$1.3Bn Builder ai goes into Bankruptcy

Summary

TLDRBuilder.ai, a once-promising tech company backed by major investors like Microsoft and Qatar, has filed for bankruptcy after allegations of financial irregularities and misleading marketing. The company, which promised to simplify app creation through AI, was accused of inflating sales figures and using human labor instead of AI for key tasks. Despite a $1 billion valuation, internal issues and leadership changes led to a collapse. This case serves as a cautionary tale about the complexities of running a startup, particularly in the AI industry, highlighting the importance of transparency and proper financial management.

Takeaways

- 😀 Builder.AI promised to make app development as easy as ordering a pizza, targeting a wide audience by simplifying software creation.

- 😀 Builder.AI received significant backing from high-profile investors, including Qatar and Microsoft, raising over $450 million and achieving a $1 billion valuation.

- 😀 The company’s core offering was an AI named Natasha, which was marketed as an all-in-one project manager for app development.

- 😀 Allegations surfaced that Builder.AI engaged in 'AI washing,' claiming AI-driven development while outsourcing much of the work to engineers in India.

- 😀 Builder.AI inflated their sales figures, which is a common yet controversial practice in the startup world, leading to credibility issues.

- 😀 Despite raising substantial funds, Builder.AI struggled with financial mismanagement and faced severe liquidity problems.

- 😀 The company’s leadership changed amid allegations against the previous CEO, including accusations of money laundering.

- 😀 Builder.AI’s major creditor seized $37 million, leaving the company with just $5 million, which was restricted to their Indian bank account, further exacerbating their financial troubles.

- 😀 The collapse of Builder.AI highlights potential risks in the AI startup ecosystem, particularly in terms of raising funds and executing on business promises.

- 😀 The story serves as a cautionary tale for other startups, especially those in the AI space, about the importance of transparent operations and sustainable business models.

- 😀 The ongoing bankruptcy of Builder.AI and the loss of trust among investors, especially high-profile ones like Qatar and Microsoft, could signal the beginning of a broader AI bubble burst.

Q & A

What was the initial promise of Builder.ai?

-Builder.ai promised to make app development as easy as ordering a pizza, allowing anyone to create software, whether it was mobile or web-based, without needing deep technical expertise.

What led to Builder.ai's downfall?

-Builder.ai faced allegations of financial irregularities, including inflating sales figures and engaging in 'AI washing,' where they claimed to use AI for tasks but outsourced much of the work to human engineers in India. Additionally, leadership changes and poor financial management contributed to their bankruptcy.

What is 'AI washing' in the context of Builder.ai?

-AI washing refers to the practice of misleadingly advertising a product as AI-powered when much of the work is still being done by humans. Builder.ai allegedly used human engineers in India to perform tasks that were marketed as being handled by their in-house AI, 'Natasha.'

How much money did Builder.ai raise and who were their major investors?

-Builder.ai raised around $450 million, with significant backing from major institutions like Qatar and Microsoft, which helped elevate the company to a $1 billion valuation.

What impact did Builder.ai's bankruptcy have on its employees?

-After Builder.ai filed for bankruptcy, employees were reportedly not paid their salaries due to the company's financial troubles, with funds being seized by creditors.

What were the accusations against Builder.ai's founder and leadership?

-The founder and leadership of Builder.ai faced accusations of financial misconduct, including potential cases of money laundering, although these accusations had not been definitively proven at the time.

How did Builder.ai's financial issues start to unravel?

-The company’s financial issues began when inflated sales figures were revealed, leading to a significant drop in forecasts. Following that, the company had to make leadership changes, and eventually, creditors seized funds, leading to the company’s collapse.

What happened to Builder.ai’s website during the bankruptcy?

-During the bankruptcy proceedings, Builder.ai's website went offline, indicating the company's operational shutdown and inability to continue business as usual.

What is the broader lesson about raising money in the startup world highlighted by Builder.ai's collapse?

