How To Select CRT Candles Perfectly - Full In Depth Guide - ICT Concepts

Summary

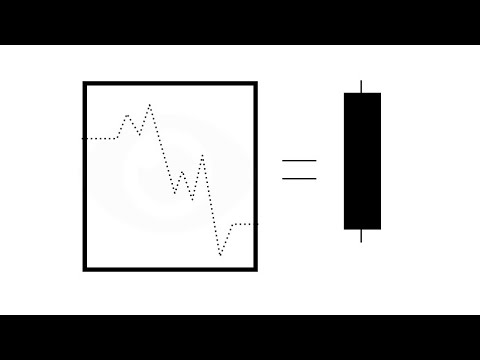

TLDRThis video script offers a comprehensive guide on choosing the right Candle Range Theory (CRT) candles for trading. It emphasizes the importance of focusing on confirmational CRT for beginners and intermediates, explaining its protocols and advantages over advanced CRT. The script covers key CRT protocols, including time frame alignment and timing of CRT formation and purge, to enhance trading accuracy. It concludes with practical examples of applying these protocols in live markets, advocating for a top-down analysis and waiting for confirmation before trading CRTs.

Takeaways

- 📈 Focus on Confirmational CRT (Candle Range Trading) for beginners and intermediates, as it is more suitable and increases margin compared to Advanced CRT.

- 🔍 Confirmational CRT requires adherence to at least two or three protocols for a high-probability setup, ensuring better trading decisions.

- 🕒 Importance of time in CRT, with specific times for CRT formation and purge being crucial for filtering out less accurate signals.

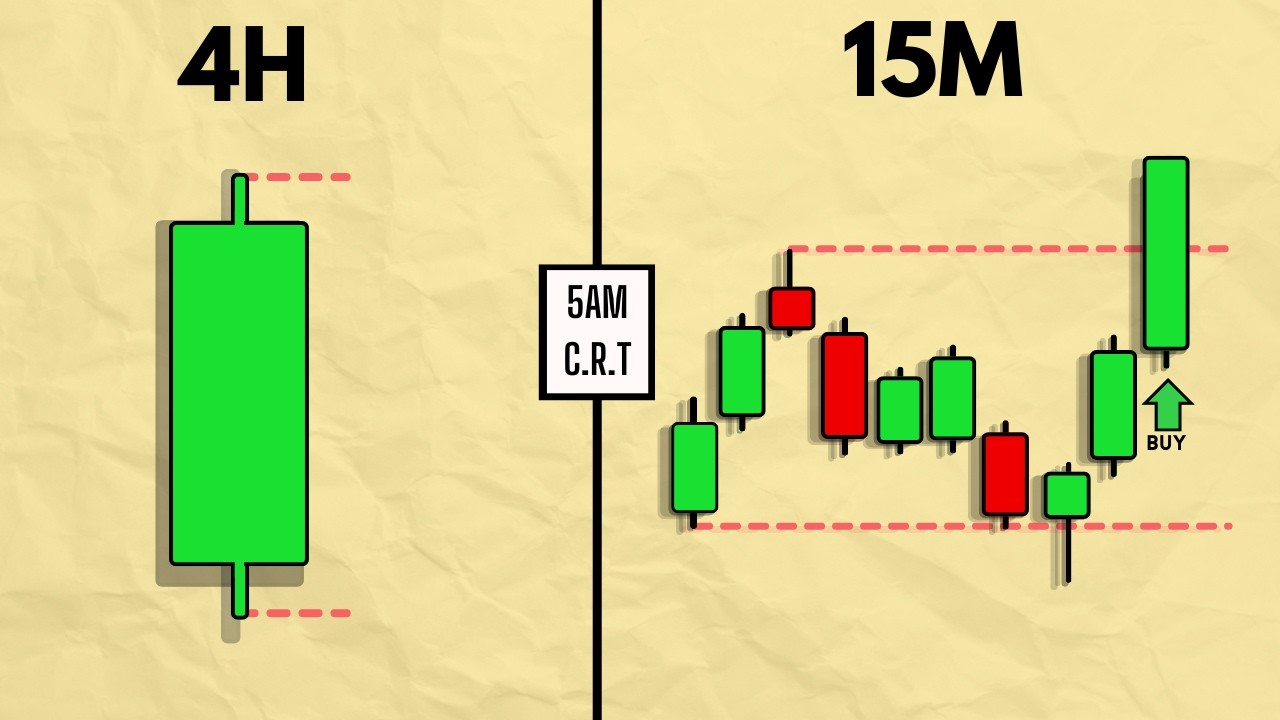

- 📊 Time frame alignment is vital for CRT, with lower and higher time frame CRTs working in tandem to provide stronger signals.

