COMPOUND INTEREST (compounded annually) || GRADE 11 GENERAL MATHEMATICS Q2

Summary

TLDRThis educational video explains how to compute compound interest that is compounded annually. It covers calculating the future value (maturity value), present value, and accumulated interest using clear formulas and step-by-step examples. The instructor demonstrates how to convert interest rates to decimals, substitute values into the formulas, and use a calculator for precise results. Several real-life examples are solved, including investments, loans, and time deposits, highlighting different interest rates and time periods. The video concludes with practice questions to reinforce learning, making it a comprehensive guide for understanding and applying compound interest in everyday financial scenarios.

Takeaways

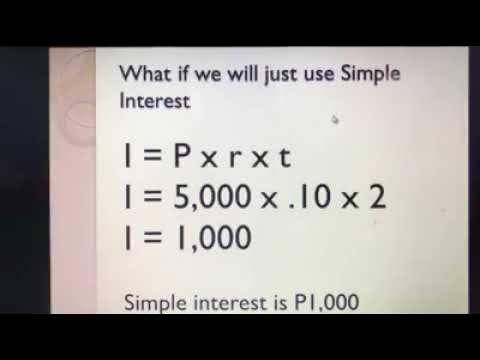

- 😀 Compound interest is calculated by applying interest to both the principal and the accumulated interest over time.

- 😀 The formula for computing the maturity or future value is: F = P * (1 + r)^t, where P is the principal, r is the interest rate (decimal), and t is the time in years.

- 😀 The future value can be found by multiplying the principal by (1 + r)^t, while compound interest is the difference between the future value and the principal.

- 😀 When converting a percentage interest rate to decimal form, divide by 100 (e.g., 2% becomes 0.02).

- 😀 Example: If $10,000 is invested at 2% annually for 5 years, the future value is $11,040.81, and the compound interest earned is $1,040.81.

- 😀 For a $50,000 investment at 5% annual interest for 8 years, the future value is $73,872.77 and the compound interest is $23,872.77.

- 😀 When calculating maturity value, always remember to convert the interest rate into decimal format and apply the appropriate time period.

- 😀 To calculate the present value, the formula is P = F / (1 + r)^t, where F is the future value and r and t are as defined before.

- 😀 For example, to calculate the present value of $50,000 due in 7 years with a 10% annual interest rate, the present value is approximately $25,657.91.

- 😀 In some scenarios, you can determine how much to deposit today to achieve a future goal by solving for the present value using the appropriate formula.

- 😀 Key practice problems help reinforce these concepts, such as calculating the future value of an investment or determining how much to invest to reach a desired maturity value.

Q & A

What is the formula for computing the future value or maturity value in compound interest?

-The formula for future value (F) is F = P × (1 + r)^t, where P is the principal, r is the interest rate in decimal, and t is the time in years.

How do you calculate compound interest once you have the future value?

-Compound interest (CI) is calculated by subtracting the principal from the future value: CI = F - P.

How do you convert an interest rate given in percent to a decimal for calculations?

-To convert a percentage to a decimal, divide the rate by 100. For example, 5% becomes 0.05.

If 10,000 is invested at 2% interest compounded annually for 5 years, what is the future value and compound interest?

-Future value: 10,000 × (1 + 0.02)^5 = 11,040.81. Compound interest: 11,040.81 - 10,000 = 1,040.81.

What formula is used to calculate the present value when the future value, interest rate, and time are known?

-The present value (P) is calculated using P = F / (1 + r)^t, where F is the future value, r is the interest rate in decimal, and t is the time in years.

How much should a student invest today to have 50,000 in 5 years at 5% annual compound interest?

-Using P = F / (1 + r)^t, P = 50,000 / (1 + 0.05)^5 = 39,176.31.

If a father deposits 10,000 at an annual rate of 0.5% compounded yearly for 12 years, what will be the amount after 12 years?

-Future value: 10,000 × (1 + 0.005)^12 = 10,612.78.

How do you calculate the amount of interest earned on a loan or investment?

