Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

Summary

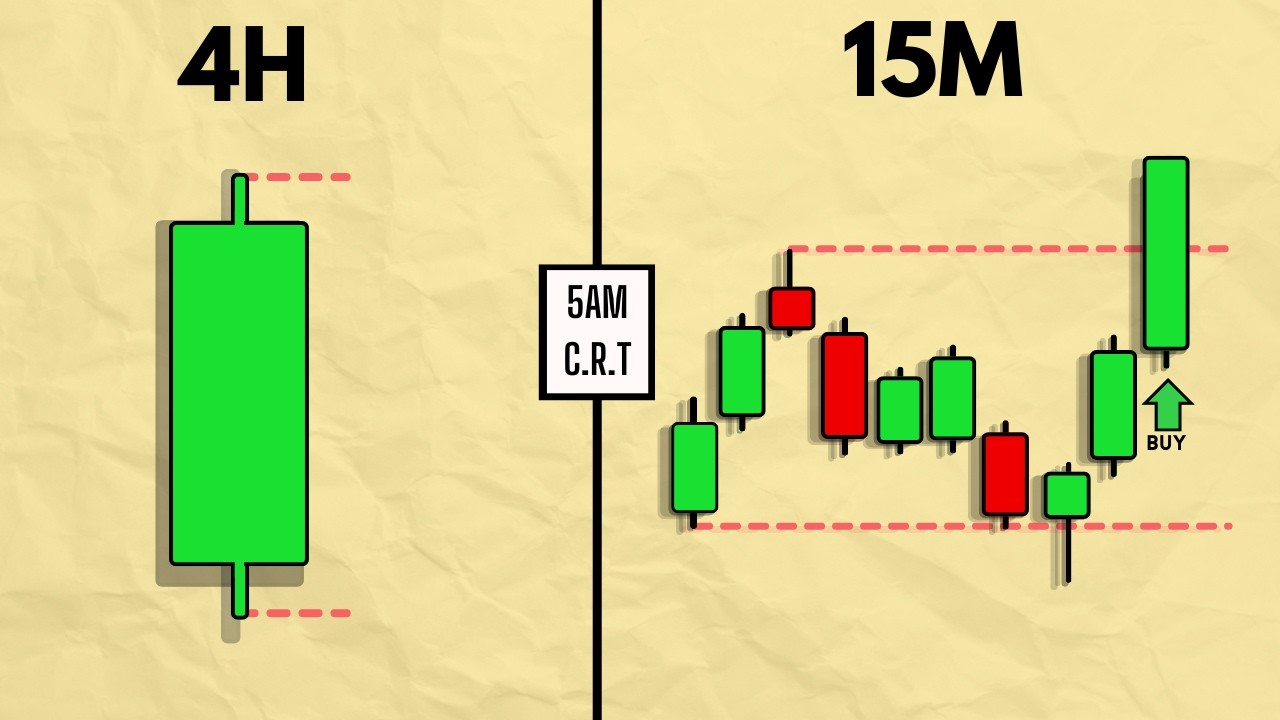

TLDRIn this episode of Smart Risk, the focus is on Candle Range Theory (CRT), an advanced trading concept that promises to enhance win rates by predicting price movements and formations. The video delves into the psychology behind CRT, explaining how every candlestick on a chart represents a price range. It outlines the market's three main phases: accumulation, manipulation, and distribution, known as the 'power of three.' The tutorial walks viewers through identifying CRT patterns using candlestick formations and offers practical tips for executing trades based on CRT, emphasizing the importance of timing and aligning time frames for high-probability trades.

Takeaways

- 🔍 Candle Range Theory (CRT) is an advanced trading concept that can significantly improve win rates by predicting price movements and candle formations.

- 📈 CRT is based on the idea that each candle on a chart represents a price range, which can be analyzed on lower time frames for more detailed insights.

- 🌐 The market moves through three phases: accumulation, manipulation, and distribution, known as the 'power of three', which is a continuous cycle.

