BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

Summary

TLDRThis video explains the concept of compound interest, demonstrating how interest income is reinvested into the initial capital, leading to an increase in value over time. It outlines the formula for calculating compound interest and explores different compounding frequencies—annually, semi-annually, quarterly, monthly, and daily—using examples. The video compares compound interest with simple interest, highlighting how compound interest grows over time. The examples show how different compounding frequencies impact the future value of an investment, with more frequent compounding resulting in a higher final value. This provides a clear understanding of compound interest and its practical applications.

Takeaways

- 😀 Compound interest is interest that is reinvested into the principal, causing the amount to grow over time.

- 😀 The formula for compound interest is FN = P * (1 + r)^n, where FN is the future value, P is the present value, r is the interest rate, and n is the number of years.

- 😀 An example of compound interest shows that a deposit of 5 million rupiah at 10% interest for 6 years grows to 8,833,313 rupiah.

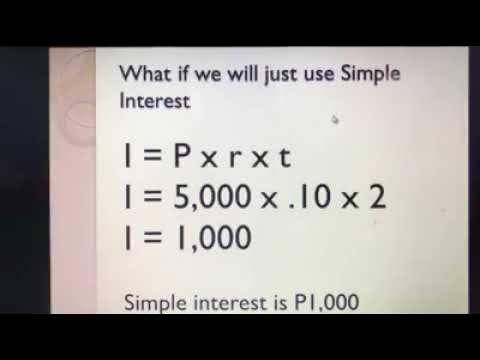

- 😀 Interest income increases each year with compound interest, unlike simple interest, which remains the same each year.

- 😀 The total compound interest income after 6 years in the example is 3,815,000 rupiah, which is higher than the simple interest income of 3,000,000 rupiah.

- 😀 Compound interest can be compounded more frequently than annually, such as quarterly, monthly, or daily, which increases the future value of the deposit.

- 😀 When interest is compounded more frequently, the future value grows more quickly due to the increased number of compounding periods.

- 😀 For semi-annual compounding, the interest rate is divided by 2 (m = 2), for quarterly compounding, m = 4, for monthly compounding, m = 12, and for daily compounding, m = 365.

- 😀 The future value calculation changes based on the frequency of compounding, with more frequent compounding leading to a higher future value.

- 😀 In the example, the future value of a 5 million rupiah deposit over 6 years with semi-annual compounding is 8,902,345 rupiah, while for quarterly compounding it is 9,436,650 rupiah, and for monthly compounding, it is 9,083,524 rupiah.

Q & A

What is compound interest and how does it work?

-Compound interest is interest that is reinvested into the initial capital, so that each period’s interest income earns interest in the subsequent period. This leads to an increasing amount of interest over time.

What is the formula used to calculate compound interest?

-The formula for compound interest is FN = P * (1 + ih)^n, where FN is the future value, P is the present value (initial capital), ih is the interest rate per year, and n is the number of years.

Can you explain the example involving Mrs. Santi’s deposit?

-Mrs. Santi deposits 5 million Rupiah at an interest rate of 10% per year for 6 years. Using the compound interest formula, the future value (FN) of her deposit after 6 years is 8,833,313 Rupiah.

How is interest income calculated in the example of Mrs. Santi’s deposit?

-Interest income is calculated by multiplying the initial value by the interest rate. For example, in the first period, the interest is 5 million Rupiah * 10%, which equals 500,000 Rupiah. This interest is added to the principal to calculate the next period's value.

What is the difference between compound interest and simple interest?

-Compound interest grows over time because the interest is added to the principal, so future interest is earned on the accumulated amount. Simple interest, on the other hand, is fixed and calculated on the original principal only.

What happens when the frequency of interest payments increases?

-The higher the frequency of interest payments (e.g., quarterly, monthly, or daily), the greater the final amount, since interest is compounded more frequently and earns interest sooner.

What happens when interest is compounded semi-annually, quarterly, monthly, or daily?

-When interest is compounded more frequently (semi-annually, quarterly, monthly, or daily), the future value increases. For example, if interest is compounded daily, the future value will be higher than if it’s compounded annually.

How is the formula adjusted when interest is compounded more than once per year?

-The formula is adjusted by dividing the annual interest rate by the number of compounding periods per year (m), and multiplying the number of years by the number of compounding periods (n * m).

In the example where Ani saves 5 million Rupiah, how is the future value calculated when compounded semi-annually?

-For semi-annual compounding, the formula is FN = 5 million Rupiah * (1 + 0.10 / 2)^(6 * 2). The result is a future value of 8,902,345 Rupiah.

What is the relationship between the frequency of interest payments and the total interest earned?

-The higher the frequency of interest payments, the more interest is compounded, resulting in a higher total interest earned. This means that daily compounding will yield more than monthly, quarterly, or semi-annual compounding.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)