Lesson 013 - Rules of Debit and Credit

Summary

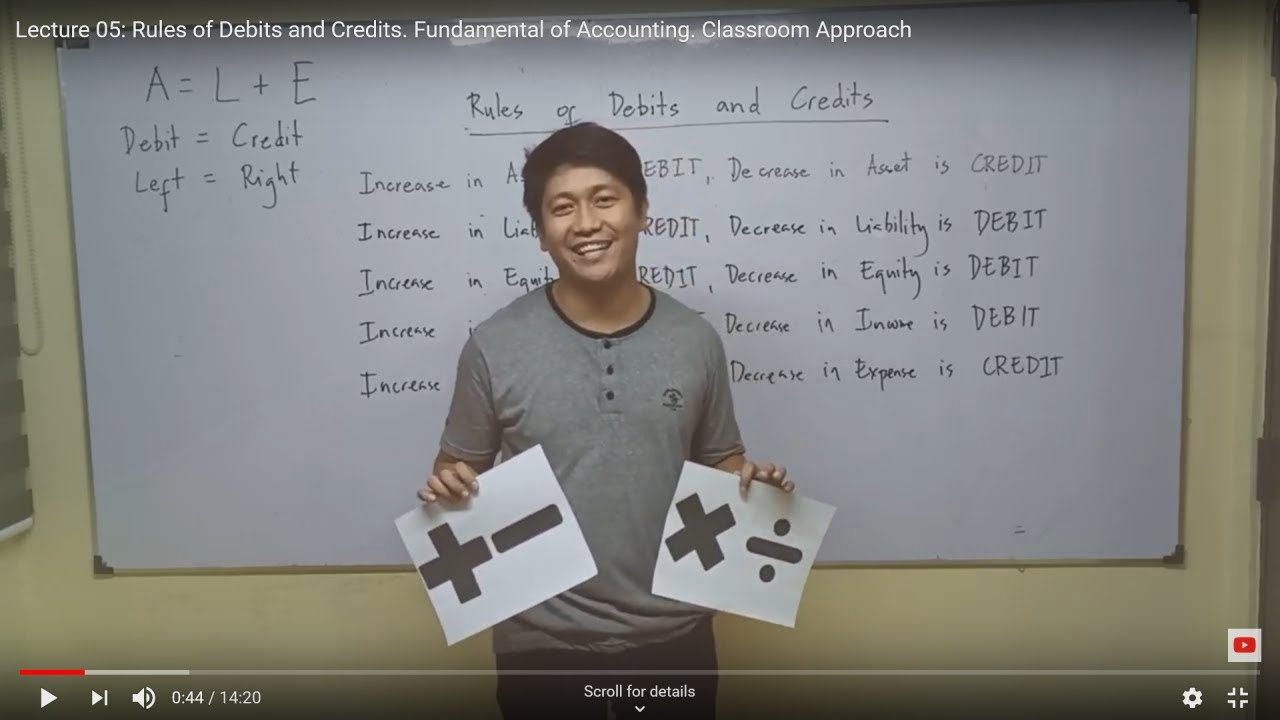

TLDRIn this lesson on accounting, the core principles of debits and credits are explained. Understanding these rules is crucial for both professional and personal financial management. An account has two sides: the left side (debit) and the right side (credit). The video covers how different financial elements like assets, liabilities, capital, drawing, revenue, and expenses increase or decrease depending on whether they are debited or credited. Practical examples of transactions are analyzed to demonstrate how to apply these rules in real-life scenarios. Memorizing and understanding these rules is emphasized for success in accounting.

Takeaways

- 📚 Understand the rules of debit and credit thoroughly, as they are essential in accounting.

- 🔄 The left side of an account is called the debit side, and the right side is called the credit side.

- 📊 Assets are increased on the debit side and decreased on the credit side.

- 💳 Liabilities are increased on the credit side and decreased on the debit side.

- 💼 Capital is increased on the credit side and decreased on the debit side.

- 📈 Revenue is increased on the credit side and decreased on the debit side.

- 💸 Expenses are increased on the debit side and decreased on the credit side.

- 📑 Each transaction affects at least two accounts.

- 🔍 Analyze transactions by identifying which accounts are affected and whether they are debited or credited.

- 📝 Memorize the rules of debit and credit using the provided patterns and examples.

Q & A

What is the core principle of accounting discussed in the lesson?

-The core principle of accounting discussed in the lesson is the rules of debit and credit.

What are the sides of an account called?

-The left side of an account is called the debit side, and the right side of an account is called the credit side.

What happens when you put an amount on the left side of the account?

-When you put an amount on the left side of the account, it is called a debit.

What are the elements of financial statements mentioned?

-The elements of financial statements mentioned are assets, liabilities, capital, drawing, revenue, and expenses.

How are assets affected by debit and credit?

-Assets are increased on the debit side and decreased on the credit side.

How are liabilities affected by debit and credit?

-Liabilities are increased on the credit side and decreased on the debit side.

What is the effect of debit and credit on capital?

-Capital is increased on the credit side and decreased on the debit side.

What is the effect of debit and credit on drawing?

-Drawing is increased on the debit side and decreased on the credit side.

What is the effect of debit and credit on revenue?

-Revenue is increased on the credit side and decreased on the debit side.

What is the effect of debit and credit on expenses?

-Expenses are increased on the debit side and decreased on the credit side.

How can you memorize the rules of debit and credit easily?

-You can memorize the rules by remembering which accounts increase on the debit side (assets, drawing, expenses) and which increase on the credit side (liabilities, capital, revenue).

What is a cash investment by the owner considered in accounting terms?

-A cash investment by the owner increases both the asset (cash) and capital.

How is the purchase of office supplies on account recorded?

-The purchase of office supplies on account is recorded by debiting office supplies (an asset) and crediting accounts payable (a liability).

What happens when payment is made on an account payable?

-When payment is made on an account payable, the accounts payable (a liability) is debited, and cash (an asset) is credited.

How is revenue from rendered services recorded?

-Revenue from rendered services is recorded by debiting cash (if payment is received immediately) and crediting service revenue (a revenue account).

How are expenses recorded in accounting?

-Expenses are recorded by debiting the appropriate expense account and crediting cash or accounts payable, depending on the payment method.

What does a cash withdrawal by the owner for personal reasons affect?

-A cash withdrawal by the owner for personal reasons affects drawing (debited) and cash (credited).

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)