Gather Information Required To Complete the FAFSA® Form

Summary

TLDRThis video provides a step-by-step guide to gathering the necessary documents for the 2024-25 FAFSA form. It highlights the essential items, such as Social Security numbers, tax returns, and financial records, required to complete the form. The video emphasizes the importance of IRS consent for tax data transfer and offers tips for using Aidan, a virtual assistant, to assist with the process. Viewers are encouraged to prepare in advance to avoid delays and ensure eligibility for federal student aid, with additional support available at StudentAid.gov.

Takeaways

- 😀 Gather all necessary documents before starting the 2024-25 FAFSA form to avoid delays.

- 😀 You will need your own Social Security number and your parent's Social Security numbers if you are a dependent student.

- 😀 Consent and approval are required to transfer federal tax information directly from the IRS to your FAFSA form.

- 😀 Without consent, you will not be eligible for Federal Student Aid.

- 😀 Make sure to have tax returns and records of child support received for both you and your contributors.

- 😀 You’ll also need current balances of cash, savings, and checking accounts for you and your contributors.

- 😀 Net worth information for investments, businesses, and farms will be required during the FAFSA process.

- 😀 Ensure you have the names, dates of birth, Social Security numbers, and email addresses for each contributor.

- 😀 Use Aidan, the virtual assistant, on StudentAid.gov for help while completing the FAFSA form.

- 😀 Look for the owl icon at the bottom right of any page on StudentAid.gov to access Aidan.

- 😀 The FAFSA form for 2024-25 will be available soon, so gather your documents now to submit your application promptly.

Q & A

What is the first step in the financial aid journey?

-The first step is gathering the necessary information and documents to fill out the 2024-25 Free Application for Federal Student Aid (FAFSA) form.

What documents do you need to complete the FAFSA form?

-You will need your Social Security number (and your parent's if you're a dependent student), federal tax information, tax returns, child support records, current balances for cash, savings, and checking accounts, and information about investments, business, and farms.

What is the role of the IRS in the FAFSA process?

-You will need to provide consent for the IRS to transfer your federal tax information directly into your FAFSA form. Without this consent, you will not be eligible for federal student aid.

How can Aidan, the virtual assistant, help during the FAFSA process?

-Aidan can provide guidance and answer questions along the way. You can access Aidan by selecting the owl icon in the bottom-right corner of any page on StudentAid.gov.

What should you do if you need additional explanations while completing the FAFSA form?

-You can click on the question mark icon on the online FAFSA form to get more details and explanations about specific sections.

What happens if you don’t provide consent for the IRS data transfer?

-If you do not provide consent for the IRS data transfer, you will not be eligible to receive federal student aid.

What other information might you need to manually enter into the FAFSA form?

-If necessary, you may need to manually enter your tax returns, child support records, account balances, and net worth of investments, businesses, and farms.

When should you submit the 2024-25 FAFSA form?

-You should submit the FAFSA form as soon as it becomes available to apply for student aid without delay.

Where can you find more information and answers to your FAFSA-related questions?

-For additional information, you can visit StudentAid.gov.

What happens if you don't gather all the necessary documents before starting the FAFSA?

-Not having all the necessary documents ready can lead to delays in completing your FAFSA form, which could delay your eligibility for federal student aid.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

