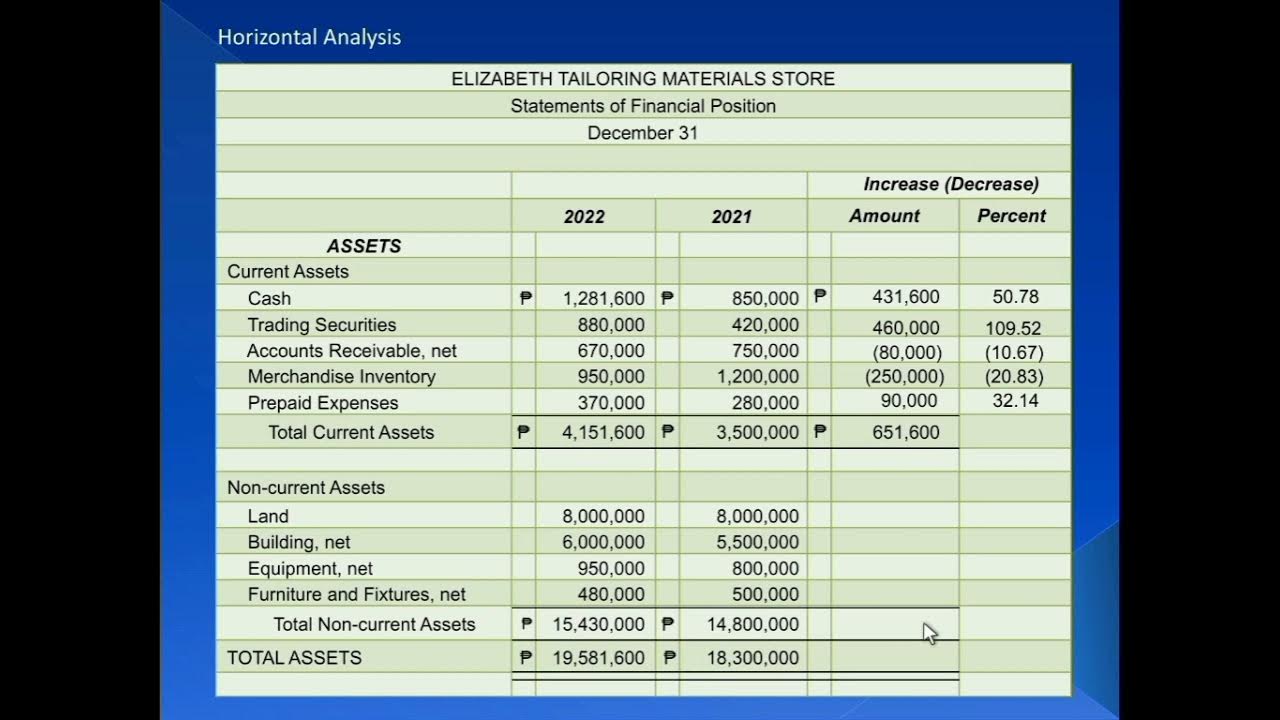

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

5.0 / 5 (0 votes)