Foreign Exchange Risk Management: How to Get Paid in Foreign Currencies

Summary

TLDRThis video discusses how U.S. exporters can manage foreign exchange risk when dealing with international customers who prefer to pay in their local currency. It outlines three main strategies: negotiating Forward Contracts to secure fixed exchange rates, accepting cash-in-advance to eliminate payment risk, and matching foreign currency receipts with expenditures to minimize conversion fees. The video emphasizes the importance of consulting with banks to understand when to sell in foreign currencies and the associated costs. By effectively managing these risks, exporters can enhance their global competitiveness.

Takeaways

- 😀 Understanding foreign exchange risk is crucial for U.S. exporters dealing with international customers.

- 💰 Foreign exchange risk involves potential financial losses due to currency depreciation against the U.S. dollar.

- 📉 An example demonstrates that a shift in exchange rates can lead to significant losses, affecting profit margins.

- 🔒 A Forward Contract allows exporters to lock in an exchange rate, ensuring predictable revenue from international sales.

- 🏦 To set up a Forward Contract, exporters must know the currency amount and payment timeline from the importer.

- 🗓️ A Window Forward Contract provides flexibility by allowing delivery between two specified dates.

- 💵 Cash-in-advance is the most risk-free method of payment for exporters, ensuring full payment upfront.

- 🌍 Matching foreign currency receipts with expenditures can minimize conversion fees and currency risks.

- 📊 Maintaining a foreign currency bank account can be beneficial but may involve additional costs and administrative effort.

- ❓ Exporters should consult their banks about fees and terms before accepting payments in foreign currencies.

Q & A

What is foreign exchange risk for a U.S. exporter?

-Foreign exchange risk is the potential financial loss that a U.S. exporter faces due to the depreciation of a foreign currency against the U.S. dollar.

How does an unfavorable exchange rate affect the U.S. exporter in the example provided?

-If the euro weakens from 1 Euro to 1.25 U.S. dollars to 1 Euro to 1.20 U.S. dollars, the exporter would receive $1.2 million instead of $1.25 million, resulting in a loss of $50,000.

What is a Forward Contract and how does it help exporters?

-A Forward Contract is an agreement with a bank or foreign exchange service provider that locks in a predetermined exchange rate for a future date, ensuring the exporter receives a fixed amount in U.S. dollars.

What steps does the exporter need to take to set up a Forward Contract?

-The exporter needs to know the foreign currency amount, negotiate a forward rate with the bank or service provider, finalize the sales price and payment terms, and enter into the contract.

What is a Window Forward Contract?

-A Window Forward Contract allows the exporter a flexible delivery date between two specified dates, providing more options if the exact payment date is uncertain.

What is the cash-in-advance payment method?

-Cash-in-advance requires the importer to pay for the goods before they are shipped, ensuring the exporter receives full payment upfront, which minimizes risk.

What are the pros and cons of accepting cash-in-advance payments?

-The advantage is that it is risk-free and ensures payment, but the drawback is that it is often the least preferred payment method for importers.

How can exporters match foreign currency receipts with expenditures?

-Exporters can set up a foreign currency bank account to handle transactions in the same currency, which helps eliminate currency conversion fees.

What should exporters consider when agreeing to accept payments in foreign currency?

-Exporters should consult their bank about the implications, including fees and whether selling in foreign currency is suitable for their transactions.

How can managing foreign exchange risk benefit U.S. companies?

-By effectively managing foreign exchange risk, U.S. companies can sell in foreign currencies, which enhances their global competitiveness and market reach.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

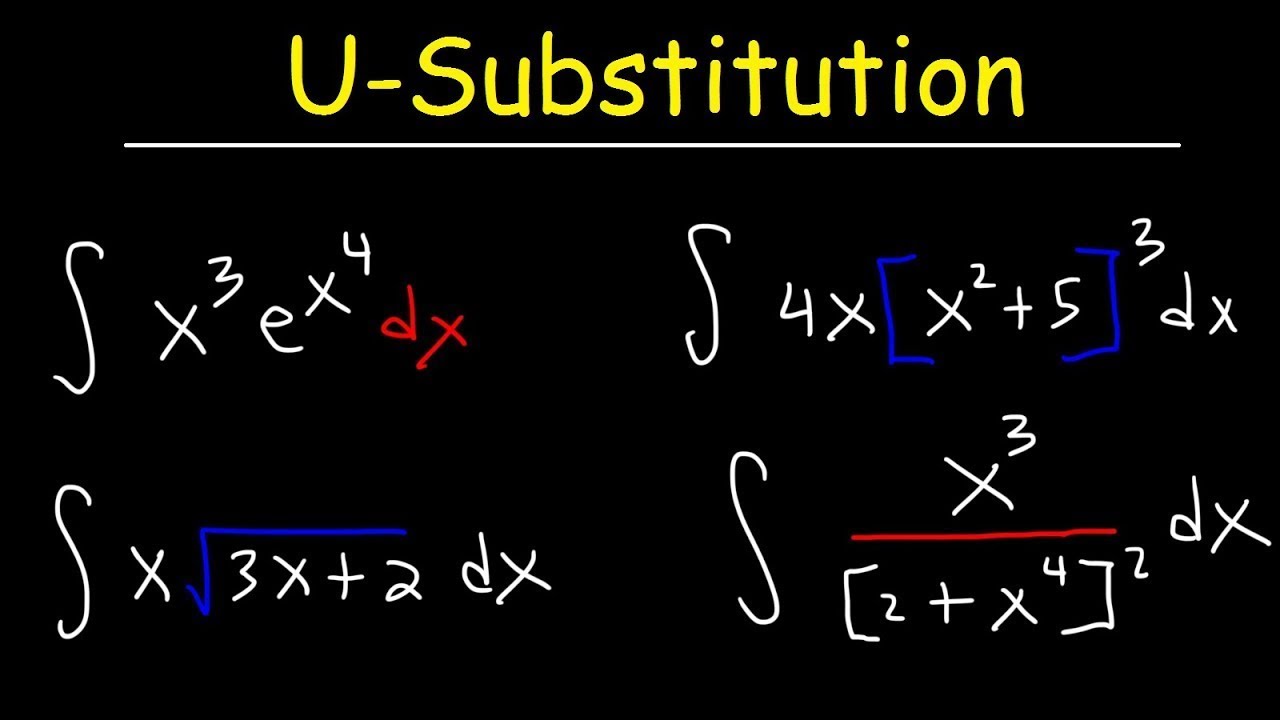

How To Integrate Using U-Substitution

How To Layout Your Warehouse Locations | Warehouse Management

For Oom Piet - Poem Analysis

Embedded Linux | Introduction To U-Boot | Beginners

5.0 / 5 (0 votes)