DON'T PAY CASH AT CAR DEALERSHIPS! (Here's Why) - Car Dealer Reacts - Marko - WhiteBoard Finance

Summary

TLDRIn this insightful video, Marco educates viewers on the pitfalls of revealing cash payment intentions when negotiating car purchases. He explains that dealerships primarily profit from finance and insurance, not the car sale itself. By pretending to finance, buyers can leverage better pricing. Marco then outlines a strategic approach to minimize costs: negotiate an 'out-the-door' price, proceed with a short-term loan, and swiftly pay it off with cash, saving on finance charges and maximizing savings.

Takeaways

- 🚗 Paying cash for a car can weaken your negotiating position with car dealers, as they make more profit from finance and insurance (F&I) than the car sale itself.

- 💰 Car dealerships make a significant portion of their profit from F&I products, such as gap insurance, wheel insurance, and extended warranties, rather than the sale of the car itself.

- 🔍 The transparency of car prices has increased due to technology, making it easier for consumers to research and know the price of a car before purchasing.

- 📉 Most dealerships' gross profit comes from F&I, service fees, and parts, not the new car sales, which only account for a small percentage of their total profit.

- 🛍️ Extended warranties are often not used by customers, making them a profitable product for dealerships and third-party warranty providers.

- 🏦 Dealerships can make money from financing by acting as a bank, either through direct lending or by shopping around customer profiles to different lenders.

- 💻 The negotiation process should focus on the out-the-door price, which includes taxes and fees, rather than just the car price, to maximize savings.

- 📋 Fees that are not taxed are generally non-negotiable, while those that are taxed can be negotiated down as part of the total price.

- 💡 When negotiating, consider using the finance process to gain more leverage, by initially agreeing to finance and then paying off the loan quickly with cash.

- 📉 The profit margin on new car sales is slim, with dealerships often making more from ancillary services and products post-sale.

- 🚨 Be cautious of 'BS fees' during the negotiation process, and use them as a negotiation chip to lower the overall price of the car.

Q & A

Why should you not tell a car dealer that you are paying cash during the negotiation process?

-Telling a dealer you're paying cash can reduce your negotiation power. Dealerships often make more profit from finance and insurance (F&I) products rather than the car sale itself, so they may not offer as competitive a price if they believe they can't upsell you on these additional services.

What percentage of sales does new car sales account for at a dealership, according to the script?

-New car sales account for 58% of sales at a dealership.

How much of the gross profit at a dealership comes from new car sales, as mentioned in the script?

-New car sales account for only 26% of the gross profit at a dealership.

Why is pricing for new cars more transparent today compared to the past?

-Pricing is more transparent due to the widespread availability of information through the internet, apps, and phones, which allows consumers to research and compare car prices easily.

What are the major profit centers for a car dealership, as discussed in the script?

-The major profit centers for a car dealership are finance and insurance products, accessories, service fees, and parts.

What is the significance of the statistic that 55% of extended warranties are never used?

-This statistic suggests that consumers are often paying for a product they will not utilize, which represents a significant profit margin for dealerships and third-party warranty providers.

How does a dealership make money from financing a car?

-A dealership can make money from financing by either being their own lender or by shopping the customer's profile and credit score to different lenders in their network, earning a commission or a flat fee for facilitating the loan.

What is the term used to describe the additional fees baked into a car loan by a dealership?

-The term used is 'points' or 'financial reserve', which refers to the additional interest percentage the dealership adds to the loan, creating a spread that they profit from.

Why is it important to negotiate the out-the-door price before discussing financing terms with the F&I manager?

-Negotiating the out-the-door price first ensures that you have the best possible price for the car, including taxes and fees, before discussing financing terms. This approach prevents the dealership from inflating the price after you've agreed to finance, as the F&I manager is not involved in setting the car's price.

What is the strategy suggested in the script for a cash buyer to maximize savings on a car purchase?

