Ratio Analysis Part 1

Summary

TLDRThis video lecture introduces ratio analysis, a financial tool that assesses relationships among financial statement items to evaluate a company's performance. It covers key types of ratios, including liquidity, profitability, and solvency ratios, explaining their significance in analyzing a firm's financial health. The current ratio and quick ratio are highlighted as crucial indicators of a company's ability to meet short-term obligations. Additionally, the concept of working capital and accounts receivable turnover are discussed, emphasizing their roles in operational efficiency. Overall, the session provides essential insights for understanding financial performance through ratio analysis.

Takeaways

- 😀 Ratio analysis is a method used to evaluate relationships between items in financial statements, offering insights into profitability, expenses, and solvency.

- 😀 The primary objective of ratio analysis is to standardize financial information for comparisons and evaluate current operations against past performance and industry standards.

- 😀 There are three main types of ratios: liquidity, profitability, and solvency ratios, each serving a specific purpose in financial analysis.

- 😀 Liquidity ratios assess a firm's ability to meet short-term commitments, with the current ratio and quick ratio being key indicators.

- 😀 The current ratio is calculated as current assets divided by current liabilities, reflecting a company's ability to pay its short-term debts.

- 😀 Working capital is defined as total current assets minus total current liabilities, indicating the capital available for day-to-day operations.

- 😀 The quick ratio (acid test ratio) measures the ability to pay current liabilities without relying on inventory, highlighting immediate liquidity.

- 😀 Profitability ratios, such as return on total assets and earnings per share, evaluate a firm's capacity to generate profit relative to various financial metrics.

- 😀 Solvency ratios, including debt to total assets ratio, assess a firm's long-term ability to meet obligations.

- 😀 Accounts receivable turnover measures the effectiveness of a company in collecting payments from credit customers, with higher turnover indicating better efficiency.

Q & A

What is the primary purpose of ratio analysis?

-The primary purpose of ratio analysis is to compute and present the relationships between items in financial statements, providing insights into profit potential, expense control, and solvency.

What are the three main types of ratios discussed in the transcript?

-The three main types of ratios discussed are liquidity ratios, profitability ratios, and solvency ratios.

How is the current ratio calculated, and what does it indicate?

-The current ratio is calculated by dividing current assets by current liabilities. It indicates a firm's ability to meet its short-term obligations.

What does the quick ratio measure, and how is it different from the current ratio?

-The quick ratio measures a firm's ability to pay its current liabilities without relying on inventory. It is similar to the current ratio but excludes inventory from current assets.

Define working capital and its significance.

-Working capital is calculated as current assets minus current liabilities. It signifies the capital available for day-to-day operations and indicates a firm's operational efficiency.

What does the accounts receivable turnover ratio indicate?

-The accounts receivable turnover ratio indicates how effectively a firm collects on credit sales, calculated by dividing net credit sales by average accounts receivable.

What are profitability ratios and what do they measure?

-Profitability ratios measure a firm's ability to generate profit from its operations, including metrics such as return on total assets and earnings per share.

Why is analyzing liquidity ratios important for a business?

-Analyzing liquidity ratios is important because they assess a firm's short-term financial health and its ability to meet immediate obligations.

Explain the significance of solvency ratios.

-Solvency ratios evaluate a firm's ability to meet long-term obligations, providing insight into financial stability and risk.

How can a business interpret an increase in working capital?

-An increase in working capital indicates that a business has created more liquid resources than it used, suggesting improved financial health and operational efficiency.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Analisis Laporan Keuangan, Sufi Jikrillah, ST, MM, CRA, CRMP

Mata Kuliah: Analisa Laporan Keuangan - Menganalisa Laporan Keuangan

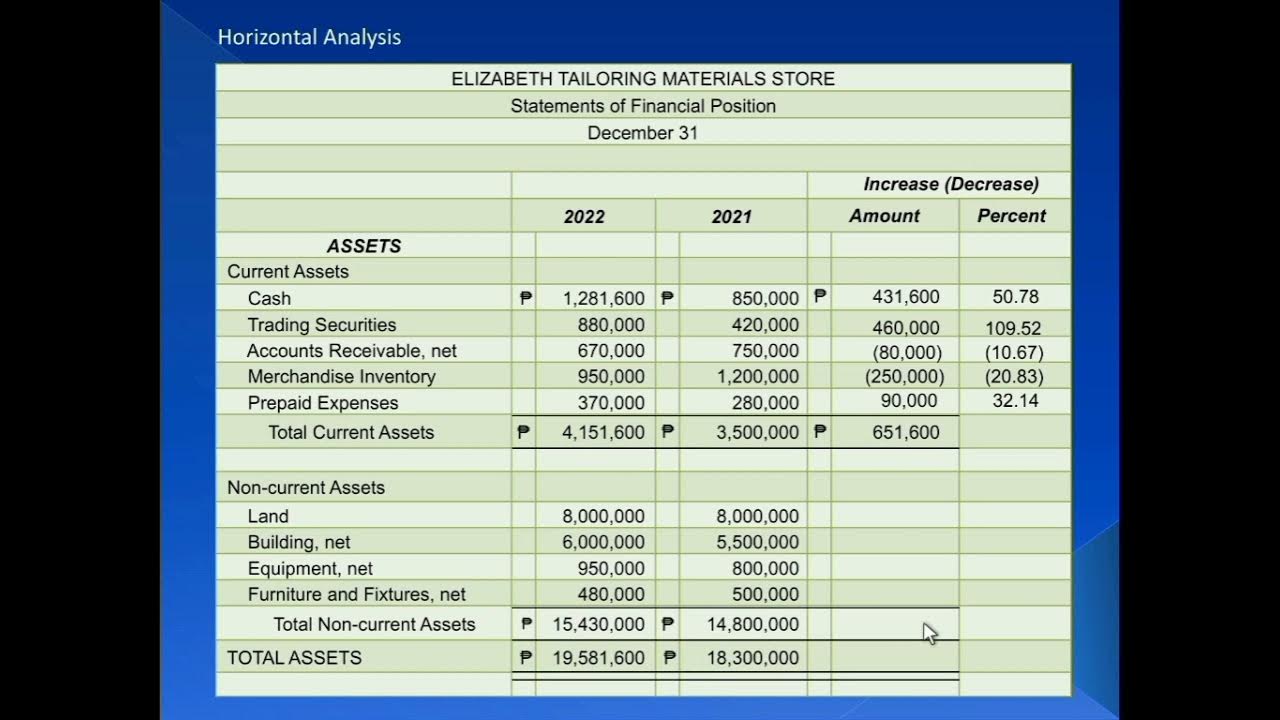

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

Vid # 5 BUSINESS MANAGEMENT ACCOUNTING Module 3 Part 1

Kenalan dengan Laporan Keuangan Emiten | feat. Brenda Andrina

ANALISIS LAPORAN KEUANGAN UNTUK SMK KELAS XII SEMESTER GENAP

5.0 / 5 (0 votes)