Financial Analysis in Arabic - 07 1080p

Summary

TLDRThis script introduces the fundamental accounting concepts of debit and credit, essential for recording financial transactions. It explains that every transaction must balance, with the sum of debits equaling the sum of credits. The rule of thumb is that increases in assets and expenses are debits, while decreases are credits. Conversely, increases in liabilities, income, and capital are credits, and their decreases are debits. The script uses the example of starting an online business with capital and a loan from a mother to illustrate how to record these transactions, emphasizing the importance of understanding debits and credits for accurate accounting.

Takeaways

- 📘 Debit and credit are fundamental terms in accounting used to record financial transactions.

- 🧐 In every transaction, the total debits must equal the total credits to maintain balance.

- ⚖️ If debits do not equal credits, it indicates an error in the transaction, similar to an imbalance in mathematics.

- 📈 An increase in assets and expenses is recorded as a debit, while a decrease is recorded as a credit.

- 📉 Conversely, an increase in liabilities, income, and capital is recorded as a credit, and a decrease as a debit.

- 💡 The rule of thumb is to debit increases in assets and expenses, and credit increases in liabilities, income, and capital.

- 💼 An example given is starting an online business with capital, where cash (an asset) and capital both increase, recorded as debit to cash and credit to capital.

- 🤔 When recording transactions, it's crucial to apply the rule of debit and credit correctly to reflect the changes in assets, liabilities, and capital.

- 💰 The script provides a practical example of recording the initial capital and a liability from the mother's cash contribution to the business.

- 📊 The transaction of receiving cash from the mother is recorded as a debit to cash (for the asset increase) and a credit to the liability (for the liability increase).

- 🔑 Understanding the principles of debit and credit is key to accurately recording and analyzing financial transactions in accounting.

Q & A

What are the two aspects of a financial transaction in accounting?

-The two aspects of a financial transaction in accounting are Debit and Credit.

Why should the sum of debits be equal to the sum of credits in a financial transaction?

-The sum of debits should be equal to the sum of credits to maintain the balance of each financial transaction, ensuring there are no errors.

What is the rule for recording an increase in assets and expenses in accounting?

-An increase in assets and expenses is recorded as a debit.

How is the decrease of assets and expenses recorded in accounting?

-The decrease of assets and expenses is recorded as a credit.

What is the accounting treatment for an increase in liabilities, income, and capital?

-An increase in liabilities, income, and capital is recorded as a credit.

How is a decrease in liabilities, income, and capital recorded in the books?

-A decrease in liabilities, income, and capital is recorded as a debit.

Can you provide an example of a financial transaction from the script involving the owner's capital?

-The example given is the owner investing 250,000 rupees as capital into the business, which is recorded as a debit to cash and a credit to capital.

What is the accounting entry for the 100,000 rupees received from the owner's mother in the example?

-The accounting entry for the 100,000 rupees received from the owner's mother is a debit to cash for 100,000 rupees and a credit to the liability for the same amount.

Why is cash considered an asset in the example of the online business?

-Cash is considered an asset because it is a resource owned by the business that has future economic benefit.

What does the acronym A and E stand for in the context of the script?

-In the context of the script, A and E stands for Assets and Expenses.

What does L, I, and C stand for in the script, and how are they treated in accounting?

-L, I, and C stands for Liabilities, Income, and Capital. In accounting, an increase in these is called credit, and a decrease is called debit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Debit and Credit | Odoo Accounting

Pendalaman Siklus Akuntansi Perusahaan Part 2

12. Single Column Cash Book - Problem No: 1

teks prosedur | cara membuat jurnal umum (nancy angelina xi akl)

كورس محاسبة مالية - (1)

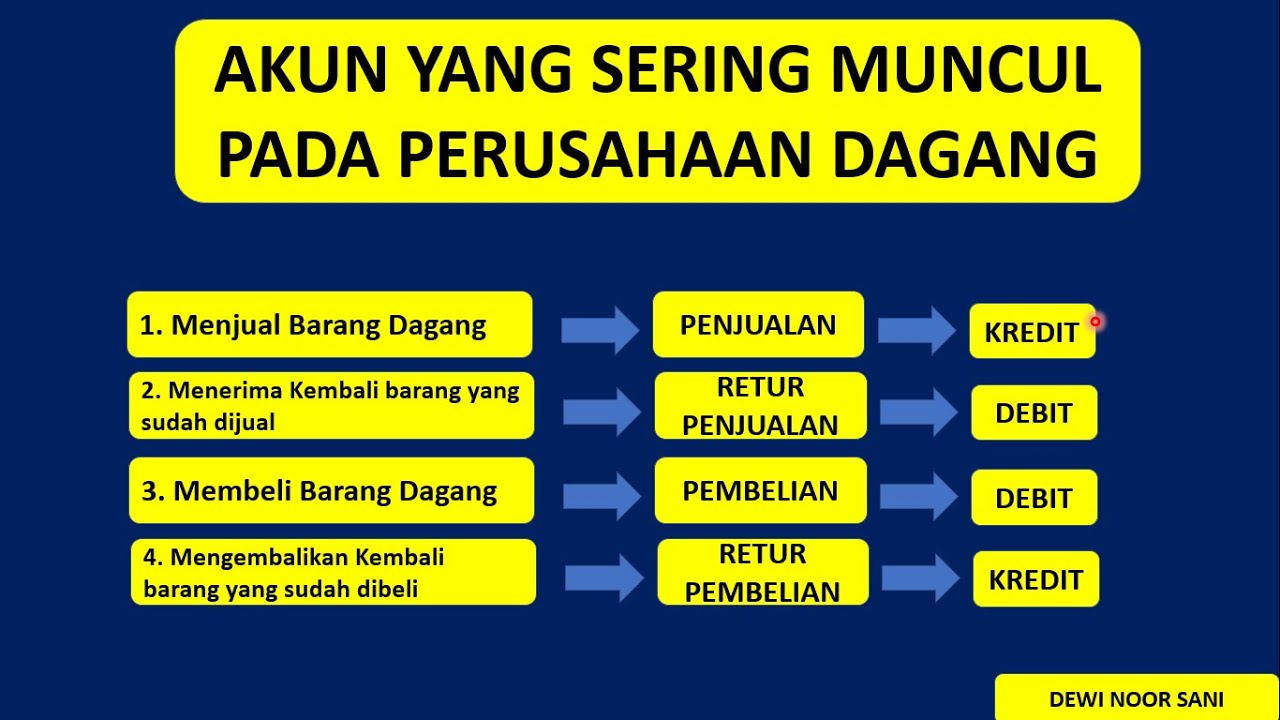

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

5.0 / 5 (0 votes)