บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.2

Summary

TLDRThis transcript provides an educational walkthrough on calculating compound interest in two scenarios: one where interest is compounded annually and the other semi-annually. It explains the necessary formulas and steps to calculate the accumulated amount after 10 years for both cases, starting with a 1,000 or 10,000 Baht deposit at a 3% annual interest rate. The comparison highlights the slight difference in the total amount accumulated when compounding frequency changes, with the semi-annual compounding resulting in slightly higher returns. The lesson emphasizes understanding interest rate adjustments and compounding frequency in financial calculations.

Takeaways

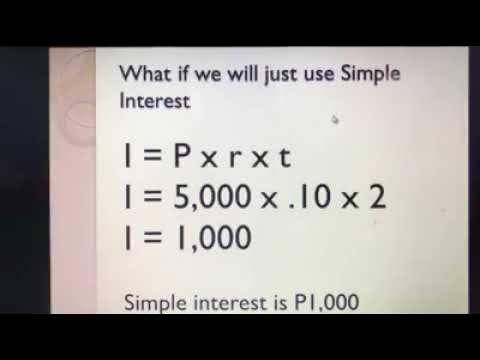

- 😀 Compound interest is calculated using the formula: A = P × (1 + R/K)^(K×N).

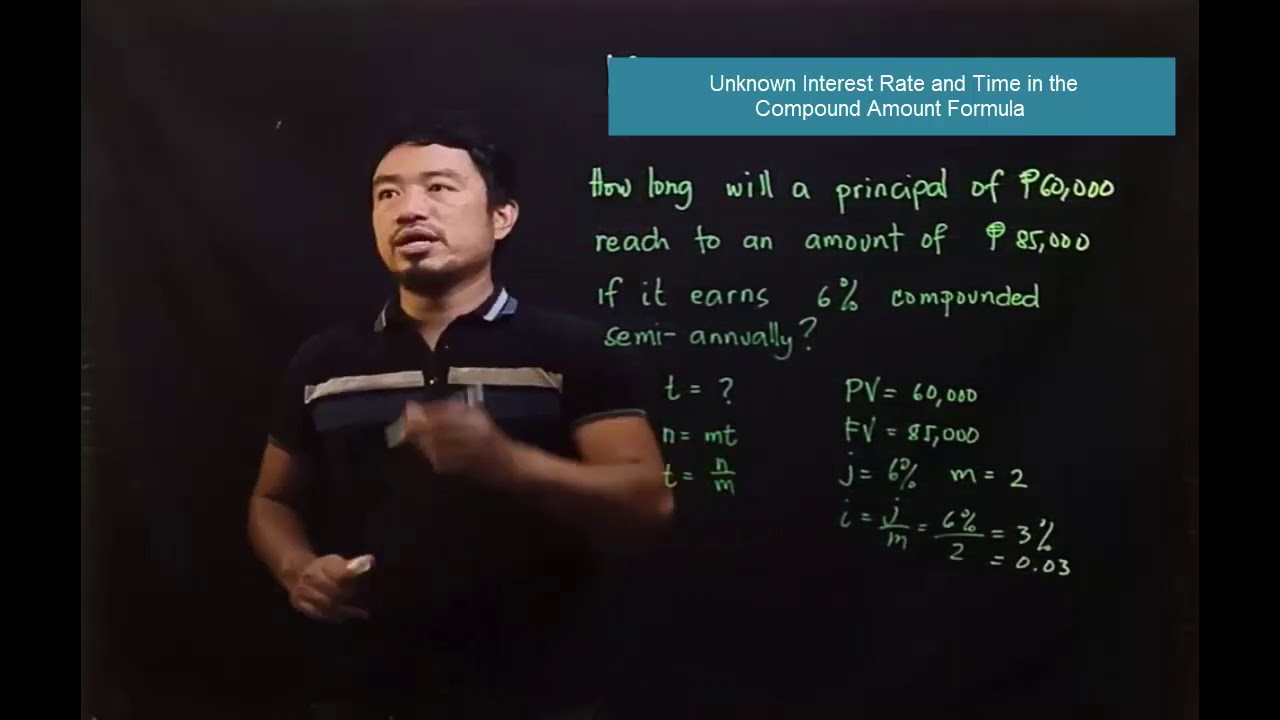

- 😀 The script explains how compound interest is applied differently when interest is compounded annually vs. semi-annually.

- 😀 Example 1 demonstrates how depositing 1,000 Baht at 3% annual interest compounded annually for 10 years results in approximately 1,343.91 Baht.

- 😀 Example 2 shows that with 10,000 Baht deposited at 3% annual interest compounded semi-annually for 10 years, the total amount is about 13,460.85 Baht.

- 😀 The more frequent compounding (e.g., semi-annual) leads to a slightly higher final amount, even with the same interest rate and time period.

- 😀 In Example 2, since interest is compounded twice per year, the interest rate per period is halved to 1.5%.

- 😀 The compound interest formula requires four key variables: the principal (P), the annual interest rate (R), the number of compounding periods per year (K), and the total number of years (N).

- 😀 The process for calculating compound interest involves substituting the appropriate values for these variables into the formula to find the accumulated amount (A).

- 😀 Small differences in the compounding frequency can result in noticeably different final amounts, even when the interest rate and time period are the same.

- 😀 The script emphasizes the importance of understanding the compounding frequency when evaluating interest-bearing investments or savings.

Q & A

What is the main topic discussed in the transcript?

-The main topic discussed is compound interest, specifically how to calculate the total amount after depositing money into a bank account with compound interest over a certain number of years.

What is the formula used to calculate the total amount of money with compound interest?

-The formula used is: Total Amount = P * (1 + R/K)^(K*N), where P is the principal, R is the annual interest rate, K is the number of times interest is compounded per year, and N is the number of years.

What does each variable in the compound interest formula represent?

-In the formula, P represents the initial deposit (principal), R represents the annual interest rate (as a decimal), K represents the number of times the interest is compounded per year, and N represents the number of years the money is invested.

In the first example, how much money is initially deposited?

-In the first example, the initial deposit is 1,000 Baht.

How often is the interest compounded in the first example?

-In the first example, the interest is compounded once per year.

What is the interest rate used in the first example?

-The interest rate in the first example is 3% per year.

How many years is the money deposited in the first example?

-In the first example, the money is deposited for 10 years.

What is the total amount after 10 years in the first example?

-The total amount after 10 years is approximately 13,430.91 Baht.

What is the difference between the second and third examples regarding how interest is compounded?

-In the second example, interest is compounded once per year, while in the third example, interest is compounded every 6 months, meaning twice per year.

Which example results in a higher total amount after 10 years?

-The third example, where interest is compounded every 6 months, results in a slightly higher total amount compared to the second example, where interest is compounded once per year.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

COMPOUND INTEREST (compounded annually) || GRADE 11 GENERAL MATHEMATICS Q2

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.5 [มูลค่าปัจจุบันและมูลค่าอนาคต]

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Bunga Tunggal

Compound Amount Formula with Unknown Interest Rate and Time

5.0 / 5 (0 votes)