CRT secrets 4: Candle anatomy

Summary

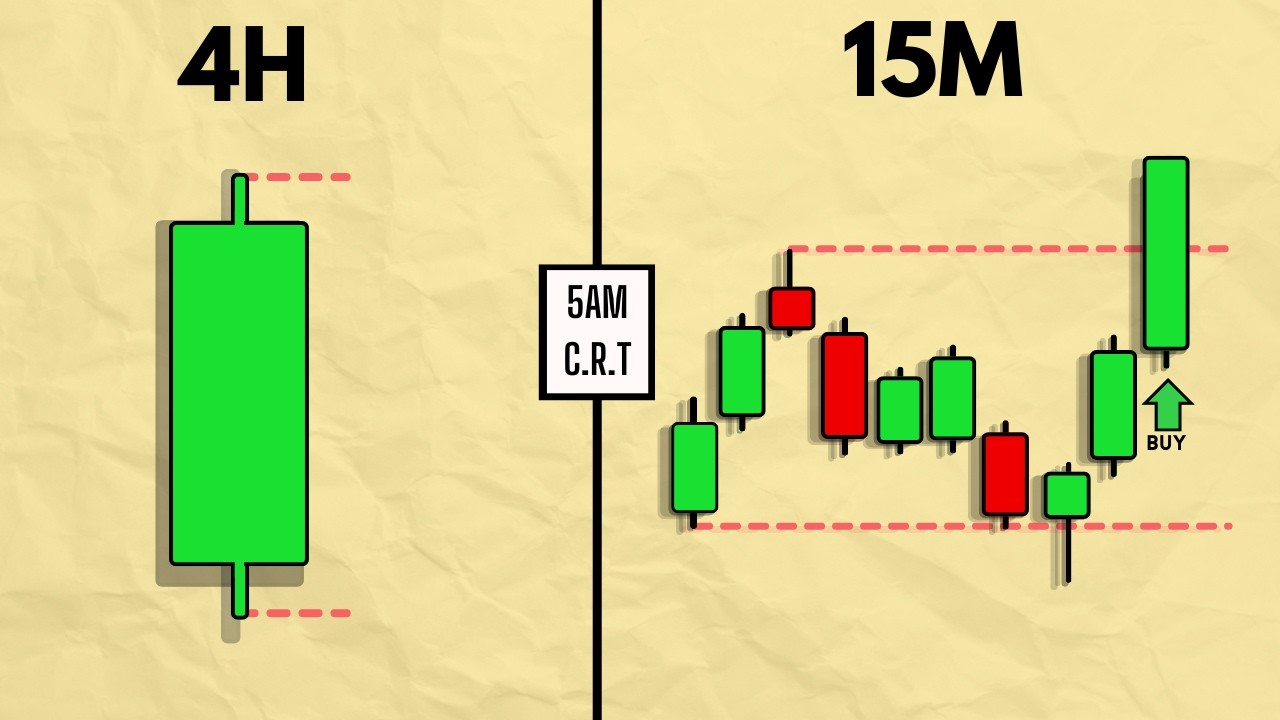

TLDRIn this video, the importance of mastering candle anatomy for successful CRT (Candle-Related Trading) is emphasized. The speaker critiques pattern traders who focus on one-time frame without context, warning that this approach leads to failure. They advocate for a deeper understanding of candles, stressing that trading should focus on higher timeframes (4-hour, daily, weekly) rather than impulsive, low-timeframe scalping. Key strategies include analyzing each candle's open and close, and practicing patience and discipline. The video encourages students to move away from gambling habits, fostering a more strategic, long-term approach to trading.

Takeaways

- 😀 Understanding candle anatomy is essential for long-term success in CRT trading.

- 😀 Traders must focus on higher time frames (4-hour, daily, weekly) for better market analysis.

- 😀 All candles, regardless of time frame, share the same structure: open, close, and price action in between.

- 😀 The fractal nature of price means that the structure of candles remains the same across different time frames.

- 😀 Avoid trading lower time frames, which leads to impulsive, gambling-like behavior and poor decision-making.

- 😀 Traders should focus on fewer, more well-analyzed trades instead of overtrading or scalping constantly.