-The strategy is to pretend to finance the car to get a better price, then pay off the loan immediately after purchase to avoid long-term finance charges, thus maximizing savings.

How soon after purchasing a car should a buyer find out their payoff amount if they plan to pay off the loan in cash?

-A buyer should find out their payoff amount within a week to ten days after purchasing the car, which is typically the time it takes for a bank to book a loan.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Como controlar o fluxo de caixa da sua empresa

Buying First Car in Canada | Tips and Tricks

Foreign Exchange Risk Management: How to Get Paid in Foreign Currencies

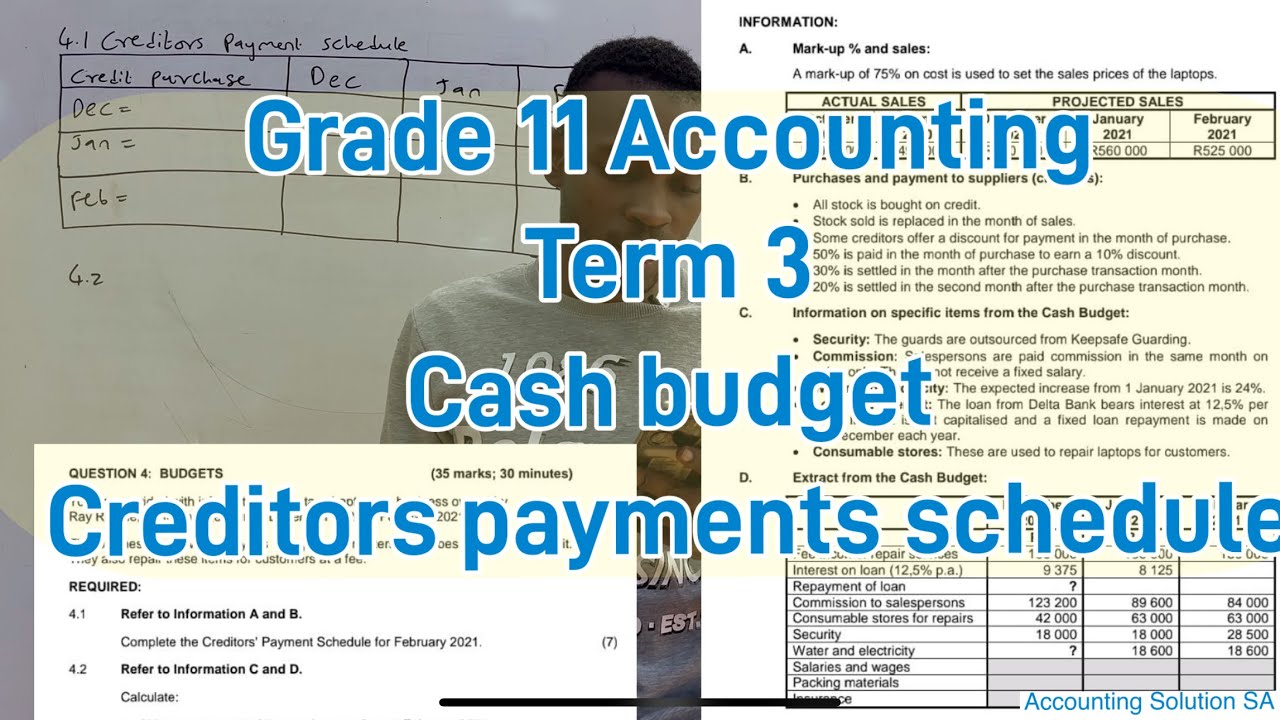

Grade 11 Accounting Term 3 | Cash budget |Creditors Payments Schedule

These MONEY rules will keep you Financially SECURE! | Ankur Warikoo Hindi

REVIEW JUJUR SETELAH 1 TAHUN PAKAI KARTU KREDIT BRI TOKOPEDIA CARD, NYESEL ATAU ENGGA !!!

5.0 / 5 (0 votes)