5 Debit and Credit Practice Questions & Solutions

Summary

TLDRIn this video, James takes viewers through five practice questions on debits and credits to help them master essential accounting concepts. Using the DEALER acronym as a guide, he walks through transactions involving cash, owner's equity, accounts payable, and revenue recognition. Each example progressively builds in complexity, offering clear insights into double-entry bookkeeping and how to apply it effectively. This tutorial is designed to help viewers understand the core principles of debits and credits, which are crucial for accurate financial record-keeping and exam preparation.

Takeaways

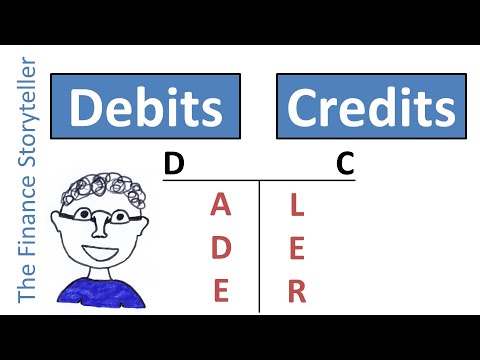

- 😀 The DEALER mnemonic helps you remember the expanded accounting equation: Dividends, Expenses, Assets = Liabilities + Owner’s Equity + Revenue.

- 😀 Assets (A) increase with Debits and decrease with Credits, as explained by the ‘A’ in DEALER.

- 😀 Owner's Equity (E) increases with Credits and decreases with Debits, as indicated by the ‘E’ in DEALER.

- 😀 Liabilities (L) are Credit accounts, so they increase with Credits and decrease with Debits.

- 😀 The Revenue (R) account increases with Credits and decreases with Debits, according to DEALER.

- 😀 Debits and Credits must balance in every transaction to maintain double-entry bookkeeping.

- 😀 In question 1, an initial investment increases Cash, so the Cash account is Debited.

- 😀 In question 2, Owner's Equity increases when the owner invests, so the Owner's Equity account is Credited.

- 😀 In question 3, paying a supplier reduces both Cash and Accounts Payable; Accounts Payable is Debited to decrease the balance.

- 😀 In question 4, a sale on account requires Revenue to be Credited since revenue is recognized when earned, not when paid.

- 😀 In question 5, receiving payment from a customer reduces Accounts Receivable and increases Cash, so Accounts Receivable is Credited to decrease the balance.

Q & A

What does DEALER stand for in accounting?

-DEALER stands for Dividends, Expenses, and Assets (which are Debit accounts) and Liabilities, Owner's Equity, and Revenue (which are Credit accounts). It helps in remembering the expanded accounting equation.

What does it mean when an account is a 'normal Debit account'?

-A normal Debit account is one that increases when debited and decreases when credited. For example, Assets like Cash increase with a Debit.

How do we determine whether to Debit or Credit an account in Double-Entry Bookkeeping?

-In Double-Entry Bookkeeping, every transaction has two sides: one Debit and one Credit. The left side (Assets, Expenses, Dividends) increases with Debits, while the right side (Liabilities, Owner's Equity, Revenue) increases with Credits.

What happens when the Car Wash owner makes an initial investment into the company?

-The initial investment increases the company's Cash account, which is an Asset. Since Assets increase with a Debit, the Cash account is debited. The Owner's Equity account is credited because it represents the owner's investment.

What happens when a Car Wash pays a supplier in cash?

-When the Car Wash pays the supplier, their Cash account decreases, so the Cash account is credited. The Accounts Payable account, which is a liability, is debited to decrease the amount owed to the supplier.

In what situation do we use the Revenue Recognition Principle?

-The Revenue Recognition Principle is applied when a service or product is provided to a customer, regardless of whether cash has been received. For example, when the customer gets a car wash and agrees to pay on account, the revenue is recognized immediately.

What account is credited when the Car Wash earns revenue for a service provided on account?

-When the Car Wash provides a service on account, the Revenue account is credited. This is because revenue is recognized when earned, not when cash is received.

How does the Car Wash handle the receipt of cash from a customer who paid on account?

