Ratio Analysis (Introduction) | A-Level, IB & BTEC Business

Summary

TLDRThis video introduces ratio analysis, a critical tool in evaluating business performance by comparing financial data. It answers key questions like profitability, solvency, and asset management. The script explains the use of income statements and balance sheets to calculate ratios, categorizing them into profitability, liquidity, financial efficiency, and shareholder ratios. It emphasizes the importance of analyzing and acting on these ratios for business improvement.

Takeaways

- 📊 **Ratio Analysis Definition**: Ratio analysis is a method of comparing financial data to gain insights into a business's performance.

- 💼 **Business Performance**: It helps answer questions about profitability, returns on investment, solvency, and asset management.

- 📈 **Widespread Use**: Ratio analysis is a common tool used across various business sectors.

- 💡 **Insight vs. Solution**: While it provides insights, ratio analysis doesn't directly offer solutions to business problems.

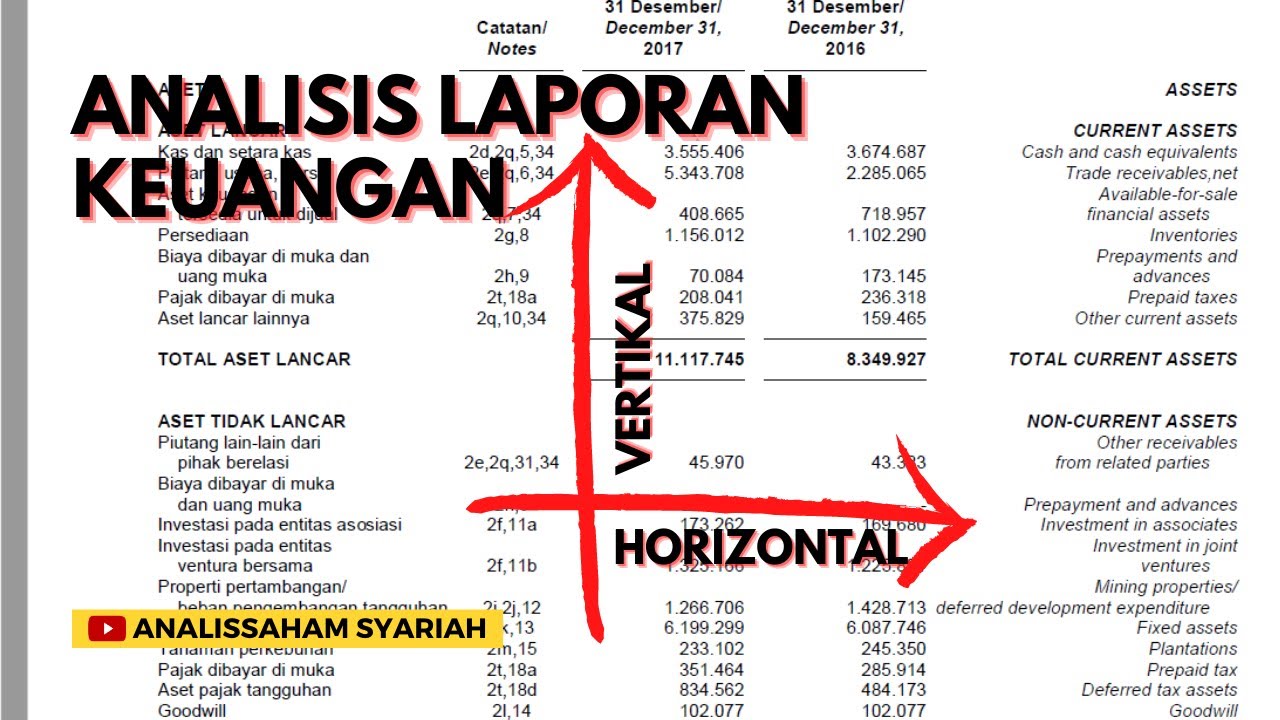

- 📋 **Financial Records**: The main sources of information for ratio analysis are the income statement and balance sheet.

- 💹 **Profitability Ratios**: These ratios measure the business's ability to earn profits and returns on capital employed.

- 💧 **Liquidity Ratios**: They assess the business's ability to pay its debts and manage its working capital.

- 🏦 **Financial Efficiency Ratios**: These ratios evaluate how effectively a business manages its finances and assets.

- 📉 **Shareholder Ratios**: Although not covered in the video, these ratios focus on returns earned by shareholders.

- 🔍 **Users of Ratios**: Various stakeholders, including shareholders, competitors, employees, and governments, use ratio analysis for different purposes.

- 📝 **Key Process**: The process of ratio analysis involves gathering data, calculating ratios, interpreting results, and taking action based on the insights gained.

Q & A

What is ratio analysis?

-Ratio analysis is a method of evaluating a company's financial health by comparing line items present in the financial statements.

Why is ratio analysis important in business?

-Ratio analysis is important because it helps to answer key questions about a business's profitability, solvency, and efficiency, providing insights into its overall performance.

What are the two main sources of information used in ratio analysis?

-The two main sources of information used in ratio analysis are the income statement and the balance sheet.

What types of questions can ratio analysis help answer?

-Ratio analysis can help answer questions about profitability, returns on investment, solvency, and asset management.

What is the difference between the income statement and the balance sheet?

-The income statement is a record of a company's financial performance over a period, while the balance sheet is a snapshot of a company's financial position at a specific point in time.

What financial data can be derived from the income statement?

-Data such as revenues, sales, costs, gross profit, operating profit, and net profit can be derived from the income statement.

What aspects of a business does the balance sheet provide information on?

-The balance sheet provides information on a business's assets, liabilities, capital, reserves, and long-term liabilities.

How are profitability ratios calculated?

-Profitability ratios are calculated using data from the income statement and can be based on revenues or the capital employed in the business.

What are liquidity ratios and why are they important?

-Liquidity ratios, such as the current ratio and the acid-test ratio, measure a company's ability to pay its short-term debts and are important for assessing solvency.

What is the purpose of financial efficiency ratios?

-Financial efficiency ratios measure how effectively a business manages its finances, including the management of working capital and the proportion of debt relative to capital.

Who are the typical users of ratio analysis?

-Typical users of ratio analysis include shareholders, competitors, employees, governments, lenders, and suppliers.

What is the final step in the ratio analysis process?

-The final step in the ratio analysis process is to take action based on the insights gained from the analysis.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)