AKUNTANSI UNTUK PENDIRIAN FIRMA : Latihan Soal Laba dan Rugi bagi anggota Firma

Summary

TLDRIn this video, Dewi Norsanie provides an accounting lesson on calculating profit distribution within a firm. She explains the complex rules for dividing profits between two partners, Andi and Rina, who run a tax consultant firm. The video covers the distribution of profits based on investment, working hours, and any remaining balance. Through a detailed example, Dewi walks viewers through the process of calculating each partner's share and recording it in the journal. The lesson also includes a follow-up with a change in profit, showcasing how the distribution process adjusts accordingly.

Takeaways

- 😀 The video introduces a lesson on calculating the profit of each member of a partnership firm with complex profit-sharing rules.

- 😀 The partnership is between Andi and Rina, where Andi invested 15 million and Rina 9 million.

- 😀 The first rule of profit distribution involves dividing the first 20 million based on the initial capital investment of each partner.

- 😀 The second rule divides the next 13 million based on the hours worked by each partner, where Andi works more hours than Rina.

- 😀 The third rule states that any remaining profit should be divided equally between the partners.

- 😀 The video walks through an example with a net profit of 30 million, calculating the share each partner gets based on the distribution rules.

- 😀 Andi’s share is determined by his higher investment and greater working hours compared to Rina.

- 😀 For a 30 million profit, Andi receives 19 million, and Rina receives 10 million, following the three rules of distribution.

- 😀 The second part of the lesson involves a change in the partnership’s net profit to 34 million, requiring recalculations of the profit distribution.

- 😀 In the revised example, the profit distribution involves dividing 20 million based on capital investment, 13 million based on working hours, and the remaining 1 million is split equally.

- 😀 The video concludes with instructions on how to record the journal entries for profit distribution in a partnership, ensuring the capital accounts of each partner are updated.

Q & A

What is the primary focus of the video?

-The video focuses on teaching how to calculate profit distribution in a partnership, using specific rules such as profit sharing based on investment, salary, and any remaining profit.

How is the first rule for profit distribution applied?

-The first rule states that the first 20 million of the partnership's net profit is divided according to the initial capital investment of each partner. In this case, Andi's investment is 15 million, and Rina's investment is 9 million.

What is the formula used to calculate each partner's share under the first rule?

-The formula used is the ratio of each partner's investment to the total investment, multiplied by the first 20 million of the profit. For example, Andi's share is calculated as (15/24) * 20 million.

How is the second rule for profit distribution applied?

-The second rule involves distributing 13 million of the profit based on the agreed-upon salary for each partner. In this case, Rina receives 5 million, and Andi receives 8 million based on their working hours.

What is the ratio used in the second rule to divide the profit?

-The ratio used is 8:5, where Andi gets 8 parts, and Rina gets 5 parts, reflecting their respective salaries.

How is the third rule for profit distribution applied?

-The third rule states that if there is any remaining profit after applying the first two rules, it will be divided equally between the partners.

What happens when the profit is adjusted to 34 million instead of 30 million?

-When the profit is increased to 34 million, the distribution changes. The first 20 million is still divided as per the first rule, and 13 million is divided according to the second rule. The remaining 1 million is then split equally between Andi and Rina.

How is the remaining profit calculated after applying the first two rules when the profit is 34 million?

-After dividing the first 20 million and the 13 million for salary distribution, there is a remainder of 1 million, which is then divided equally between Andi and Rina, resulting in an additional 500,000 each.

What is the final total amount received by Andi and Rina when the profit is 34 million?

-When the total profit is 34 million, Andi receives 21 million, and Rina receives 13 million, based on the distribution rules.

How do the journal entries reflect the profit distribution in the partnership?

-The journal entries include a debit to the profit and loss summary account for the total profit, and credits to the capital accounts of Andi and Rina for their respective shares of the profit. For example, Andi’s capital account would be credited by 21 million, and Rina's by 13 million when the profit is 34 million.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

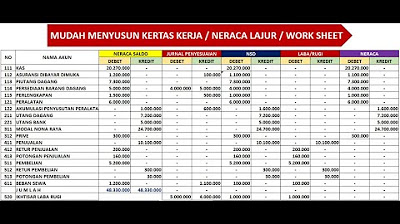

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

AKUNTANSI UNTUK PENDIRIAN FIRMA : Para anggota nya belum memiliki usaha sebelumnya

AKUNTANSI UNTUK PENDIRIAN FIRMA : salah satu anggota nya sudah memiliki usaha

JURNAL PEMBELIAN - JB - JURNAL KHUSUS

Deskripsi Perusahaan Dagang - Pengertian, Ciri, Akun, Syarat Penyerahan Barang, Syarat Pembayaran

JURNAL PENYESUAIAN -Tips dan Trik Memahami dengan Cepat

5.0 / 5 (0 votes)