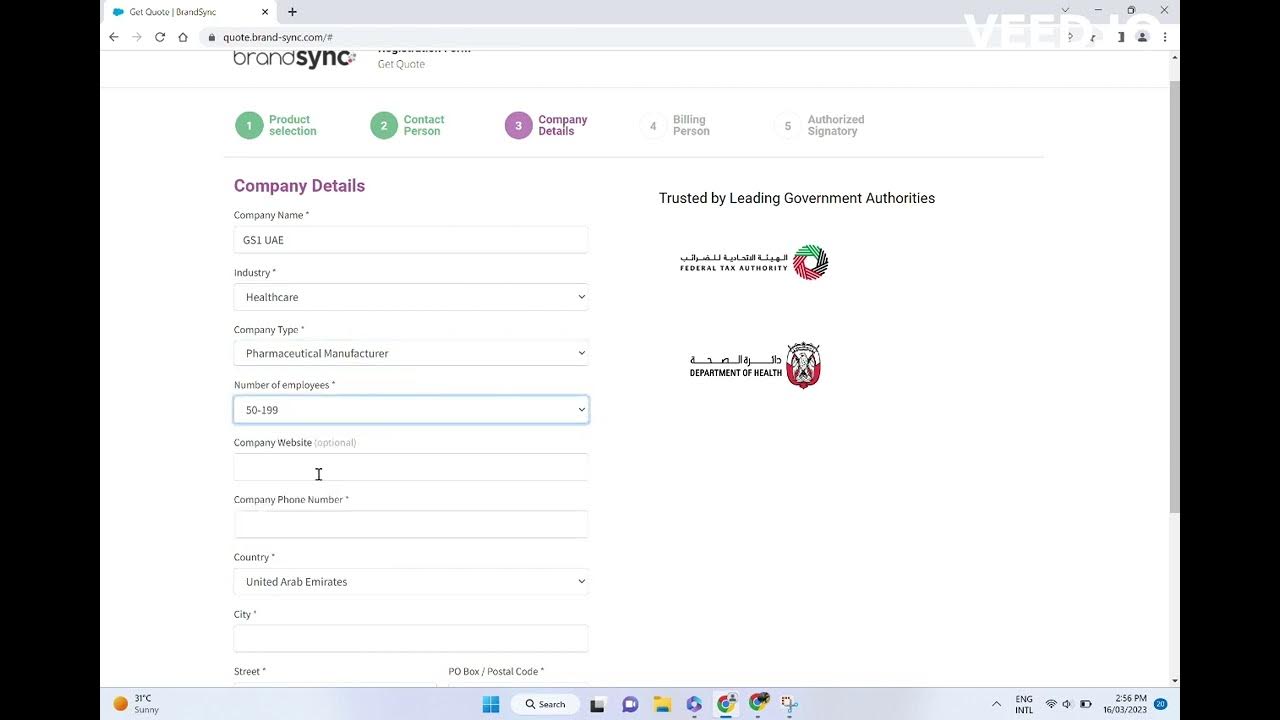

How to Register on BrandSync for Tatmeen

Gimana kalau gue mulai ekspor dari nol

Create and Access Your StudentAid.gov Account

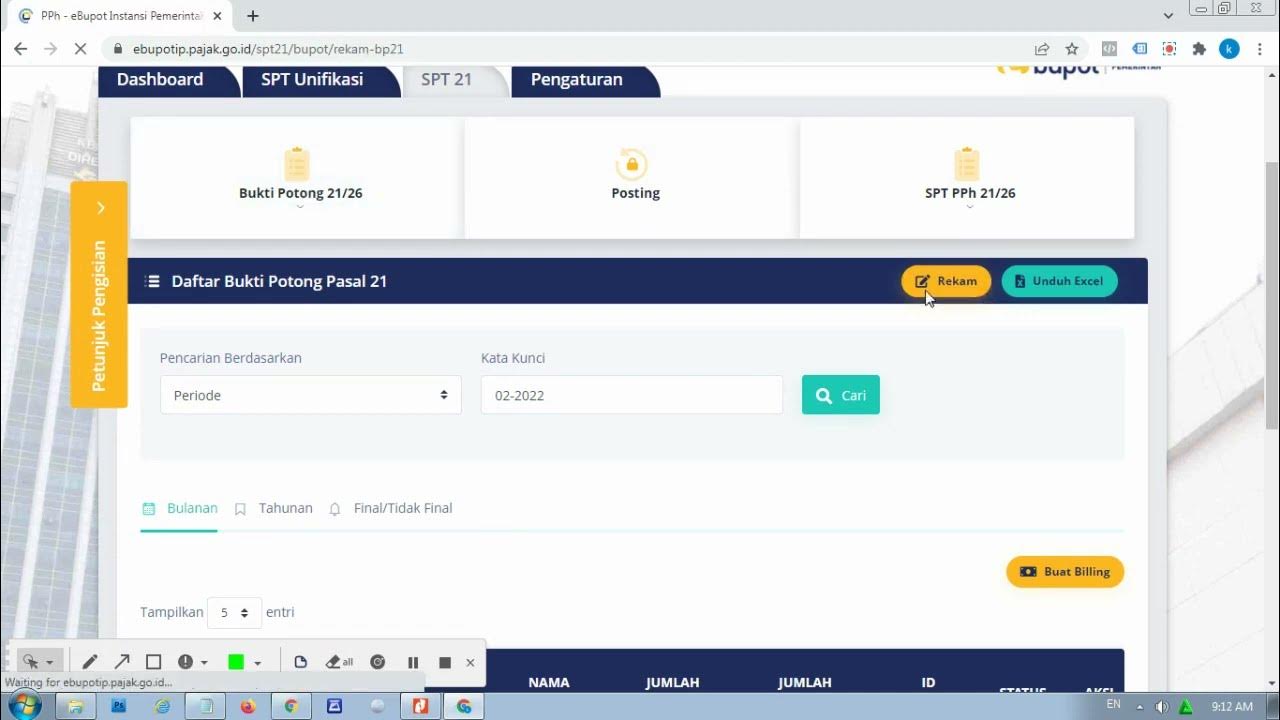

Tata Cara input PPh 21 di E-Bupot dan Pelaporannya

Mudah Banget! Membuat Laporan Keuangan UMKM untuk Lapor SPT Tahunan

Tutorial Pelaporan SPT Tahunan 1770S | Bagi WP Orang Pribadi dengan e-Form

5.0 / 5 (0 votes)