-The interest earned is the difference between the future value and the principal: Interest = F - P.

What is the present value of 50,000 due in 7 years at an annual interest rate of 10%?

-P = 50,000 / (1 + 0.10)^7 = 25,657.91.

If a parent wants 100,000 for their child in 18 years at 1% annual compound interest, how much should they deposit now?

-P = 100,000 / (1 + 0.01)^18 = 89,632.37.

Why is it important to convert the interest rate to decimal form in compound interest calculations?

-Because the formula F = P × (1 + r)^t requires r to be in decimal form; using a percentage directly would result in incorrect calculations.

What is the effect of compounding annually on the growth of an investment?

-Compounding annually means interest is applied once per year, causing the investment to grow faster than simple interest due to interest being calculated on the accumulated principal each year.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.2

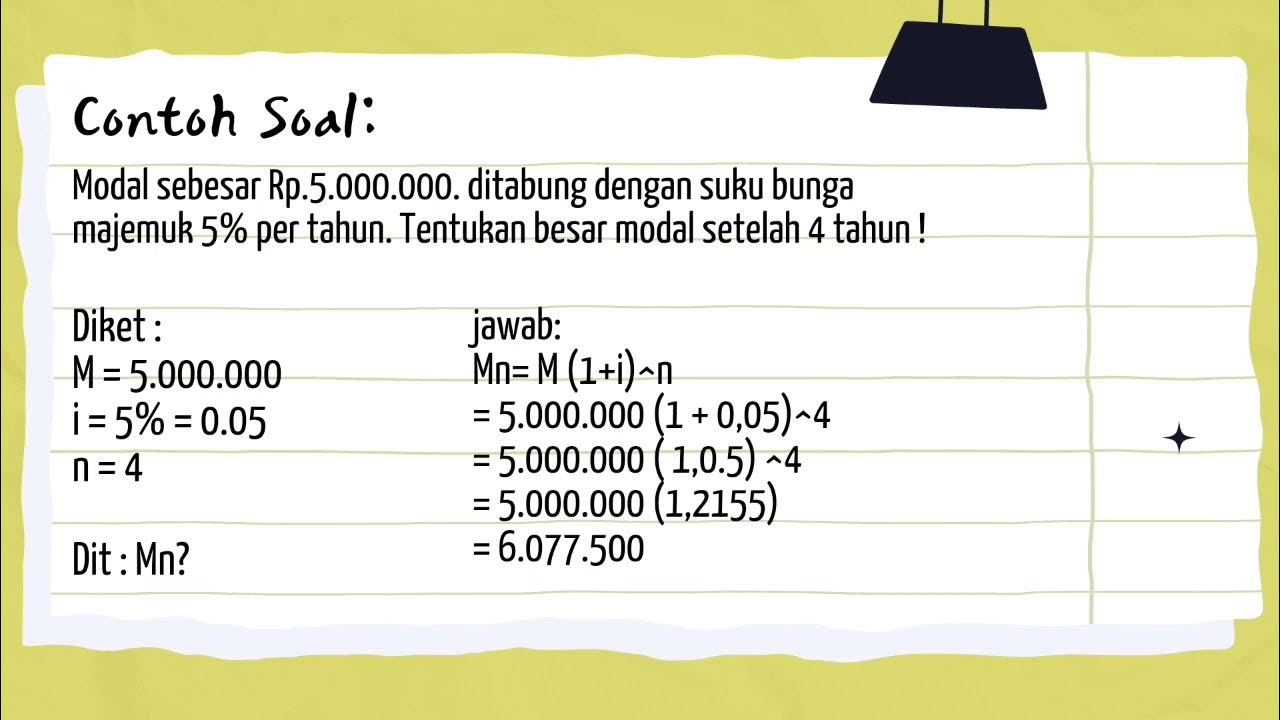

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Formula for continuously compounding interest | Finance & Capital Markets | Khan Academy

Bunga Majemuk || Materi Mtk wajib kelas 11 ( kurikulum merdeka)

5.0 / 5 (0 votes)