-The collapse of Builder.ai underscores that raising money is not enough to guarantee success; running the business effectively and managing finances are crucial to sustaining growth and avoiding bankruptcy.

What role did the credit company 'Walla Credit' play in Builder.ai’s bankruptcy?

-Walla Credit was a creditor to Builder.ai, and when they realized the company would not be able to repay its debts, they seized $37 million, leaving the company with very little capital to continue operations or pay its employees.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

日本にそっくりな世界一住みやすい街『 Cities Skylines II / シティーズスカイライン2 』

Easily Estimate Your Cost to Build

WordPress Page Speed: Elementor v Bricks v Breakdance

The Foundation, Permits, Ordering Material | 60 Day Home Build CHALLENGE!

Frontly - Build Apps With A No-Code Drag-And-Drop Builder

Divi Feature Update! Introducing Split Testing And Powerful Insights For The Visual Builder

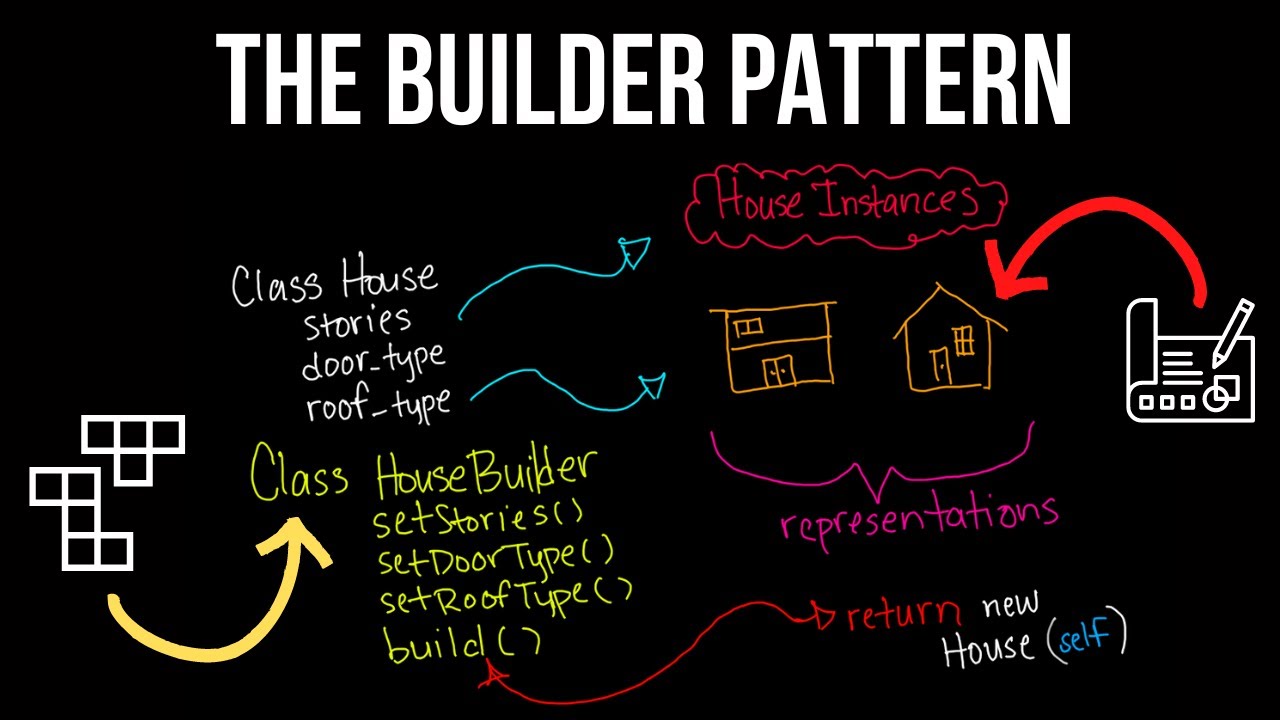

Builder Design Pattern Explained in 10 Minutes

5.0 / 5 (0 votes)