JURNAL PENYESUAIAN -Tips dan Trik Memahami dengan Cepat

Summary

TLDRThis video by Dewi Norsanie offers practical tips and tricks for preparing adjusting journal entries in accounting. It covers topics like adjusting supplies, fixed assets, unpaid expenses, and prepaid expenses using different methods (asset or expense method). Dewi explains each concept with step-by-step examples, ensuring clarity on debits, credits, and calculations. The video also includes demonstrations on depreciation and adjustments for unpaid salaries and utilities. Overall, the lesson aims to simplify the process of creating accurate adjusting journal entries while reinforcing key accounting principles.

Takeaways

- 📘 Introduction to adjustment journals in accounting, focusing on tips and tricks for quick and accurate preparation.

- 🖊️ Adjusting supplies involves debiting supplies expense and crediting supplies. For example, office or store supplies must be treated similarly.

- 🏢 Fixed assets like equipment, vehicles, and buildings require depreciation adjustments, where depreciation expense is debited and accumulated depreciation is credited.

- 📈 Adjusting unpaid expenses, such as unpaid salaries or utilities, involves debiting the expense and crediting a liability (e.g., unpaid wages, unpaid electricity).

- 📄 Prepaid expenses can be adjusted using either the asset or expense method, depending on how it’s recorded in the trial balance (e.g., prepaid rent or rent expense).

- 💡 Using the asset method, debit the expense and credit the asset account for the amount used (e.g., prepaid rent debited to rent expense).

- 📊 If using the expense method for prepaid expenses, debit the asset and credit the expense for the amount not yet used.

- 📉 Straight-line depreciation involves dividing the asset cost by its useful life, adjusting for depreciation each year (e.g., vehicles or equipment).

- 💸 Advertising adjustments follow the same principles as other expenses, adjusting based on whether it’s recorded as prepaid or an expense.

- 💼 End-of-period adjustments for utilities and wages ensure accurate liability recording, with adjustments split between sales and administrative expenses.

Q & A

What is the main topic of the video presented by Dewi Norsanie?

-The main topic of the video is accounting, specifically focusing on tips and tricks for preparing adjusting journal entries.

What is the purpose of adjusting journal entries according to the video?

-Adjusting journal entries are used to update the balances of accounts at the end of a period to reflect the true financial state, such as accounting for supplies used, depreciation of fixed assets, and unpaid expenses.

How should supplies be adjusted in an adjusting journal entry?

-When adjusting supplies, the debit entry should be to 'Supplies Expense' and the credit entry to 'Supplies.' The adjustment amount is the value of supplies used during the period.

How is depreciation on fixed assets recorded?

-Depreciation on fixed assets is recorded by debiting 'Depreciation Expense' and crediting 'Accumulated Depreciation' for the asset, such as vehicles or machinery.

What is the difference between prepaid expenses and expenses paid in advance?

-Prepaid expenses represent assets because the payment covers future periods. If it appears as 'Prepaid Expense' in the trial balance, it uses the asset method, while 'Expense' in the trial balance indicates the use of the expense method for adjustment.

What are the steps for adjusting prepaid expenses using the asset method?

-When adjusting prepaid expenses using the asset method, debit the relevant expense account (e.g., Rent Expense) and credit the prepaid account (e.g., Prepaid Rent) for the portion that has expired or been used.

How are unpaid expenses (such as salaries or utilities) recorded in adjusting entries?

-For unpaid expenses, debit the expense account (e.g., Salaries Expense) and credit a liability account (e.g., Salaries Payable) for the amount owed but not yet paid.

What is the significance of the date '31' in the adjusting journal entries?

-The date '31' is used in all adjusting journal entries in the example because adjustments are typically made at the end of the period, which is often the last day of the month.

How is the straight-line depreciation method applied to vehicles?

-The straight-line depreciation method divides the cost of the vehicle (minus any residual value) by its useful life in years to calculate annual depreciation. This value is then used for adjusting entries.

How are expenses split between departments in the adjusting entries for salaries?

-In the example, salaries are split between departments, with 30% allocated to sales and the remaining 70% to administration and general expenses. Separate entries are made for each portion.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Menyusun Jurnal Penyesuaian

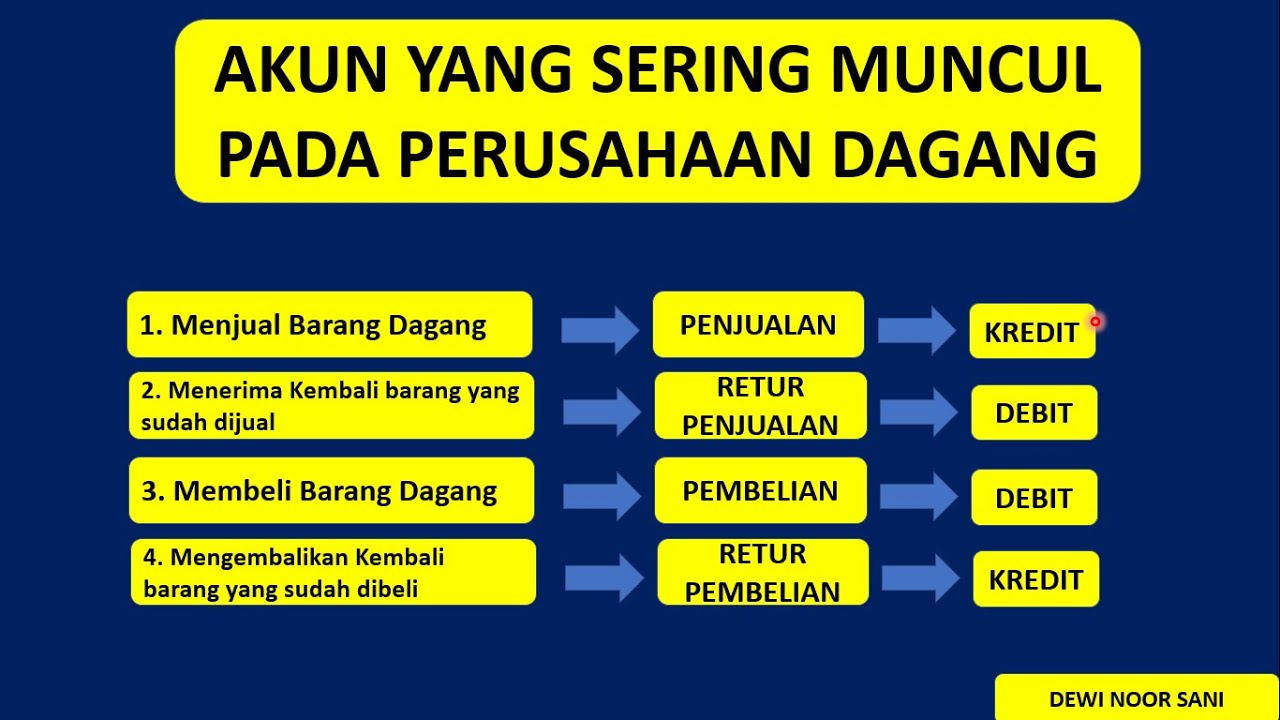

JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

AKUNTANSI UNTUK PENDIRIAN FIRMA : salah satu anggota nya sudah memiliki usaha

AKUNTANSI UNTUK PENDIRIAN FIRMA : Para anggota nya belum memiliki usaha sebelumnya

Cara Membuat Jurnal Umum Perusahaan Jasa

JURNAL PEMBELIAN - JB - JURNAL KHUSUS

5.0 / 5 (0 votes)