COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Summary

TLDRThis lesson explains the concept of compound interest, comparing it to simple interest and demonstrating the differences in interest calculation. It covers the process of manual calculation, showing how interest is computed multiple times over the term based on the compounding period—annually, semi-annually, quarterly, monthly, or daily. The video also highlights how varying compounding periods result in higher interest amounts. Using an example of 5000 pesos at 10% annual interest, the script illustrates the calculation for different compounding methods, leading to a better understanding of the advantages of compound interest over simple interest. The lesson concludes with a preview of the formula-based calculation method for compound interest.

Takeaways

- 😀 Compound interest differs from simple interest by computing interest multiple times during the term, based on compounding periods.

- 😀 In simple interest, the interest is computed once for the entire term, while in compound interest, it is calculated more than once, depending on the agreement between the creditor and debtor.

- 😀 The number of compounding periods affects how often the interest is applied, with options like annually, semi-annually, quarterly, monthly, or daily.

- 😀 Compounding annually means interest is computed once per year, while semi-annual compounding results in two interest computations per year.

- 😀 With quarterly compounding, interest is computed four times per year, monthly compounding results in 12 computations, and daily compounding leads to 365 computations in a year.

- 😀 The more frequent the compounding periods, the more the interest accumulates, leading to a higher final amount compared to simple interest.

- 😀 Example 1: For a principal of 5000 at 10% annual interest, compounded annually, the compound interest after two years is 1050, which is higher than the simple interest (1000).

- 😀 Example 2: When interest is compounded semi-annually, the compound interest after two years is 1077.54, which is higher than both simple interest and annual compounding.

- 😀 Manual compound interest computation involves calculating interest for each period and adjusting the principal after each computation.

- 😀 A higher number of compounding periods, such as monthly or daily, results in more interest being accumulated, making compound interest more beneficial for long-term loans.

- 😀 The next lesson will introduce a compound interest formula to make these calculations easier and more efficient than the manual method.

Q & A

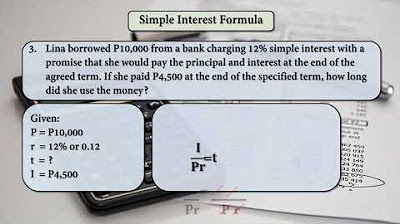

What is the main difference between compound interest and simple interest?

-The main difference is that under simple interest, the interest is computed once for the entire term, while in compound interest, the interest is computed more than once during the term based on compounding periods agreed upon by the debtor and the creditor.

What is the purpose of compounding in compound interest?

-Compounding refers to the process of calculating interest on both the original principal and the accumulated interest from previous periods. This results in interest being earned or charged multiple times over the term of the loan or investment.

How is compound interest computed manually using the long method?

-In the long method, you calculate the compound amount (future value) by applying the interest rate to the principal for each compounding period. After computing the compound amount, the compound interest is determined by subtracting the original principal from the compound amount.

What is the formula for calculating compound interest?

-The compound interest formula is A = P(1 + r/n)^(nt), where A is the compound amount, P is the principal, r is the annual interest rate, n is the number of compounding periods per year, and t is the time in years.

How do the number of compounding periods affect the total interest earned or paid?

-The more frequent the compounding periods (e.g., quarterly, monthly, daily), the higher the total interest accumulated because the interest is compounded more often, leading to more interest being charged or earned.

What are the common compounding periods used in financial agreements?

-Common compounding periods include annually, semi-annually, quarterly, monthly, and daily. The compounding period affects how often the interest is calculated and added to the principal.

How does semi-annual compounding affect interest computation?

-With semi-annual compounding, interest is computed twice a year. The annual interest rate is divided in half, and the principal is updated after each 6-month period to reflect the accumulated interest.

What was the compound amount and compound interest in the example where the interest is compounded annually?

-In the example with annual compounding, the principal of 5000 pesos at an annual interest rate of 10% for 2 years resulted in a compound amount of 6050 pesos. The compound interest earned was 1050 pesos.

What is the effect of compounding semi-annually versus annually on the interest earned?

-With semi-annual compounding, interest is compounded twice a year, leading to a higher total interest earned compared to annual compounding, where interest is compounded only once a year.

Why is it difficult to calculate compound interest manually for frequent compounding periods?

-It becomes taxing to calculate manually because the interest is compounded more frequently, which requires more complex calculations. As the frequency increases, the number of compounding periods also increases, making the process time-consuming.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bunga Tunggal dan Bunga Majemuk | Matematika SMA Kelas XI

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

Simple Interest | Numbers | Maths | FuseSchool

Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

LESSON 5: Compound Interest (Finding for the Principal, Future Value, and Time)

5.0 / 5 (0 votes)