Menguak Misteri : Inflasi AS Turun, Gold Kok malah Naik?

Summary

TLDRThis video delves into the correlation between U.S. inflation data and gold price movements, explaining the impact of The Fed's interest rate decisions. It introduces Intermarket Analysis, a technical approach to understanding the relationships between key asset classes like equities, commodities, fixed income, and digital assets such as Bitcoin. The script explores how gold, typically seen as a hedge against inflation, behaves under different economic conditions and central bank policies. It also covers historical trends, market strategies, and insights for investing in gold and other assets amidst economic shifts.

Takeaways

- 😀 Gold prices are highly influenced by U.S. inflation data. If inflation decreases towards the Fed's 2% target, gold is bullish; if inflation rises, gold prices may fall.

- 😀 Understanding intermarket analysis is key to grasping the relationship between different asset classes, including equities, commodities, fixed income securities, and digital assets like Bitcoin.

- 😀 In intermarket analysis, assets such as gold, stocks, commodities, and bonds are used as storage of value to combat inflation, with each asset class having its unique characteristics.

- 😀 Bitcoin, though considered a digital asset, functions similarly to gold and other assets in serving as a storage of value, despite its early association as a potential medium of exchange.

- 😀 The U.S. Dollar (USD) is the most widely used unit of account globally, making it essential for measuring purchasing power and wealth despite its susceptibility to inflation.

- 😀 When inflation rises, there is a theoretical expectation for gold to rise, as it is seen as a hedge against inflation. However, trading dynamics between different types of traders influence this relationship.

- 😀 Three major categories of traders exist in gold futures: non-reportable traders (retail), large speculators (institutional traders), and commercial traders (entities seeking physical delivery).

- 😀 The Federal Reserve (Fed) plays a significant role in determining market behavior. Its actions, such as increasing or decreasing interest rates, heavily influence gold prices.

- 😀 Historical market trends show that during periods of high inflation and rising interest rates, gold tends to correct, while during periods of low inflation and easing monetary policies, gold tends to strengthen.

- 😀 The relationship between the Federal Reserve's policies and gold is crucial for predicting market trends. When the Fed signals a halt to interest rate hikes or cuts rates, it often leads to a bullish outlook for gold.

Q & A

What happens to gold when the Fed stops raising interest rates or even cuts them?

-Gold becomes bullish when the Federal Reserve stops raising interest rates and even cuts them, as lower interest rates make gold more attractive as an investment.

Why does gold sometimes decrease when inflation data rises in the US?

-When inflation data rises, gold can decrease because, in some cases, investors may believe the Fed will raise interest rates to control inflation, which can make fixed income assets like bonds more attractive compared to gold.

What is the relationship between inflation in the US and the price of gold?

-The price of gold is often influenced by US inflation data. If inflation decreases toward the Fed's target of 2%, gold tends to go bullish. However, if inflation increases, gold can go bearish.

What is Intermarket Analysis and how does it relate to asset classes?

-Intermarket Analysis is a branch of technical analysis that studies the relationships between various asset classes. It focuses on the interaction between equities, commodities (including gold), fixed income securities, and digital assets like Bitcoin.

What are the three primary asset classes in Intermarket Analysis?

-The three primary asset classes in Intermarket Analysis are equities (stocks), commodities (including gold), and fixed income securities (like US Treasury Bonds).

What role does the US dollar play in Intermarket Analysis?

-In Intermarket Analysis, the US dollar is used as a medium of exchange for all asset classes, as most commodities and assets are priced in USD.

How does gold act as a store of value compared to other asset classes?

-Gold is considered a store of value because it retains its purchasing power over time, unlike fiat currencies like the US dollar, which decrease in value due to inflation. It also performs well in times of crisis, geopolitical tension, or natural disasters.

What is the main difference between gold and equity as investment assets?

-Gold is considered a safer, less volatile asset that does not offer passive income (like dividends), while equity or stocks represent ownership in a business, often providing dividends and capital gains. Gold is seen as a 'safe haven' in times of crisis, whereas stocks are more productive and can offer higher returns over time.