-When the Car Wash receives the cash, the Cash account is debited to increase it. The Accounts Receivable account is credited to reduce the amount the customer owes, as the debt is settled.

What is the relationship between Debits and Credits in accounting?

-In accounting, Debits and Credits must always balance. Debits increase Assets, Expenses, and Dividends, while Credits increase Liabilities, Owner's Equity, and Revenue.

Why is it important to know the rules for Debits and Credits?

-Knowing the rules for Debits and Credits is essential for maintaining accurate financial records. It ensures that each transaction is properly recorded and balanced, which is key to the integrity of the financial statements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

T Accounts Explained SIMPLY (With 5 Examples)

Debits and credits DC ADE LER

ACCOUNTING BASICS: Debits and Credits Explained

Accounting: 32 Things YOU SHOULD KNOW

RAZONETES E PARTIDAS DOBRADAS - CONTABILIDADE BÁSICA - DÉBITO E CRÉDITO - CONTAS T 📊☑️

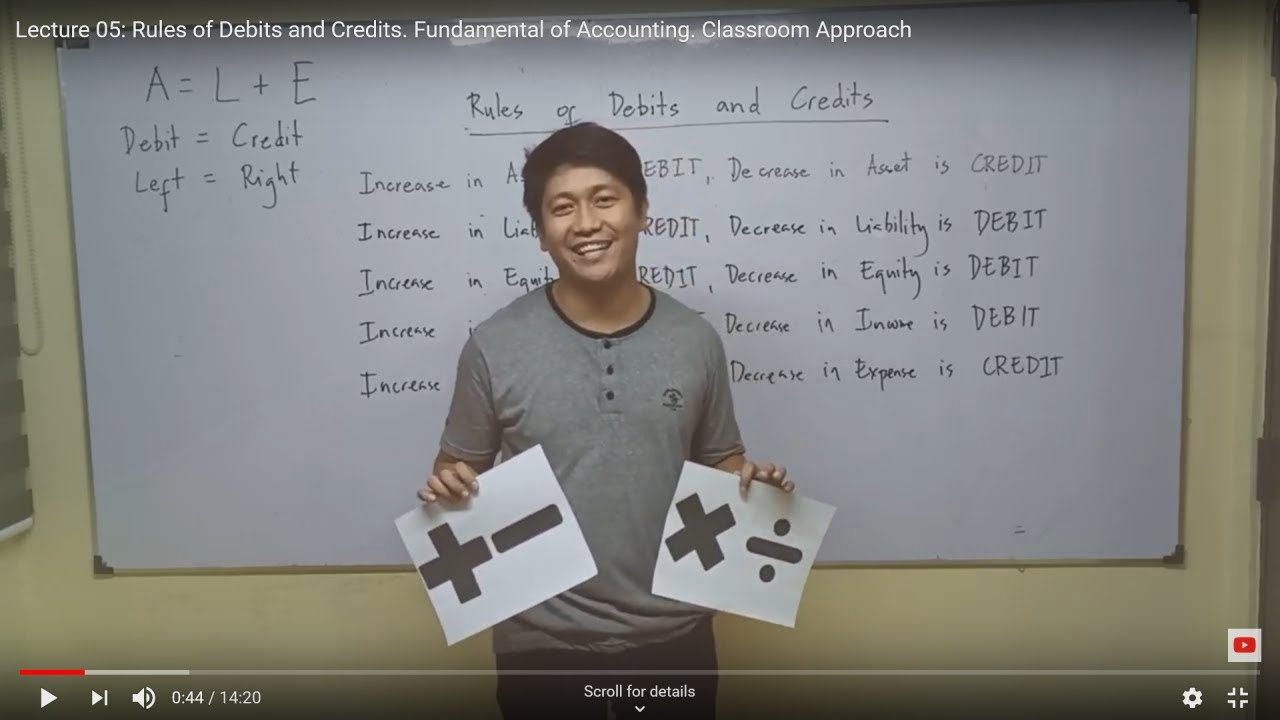

Lecture 07: Rules of Debits and Credits. [Fundamentals of Accounting]

5.0 / 5 (0 votes)