Candle Range Theory (CRT) Trading Model

Summary

TLDRCandle Range Theory (CRT) simplifies a powerful trading model by focusing on key candlestick high and low points. Traders can use these liquidity levels to predict market movements, identify reversal opportunities, and enhance their trading strategies. By combining CRT with trend-following and trend-reversal techniques, along with lower time frame analysis and fair value gaps, traders can optimize their entries and manage risk effectively. This strategy, especially useful around market session transitions, offers a high-probability approach for trading in trending markets, helping traders navigate complex price movements with greater confidence.

Takeaways

- 😀 CRT (Candle Range Theory) focuses on using the high and low of a single candlestick to identify key liquidity levels for potential trading opportunities.

- 😀 Each candlestick's high and low represent important turning points, which are used as liquidity levels on lower time frames.

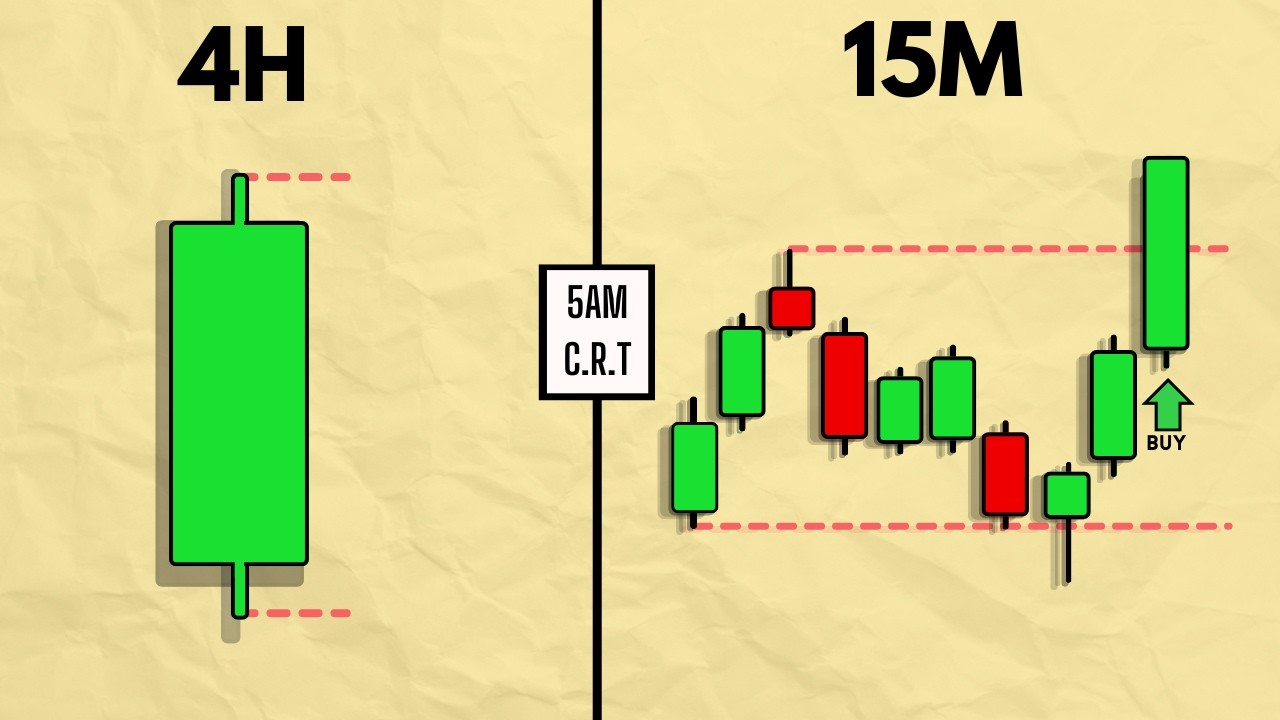

- 😀 The typical CRT strategy involves three candles: the first defines the range, the second creates a sweep, and the third provides the entry.