- 😀 It’s important to visualize and conceptualize each candle from open to close before making any trade.

- 😀 Acknowledge the addictive nature of frequent trading and strive for a disciplined, methodical approach.

- 😀 Successful traders understand that trading less frequently with precision is far more profitable than constant, impulsive trades.

- 😀 Before making any trade, ask yourself: What candle am I trading? (4-hour, daily, weekly, etc.)

- 😀 Avoid blind pattern trading without understanding the context or the candle anatomy behind it.

Q & A

What is candle anatomy and why is it important in CRT trading?

-Candle anatomy refers to understanding the structure and behavior of candles in trading charts, specifically the opening and closing times and the price movement between them. It is crucial for CRT (Candle Reverse Trading) because traders who don't understand candle anatomy are more likely to fail in the long term. Understanding candles provides a better foundation for reading price action and making informed trading decisions.

What types of traders are mentioned in the script, and what is their common mistake?

-The script mentions various types of traders: pattern traders, SMC (Smart Money Concept) traders, supply and demand traders, Elliot wave traders, harmonic traders, and others. Their common mistake is blind pattern trading without context, narrative, or bias, which leads to inconsistency and losses in the market.

What is the ultimate goal for traders following CRT principles?

-The ultimate goal for CRT traders is to avoid falling into the endless loop of pattern trading and gambling-like behavior, and instead focus on mastering candle analysis. This allows them to make informed, deliberate trades with a higher chance of long-term success.

Why is it important to choose the right candle to trade, and how can this impact trading success?

-Choosing the right candle to trade is fundamental because it directly influences the timing and direction of the trade. The script stresses that beginners should focus on higher timeframes, such as 4-hour, daily, and weekly candles, while advanced traders can work with longer timeframes like monthly or quarterly candles. Trading lower timeframes without a solid strategy often leads to impulsive and poor decisions.

What timeframes are considered valid for trading according to the script, and why?

-The script recommends trading only on 4-hour, daily, or weekly candles. These timeframes allow traders to focus on more meaningful price movements and avoid the noise and randomness of lower timeframes. As traders become more advanced, they can analyze higher timeframes such as monthly and quarterly candles, which offer even more stability and clarity.

What does the script mean by the 'fractality' of price?

-The fractality of price refers to the idea that candles look the same regardless of the timeframe. Whether on a 4-hour candle or a monthly candle, the structure is identical, and the same principles can be applied across different timeframes. This concept allows traders to apply the same strategies regardless of whether they are trading short-term or long-term positions.

How can lower timeframes be used effectively according to the script?

-Lower timeframes should be used for analysis rather than active trading. By studying lower timeframes like the 1-hour or 5-minute candles, traders gain valuable insights into price action and how it behaves at different levels. This analysis is important because it can help traders understand longer-term trends and better time their entries and exits.

What does the script say about the addictive nature of trading, particularly with lower timeframes?

-The script compares the addictive behavior of traders on lower timeframes to gambling. Traders who are addicted to scalping and constantly pressing buttons often end up losing track of their trades and are unaware of their success or failure rates. This impulsive behavior leads to frustration and failure, and the script encourages traders to break free from this habit.

What is the 'Turtle Soup' entry model mentioned in the script?

-The 'Turtle Soup' entry model refers to a specific trading strategy used within CRT. It involves waiting for a price to make a false breakout, triggering an entry based on the candle's open and subsequent movement. This model aims to capture price reversals after the breakout fails, offering a potentially profitable trade setup.

How does the script suggest managing the number of trades you take for long-term success?

-The script emphasizes that fewer trades are better for long-term success. The wealthiest and most successful traders focus on fewer, higher-quality trades rather than attempting to make dozens of trades every day. This approach ensures that traders can give each trade the attention and analysis it deserves, ultimately increasing the probability of profitable outcomes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How To Select CRT Candles Perfectly - Full In Depth Guide - ICT Concepts

Morning Star Candlestick Pattern | Basic Price Action Roadmap | Part 3

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

Trading one candle is easy, actually | Determine Market Direction and Daily bias

**NEW** CRT Trading Strategy! The 2026 Game Changer

Candle Range Theory Explained

5.0 / 5 (0 votes)