AKUNTANSI UNTUK PENDIRIAN FIRMA : salah satu anggota nya sudah memiliki usaha

Summary

TLDRIn this video, Dewi Norsanie explains the accounting process for establishing a firm, especially when one of the members already owns a business. Using a case study of Mr. Soleh's online shop, the video demonstrates how to handle revaluations, asset deposits, and the preparation of balance sheets. Dewi outlines two methods: using old bookkeeping or establishing new bookkeeping with adjusted capital accounts. She covers journal entries, asset adjustments, and final balance sheet preparation to ensure a smooth transition when forming a partnership or firm.

Takeaways

- 😀 Introduction to the accounting lesson on establishing a firm when one of the members already has a business.

- 😀 Explanation of the partnership agreement among Mr. Soleh, Mr. Ali, and Mr. Deni, where each member deposits assets into the firm.

- 😀 Discussion on the two methods of accounting: using old bookkeeping or new bookkeeping for establishing the firm.

- 😀 For old bookkeeping, adjustments must be made to the assets, such as revaluation and debt payment before proceeding with deposits.

- 😀 Detailed example provided on how to adjust Mr. Soleh's financial position, including cash, inventory, and debt.

- 😀 Importance of recording asset deposits made by new members (Mr. Ali and Mr. Deni) in the general journal.

- 😀 Revaluation of assets (e.g., Mr. Ali's land and Mr. Deni's vehicle) for accurate recording in the firm's balance sheet.

- 😀 Clear steps provided on preparing the firm’s balance sheet after accounting for the member's deposits and adjustments.

- 😀 Explanation of the process when using new bookkeeping, including closing the old business, recording new deposits, and preparing the initial balance sheet.

- 😀 Step-by-step demonstration of the closing journal for old members and recording the deposit of assets by Mr. Soleh, Mr. Ali, and Mr. Deni.

- 😀 Detailed description of how to create a trial balance and how to organize the balance sheet for the newly established firm.

Q & A

What is the main topic of the video?

-The main topic of the video is accounting for the establishment of a firm where one of the members already has an existing business. The video explains two methods for handling the accounting process: using old bookkeeping or new bookkeeping.

What should be done first if the accounting method uses old bookkeeping?

-The first step is to conduct a revaluation of the assets if necessary. This includes adjusting any assets that need to be revalued or making adjustments to the assets of members who already had a business.

What happens if no revaluation is needed in old bookkeeping?

-If no revaluation is needed, this step is skipped, and the process continues by recording the deposits of the new members and preparing the firm's balance sheet.

How are the assets of new members recorded when using old bookkeeping?

-The assets deposited by new members, such as cash, land, or equipment, are recorded in the general journal, and the corresponding capital accounts of the members are adjusted accordingly.

What adjustments need to be made in the old bookkeeping method for Mr. Soleh’s existing business?

-In the old bookkeeping method, adjustments include crediting Mr. Soleh's cash account for the withdrawal of his special property, reducing the inventory of goods to 8 million, and debiting the bank debt paid off by Mr. Soleh.

What is the process when using new bookkeeping to establish a firm?

-In new bookkeeping, the first step is to adjust the assets of the old member (if needed). Afterward, the old firm's assets and liabilities are closed by making a closing journal. Then, the capital deposits of all members joining the new firm are recorded, and the new balance sheet is prepared.

What must be done to close the assets and liabilities of the old firm in new bookkeeping?

-To close the old firm's assets and liabilities, a closing journal is created, transferring the balances of the old assets (like trade receivables, inventory, equipment) and liabilities (like trade debt) to appropriate capital accounts.

What is the difference between the old bookkeeping and new bookkeeping methods?

-The main difference is that in old bookkeeping, the existing records and assets are adjusted and continued, while in new bookkeeping, all old records are closed, and new accounts are established for the firm, starting fresh with new asset and capital deposits.

How are the capital deposits of new members recorded in new bookkeeping?

-In new bookkeeping, the capital deposits of new members are recorded by creating journal entries for each member's contribution, including cash, land, or other assets, and adjusting the corresponding capital accounts.

What is the significance of preparing a balance sheet in both bookkeeping methods?

-Preparing a balance sheet is crucial in both bookkeeping methods as it summarizes the financial position of the firm, ensuring that assets and liabilities are properly balanced and that the accounting records are accurate after adjustments and deposits.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

AKUNTANSI UNTUK PENDIRIAN FIRMA : Para anggota nya belum memiliki usaha sebelumnya