- 😀 The market often reverses after sweeping liquidity from the candle range high, signaling a potential move towards the opposite end of the range.

- 😀 The best time to apply CRT is during the New York session, particularly the 1-hour candle before the session opens, which is known for strong reversal movements.

- 😀 To trade with the trend, focus on bearish candles in an uptrend or bullish candles in a downtrend and use the CRT model to spot key entry points.

- 😀 A valid CRT setup requires the second candle to sweep the range but close inside it, indicating a potential reversal in price direction.

- 😀 To refine entries, zoom into a lower time frame and look for fair value gaps (FVG) after the sweep, then set your entry at those levels.

- 😀 Avoid trading CRT setups in a choppy or sideways market, as the model works best in trending conditions where impulse and correction legs are clear.

- 😀 Check the broader market context before trading CRT setups, as news releases or strong support/resistance levels can invalidate setups, even if they appear perfect.

Q & A

What is Candle Range Theory (CRT)?

-Candle Range Theory (CRT) is a trading concept that focuses on the price range (high to low) of a single candlestick. It suggests that these price levels, when broken down into lower time frames, often act as important liquidity levels and turning points in the market.

How do traders typically use CRT in their strategy?

-Traders often use CRT by focusing on three key candles: the first candle defines the range, the second creates a sweep, and the third provides the entry. The key is to observe how price reacts around the high and low of the first candle and look for liquidity sweeps as indicators of market reversal or continuation.

What is the significance of the second candle in CRT?

-The second candle in CRT plays a crucial role by either attacking the liquidity above or below the first candle’s range. If the second candle sweeps the range and reverses, it suggests a potential market shift towards the opposite end of the range, providing an entry signal.

What should traders do if the second candle closes above the candle range high?

-If the second candle closes above the candle range high, the CRT setup is considered invalid. This is because the market is more likely to continue moving upwards rather than targeting the low of the first candle's range.

Which time frame is most commonly used in CRT, and why?

-The 1-hour chart is commonly used in CRT, especially before the New York session opens. This is because the New York session often experiences strong reversal movements after liquidity from the London session is swept, providing high probability setups when combined with CRT principles.

How can CRT be applied while following the market trend?

-To use CRT with the trend, traders look for a trending market and wait for a correction. They then apply CRT to bearish candles in an uptrend or bullish candles in a downtrend, marking the high and low, and wait for a sweep before entering in the direction of the trend.

What role do fair value gaps (FVGs) play in CRT setups?

-Fair value gaps (FVGs) are used to fine-tune entries in CRT setups. After identifying a sweep candle on the higher time frame, traders zoom into lower time frames (e.g., 5-minute or 15-minute charts) to find an FVG, which acts as an entry zone with a more precise entry point.

How do the concepts of discount and premium zones enhance CRT trading?

-In CRT trading, applying discount and premium zones helps traders improve their entry points. In a downtrend, waiting for price to pull back into a premium zone before applying CRT increases the likelihood of a successful trade, as it aligns with both market manipulation and trend-following principles.

What are common mistakes traders make when using CRT?

-Common mistakes include trading in choppy markets with no clear direction, entering too early without waiting for a proper liquidity sweep, and neglecting market context, such as major news events or key support/resistance levels that can invalidate a CRT setup.

How can traders avoid losing money when a CRT trade fails?

-One effective strategy is to close half of the position at a 1:1 risk-to-reward level, making the trade risk-free. If the trade reverses and hits the stop-loss, the trader won't lose any money, as they’ve already taken partial profits.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

Candle Range Theory Explained

Trading one candle is easy, actually | Determine Market Direction and Daily bias

**NEW** CRT Trading Strategy! The 2026 Game Changer

How To Select CRT Candles Perfectly - Full In Depth Guide - ICT Concepts

Perfecting LTF Orderblock Entries With CRT - Candle Range Theory - ICT Concepts

5.0 / 5 (0 votes)