What is the function of Bitcoin as an asset class?

-Bitcoin is viewed as a digital asset class, primarily considered a store of value rather than a medium of exchange. It has gained popularity due to its potential to hedge against inflation and its increasing adoption as an alternative to traditional assets like gold.

Why did gold prices drop when the Fed raised interest rates in 2017?

-Gold prices dropped when the Fed raised interest rates in 2017 because higher interest rates make bonds and other fixed income assets more attractive compared to non-yielding assets like gold, leading investors to move away from gold.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Correlation vs Regression | Difference Between Correlation and Regression | Statistics | Simplilearn

Correlation Analysis

What haunts statisticians at night

What is the difference between parametric and nonparametric hypothesis testing?

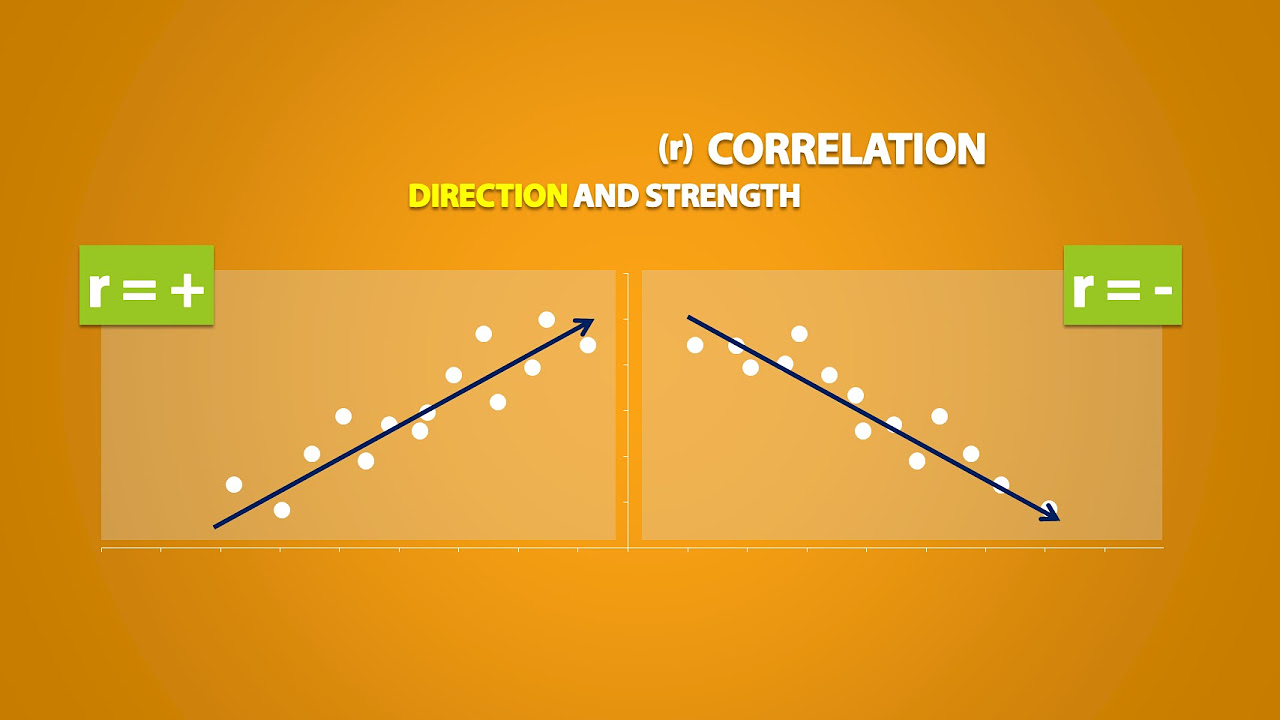

MINI-LESSON 5: Correlation, the intuition. Doesn't mean what people usually think it means.

Explanatory and Response Variables, Correlation (2.1)

Parametric and Nonparametric Tests

5.0 / 5 (0 votes)