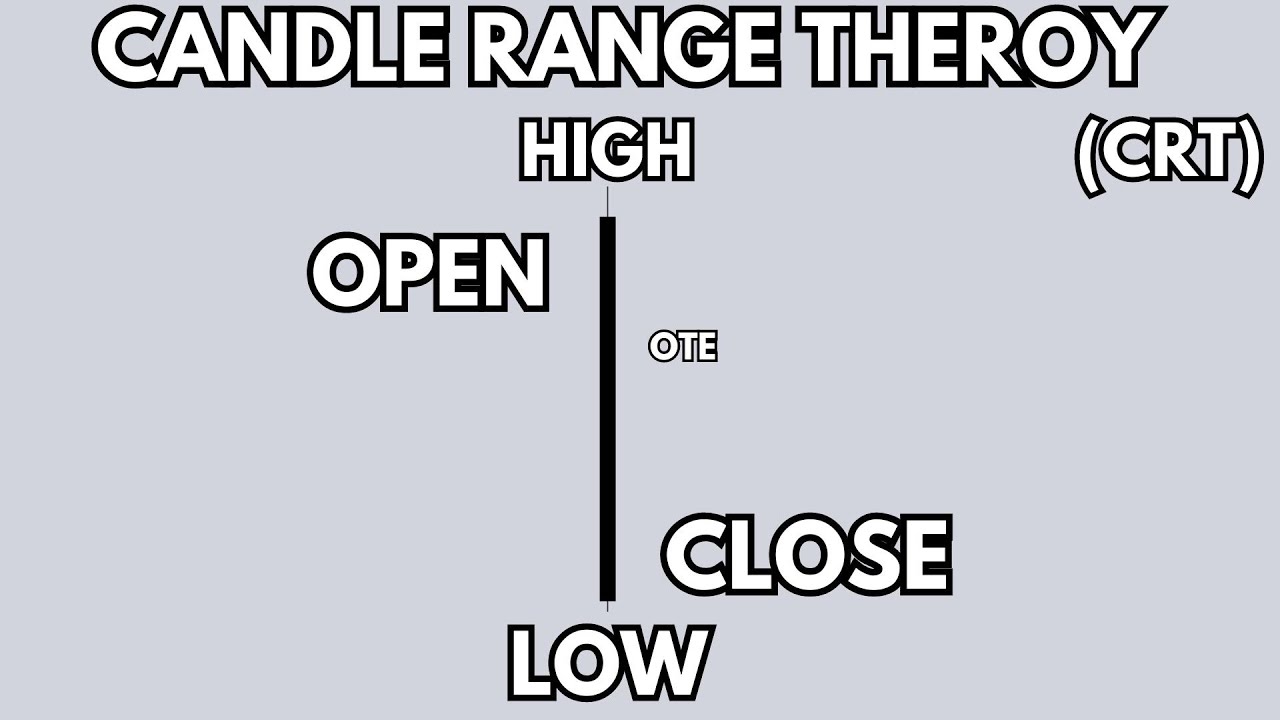

- 📝 Protocols for CRT include lower time frame CRT within a higher time frame, timing of CRT formation, and the presence of a higher time frame PD (Pivot Point).

- ⏳ Wait for the second candle to close within the CRT range for confirmation before trading, which increases the accuracy of the trade.

- 📉 Avoid trading CRT without confirmation; it significantly reduces the probability of a successful trade.

- 🚫 Discard CRTs that do not follow at least two protocols, as they are less reliable for trading.

- 🔑 Combine multiple protocols to select high-probability CRTs effectively, enhancing the trading strategy's success rate.

- 📚 Study and backtest different time alignments and CRT setups to find recurring patterns that can be used in trading strategies.

- 🌐 Follow the presenter on Twitter or join the telegram for daily trades and updates on trading strategies and concepts.

Q & A

What is the main focus of the video?

-The main focus of the video is to teach viewers how to select high probability Confirmational Range Trading (CRT) candles for trading.

What are the two types of CRT methods mentioned in the video?

-The two types of CRT methods mentioned are Confirmational CRT and Advanced CRT.

Why should beginners focus predominantly on Confirmational CRT?

-Beginners should focus on Confirmational CRT because it has a confirmational aspect, making it more suitable and increasing the margin of success compared to Advanced CRT.

What is the significance of waiting for the second candle to close before trading the CRT candle in Confirmational CRT?

-Waiting for the second candle to close provides confirmation, which is crucial for the name Confirmational CRT. It helps in determining the probability of the trade and reduces risk.

What is the importance of protocols in selecting a CRT?

-Protocols are important because a CRT must follow at least two or three of them to be considered correct and high probability for trading.

What is Time Frame Alignment and why is it important in CRT?

-Time Frame Alignment is the concept of aligning different time frames in a way that a lower time frame CRT is within a higher time frame CRT. It is important because it offers strong CRT signals and increases the accuracy of trades.

Can you trade a CRT if the second candle closes outside the CRT?

-Yes, you can still trade a CRT if the second candle closes outside, but it is considered a lower probability trade, and you should reduce your risk.

What is the role of the high time frame PDR in CRT protocols?

-The high time frame PDR acts as a catalyst for price expansion in the opposite direction, helping to filter out low probability CRTs and select only high-quality ones.

Why is the timing of the CRT formation and purge important in the protocols?

-The timing of the CRT formation and purge is important because it helps filter out less accurate CRTs that form at random times, enhancing the effectiveness of the trading strategy.

How should a trader approach a candle they are unsure about in terms of CRT?

-A trader should perform a top-down analysis, checking for the protocols discussed in the video. If the candle follows the protocols and the second candle closes inside the CRT, it confirms the CRT as valid for trading.

What is the advice given for traders who are new to CRT?

-The advice for new traders is to focus on Confirmational CRT, learn the protocols, and wait for confirmation before trading. They should avoid guessing CRTs randomly and trading without confirmation.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Trading one candle is easy, actually | Determine Market Direction and Daily bias

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

Candle Range Theory (CRT) Trading Model

Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

CRT secrets 4: Candle anatomy

CRT (Candle Range Theory) - La entrada TURTLE SOUP.

5.0 / 5 (0 votes)