AKUNTANSI UNTUK PENDIRIAN FIRMA : Latihan Soal Laba dan Rugi bagi anggota Firma

AKUNTANSI SEBAGAI SISTEM INFORMASI

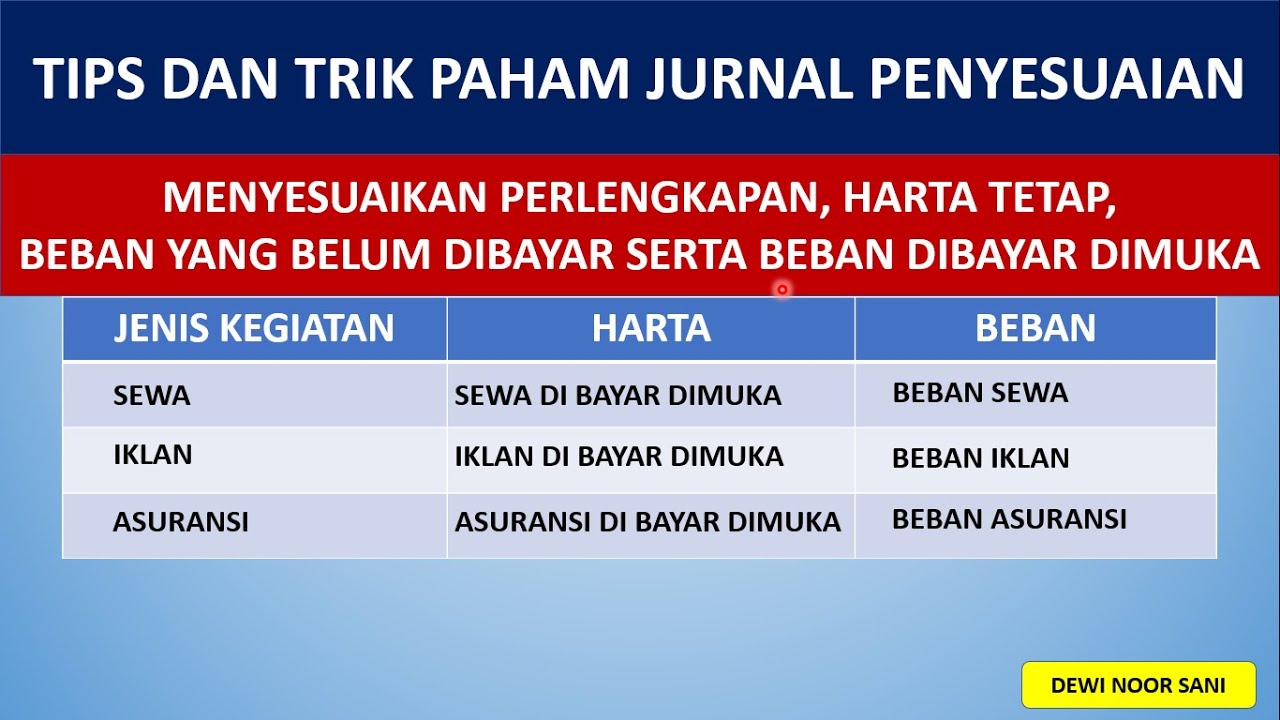

JURNAL PENYESUAIAN -Tips dan Trik Memahami dengan Cepat

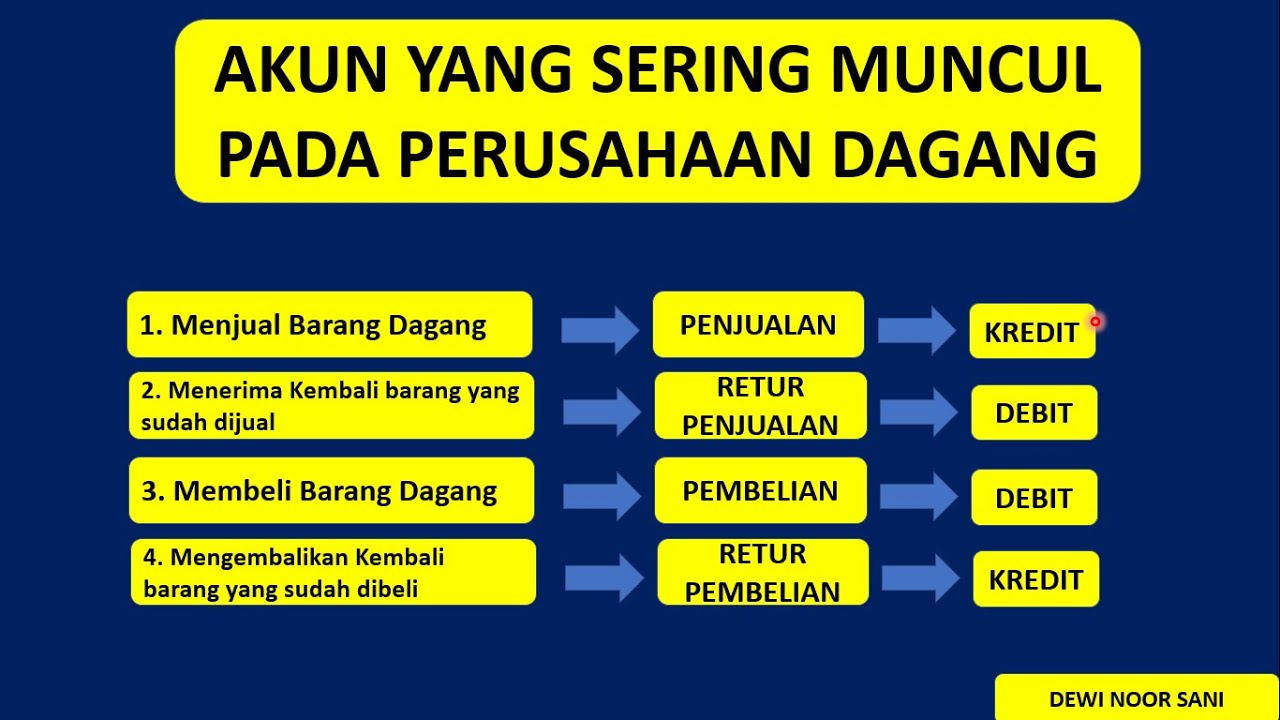

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

Deskripsi Perusahaan Dagang - Pengertian, Ciri, Akun, Syarat Penyerahan Barang, Syarat Pembayaran

5.0 / 5 (0 votes)