- 🕒 The Asian, London, and New York trading sessions play crucial roles in identifying the accumulation, manipulation, and distribution phases, respectively.

- 📊 The 15-minute chart is recommended for recognizing CRT patterns as it provides clear price action aligned with higher time frames.

- 📌 CRT patterns can be identified using Candlestick patterns, which can be a sequence of three or more candles, with the key being the range they form.

- 🐉 In a bullish scenario, the CRT pattern involves a range candle setting up a range, a second candle sweeping through liquidity, and a third candle breaking out of the range.

- 📉 Bearish markets also follow CRT principles, applying the same concepts to downward price movements and formations.

- ⏰ Timing is essential for high-probability CRTs, with specific times in the Forex market being optimal for identifying and executing trades based on CRT patterns.

- 📈 CRT provides a systematic approach to trading by simplifying the process with fixed objectives, rules, and minimal conditions to look for before executing a trade.

Q & A

What is Candle Range Theory (CRT)?

-Candle Range Theory is an advanced trading concept that involves analyzing candlestick patterns to predict price movements and formations. It suggests that every candle on a chart represents a range of price action, which can be further analyzed on lower time frames.

How does CRT relate to the psychology of trading?

-CRT is based on the idea that market movements can be understood through three main phases: accumulation, manipulation, and distribution. These phases reflect the market's heartbeat and are psychological stages that traders can use to anticipate price movements.

What are the three main phases of market movement according to CRT?

-The three main phases are accumulation, manipulation, and distribution. Accumulation is a period of consolidation where price moves sideways. Manipulation involves taking out liquidity, and distribution occurs within the range created by manipulation.

Why is the Asian session important in CRT?

-The Asian session is crucial in CRT because it often sets the stage for the day's trading by accumulating price action. The behavior of the Asian session can dictate whether the subsequent London and New York sessions will manipulate or accumulate further.

What is the 'power of three' in CRT?

-The 'power of three' refers to the three-candle sequence that captures the accumulation, manipulation, and distribution phases within a single pattern. This sequence is considered a high-probability setup for successful trades.

How can traders identify CRT patterns using candlestick patterns?

-Traders can identify CRT patterns by looking for specific sequences of candles on higher time frames, such as a range candle followed by a liquidity-taking candle and then a breakout candle. The key is to recognize the formation and the subsequent price action that confirms the pattern.

What is the recommended time frame for recognizing CRT patterns?

-The 15-minute chart is recommended for recognizing CRT patterns as it provides clear price action that aligns with higher time frames and allows traders to identify key levels and potential breakouts.

What criteria and rules should be considered when identifying high-probability CRTs?

-When identifying high-probability CRTs, traders should look for patterns around key levels, consider the timing of the pattern in relation to the market sessions, and match the entry time frame with the CRT's time frame. They should also consider the sequence of candles and the price action that confirms the pattern.

How can traders use the CRT model to execute trades?

-Traders can use the CRT model to execute trades by identifying key times and patterns, zooming into appropriate time frames to monitor price action, and placing orders at strategic points such as order blocks or previous high/low points. They can set take profit levels based on the range of the CRT pattern.

What are the key times to consider for high-probability CRTs in the Forex market?

-The key times for high-probability CRTs in the Forex market are 1:00 a.m., 5:00 a.m., 9:00 a.m., 1 p.m., 3:00 p.m., 6:00 p.m., and 9:00 p.m. These times correspond to market sessions and shifts in liquidity that can influence CRT patterns.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Candle Range Theory (CRT) Trading Model

Trading one candle is easy, actually | Determine Market Direction and Daily bias

How To Select CRT Candles Perfectly - Full In Depth Guide - ICT Concepts

ICT Didn’t Work for You - Try This Instead

Candle Range Theory Explained

The Ultimate Guide to Fair Value Gaps: Inversed Fair Value Gap (IFVG) Trading Strategy Explained!

5.0 / 5 (0 votes)