My Incredibly Easy Scalping Strategy That Works Everyday

Summary

TLDRThis video presents a strategic approach to trading using the 15-minute opening range, focusing on breakouts and reversals. It highlights the use of multiple timeframes (15-minute, 5-minute, and 1-minute) to confirm price action and manage risk effectively. The strategy offers both continuation and reversal setups, with an emphasis on tight risk management and precise entries. The video emphasizes the importance of volatility and liquidity for optimal success and encourages personal adaptation and backtesting to suit individual trading preferences. Overall, it's a methodical, adaptable strategy that combines technical analysis with disciplined execution.

Takeaways

- 😀 The strategy revolves around using the 15-minute opening range (OR) high and low as key levels to determine market direction.

- 😀 Price action around these OR levels, including breaks and retests, signals potential trade setups for both continuations and reversals.

- 😀 Using multiple time frames (15-minute, 5-minute, 1-minute) helps refine entries and manage risk with tight stop losses.

- 😀 Confirmation candlesticks, such as upper and lower wicks on the 5-minute chart, are essential for validating trades and potential reversals.

- 😀 A risk-to-reward ratio of 1:2 is commonly targeted, emphasizing low-risk, high-reward trades with tight stop-losses.

- 😀 It's important to adapt the strategy based on market conditions; range-bound markets might be less favorable for continuation trades.

- 😀 The strategy is designed for high volatility and liquidity periods, as these environments tend to produce better results.

- 😀 Clear breaks above or below the opening range indicate potential trades, while range-bound periods suggest caution and limited trading opportunities.

- 😀 Reversal setups can be identified when price initially moves in one direction but shows signs of a return in the opposite direction.

- 😀 Backtesting the strategy and adapting it to your trading style is crucial for identifying personal preferences in trading reversals vs. continuations.

- 😀 The approach focuses on risk management with minimal losses, even when trades do not go as planned, allowing traders to adapt quickly.

Q & A

What is the core strategy described in the video?

-The core strategy involves marking the 15-minute opening range high and low and waiting for a breakout above or below these levels on the 5-minute chart. The strategy aims to capture short-term price movements with minimal risk and clear risk-to-reward ratios.

Why is it important to wait for a 5-minute candle close above or below the 15-minute opening range?

-Waiting for a 5-minute candle close above or below the 15-minute opening range confirms the breakout and ensures that the price action is strong enough to follow through, minimizing false signals.

What are the primary indicators for identifying trade opportunities?

-The primary indicators are the 15-minute opening range levels, the 5-minute candle closures, and price action signals like upper or lower wicks that suggest potential reversals or continuations.

How do you manage risk when trading using this strategy?

-Risk is managed by setting tight stop losses, usually just below or above key levels. The strategy focuses on having minimal loss if the trade doesn’t work out and aims for a 1:2 risk-to-reward ratio.

What role does market volatility play in this strategy's effectiveness?

-Volatility plays a key role because the strategy performs best in volatile markets with high liquidity, which increases the likelihood of successful breakouts and reversals. In less volatile markets, the win rate may decrease.

What is the significance of 'displacement' in the strategy?

-Displacement refers to a strong price move in one direction, indicating momentum. A displacement, followed by a retest, can confirm a trade setup and provide a higher probability of success.

How can you adjust the strategy to suit your personal trading style?

-The strategy can be adjusted by focusing on either continuation or reversal patterns, depending on the trader's preference. Tweaking entry criteria or adjusting risk parameters can also align it with personal risk tolerance and market conditions.

What do you do when the price range starts to consolidate without clear direction?

-When the price consolidates and there is no clear breakout or breakdown, it’s best to wait for a strong signal that indicates a reversal or continuation. This helps avoid trading during unclear market conditions.

What are the potential signs that the strategy is working effectively?

-The strategy works effectively when there is clear displacement in price following a breakout, a successful retest, and continued movement towards the target. Consistent 1:2 risk-to-reward ratios and a low stop-out rate also indicate effectiveness.

How does the strategy handle different market conditions, like news events?

-The strategy can be adjusted for news events by staying cautious around key times (e.g., 10:00 AM) when significant price reversals can occur. Traders might need to wait for clearer signals or adjust entry/exit points based on market reactions to news.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How Do I Engage Markets When I Don't Have An Initial Bias?

Trading the 15 minute ORB the MAX way!

This 1 Minute Scalping Strategy Works Everyday (Stupid Simple and Proven)

Day Trading Advanced Lesson 3: How to Trade ABCD Pattern (Opening Range Breakouts, ABCD Pattern)

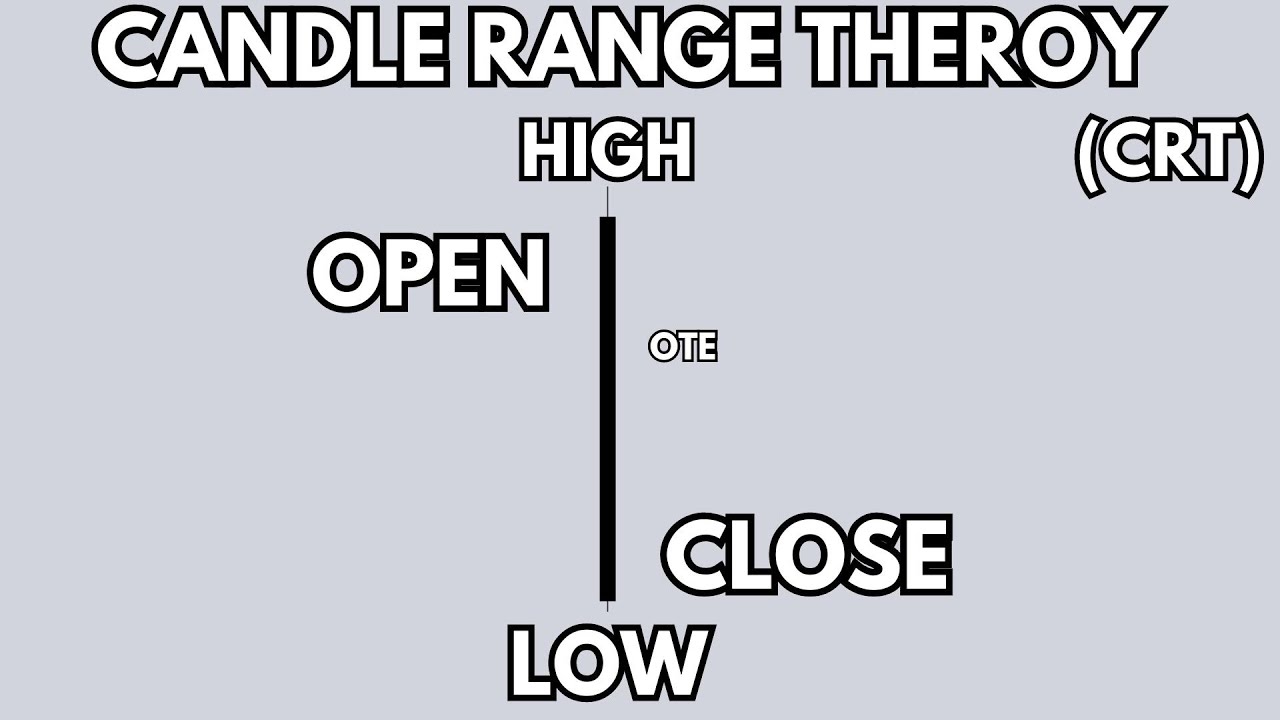

Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

**NEW** CRT Trading Strategy! The 2026 Game Changer

5.0 / 5 (0 votes)