Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

Summary

TLDRThis video script delves into the concepts of simple and compound interest, providing a clear explanation of how each works. It uses an example of an 8000 loan with a 10% interest rate, demonstrating the calculations for simple interest over one and two years. The script also introduces the formula for simple interest and hints at compound interest, promising a detailed discussion in the next video. It concludes with an example of calculating simple interest over three and a half years, highlighting the differences in interest accumulation between simple and compound methods.

Takeaways

- 📚 The video discusses the concept of Simple and Compound Interest, explaining their differences and calculations.

- 🔢 Simple Interest is calculated on the principal amount only, at a fixed rate, and does not change over time.

- 📈 Compound Interest, however, is calculated on the initial principal plus any accumulated interest, causing the amount to grow exponentially.

- ⏳ The formula for Simple Interest is the principal amount multiplied by the rate and time period, divided by 100.

- 💡 The script provides an example where if Rs. 8000 is given at a 10% interest rate, the Simple Interest for one year would be Rs. 800.

- 📉 In the case of Compound Interest, the interest for the first year is Rs. 800, but for the second year, it would be calculated on Rs. 8800 (the initial principal plus first year's interest).

- 🕒 The time period in the examples given is in years, but the script also mentions calculating interest for periods less than a year, such as 1.5 years.

- 📝 The script explains how to calculate the total amount after Simple Interest for different time periods, including fractional years.

- 🤔 It poses a question about determining the rate needed for the principal amount to double in 8 years using Simple Interest.

- 🧮 The script also discusses a scenario with different interest rates applied to different parts of a total amount, totaling Rs. 8000, and how to calculate the annual interest for each part.

- 💻 The video seems to be educational, aiming to help viewers understand the mathematical concepts behind interest calculations in finance.

Q & A

What is the basic concept of simple interest discussed in the video?

-The video explains simple interest as the interest calculated on the principal amount at a set rate per annum. It is given by the formula: Simple Interest = (Principal * Rate * Time) / 100.

How is the formula for calculating simple interest derived in the video?

-The formula for simple interest is derived from the basic components: Principal (P), Rate (R), and Time (T), and is expressed as SI = (P * R * T) / 100.

What is the difference between simple interest and compound interest as mentioned in the video?

-Simple interest is calculated only on the initial principal amount, whereas compound interest is calculated on the initial principal plus any accumulated interest from previous periods.

How does the video illustrate the calculation of simple interest for different time periods?

-The video provides examples of calculating simple interest for one year, two years, and three and a half years, showing how the interest amount increases with time.

What is the example given in the video for calculating simple interest for three and a half years?

-The example given is for an amount of 1600 with a rate of 6% per annum for 3.5 years. The simple interest is calculated as 1600 * 6 * 146 / 365, which equals 2921.

How does the video handle the calculation of interest for a non-integer number of years?

-The video breaks down the non-integer number of years into months and days, then calculates the interest accordingly, as demonstrated with the 3.5 years example.

What is the concept of 'Principal Amount Plus Simple Interest' mentioned in the video?

-The concept refers to the total amount that one would receive after adding the simple interest earned to the initial principal amount.

How does the video explain the calculation of interest for a period of 1.5 years?

-The video calculates the interest for 1.5 years by using the formula for simple interest and adjusting the time to 1.5 years, which is equivalent to 1.5 times the rate.

What is the method used in the video to find out how much interest is added in a certain number of years to double the principal amount?

-The video suggests that if the simple interest rate is applied for a certain number of years, the total amount including the principal and the interest will be double the initial principal amount if the interest rate is such that it equals the principal amount over the given years.

How does the video address the scenario where different parts of a principal amount are invested at different interest rates?

-The video explains that the total annual interest is the sum of the interests calculated separately for each part of the principal amount at their respective rates.

What is the significance of the term 'annual interest' in the context of the video?

-The term 'annual interest' refers to the total interest earned in one year, which is calculated by summing up the interests from different parts of the principal amount invested at different rates.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Pertumbuhan,Peluruhan,Bunga,dan Anuitas Kelas X SMK

Matematika Keuangan (Bunga Tunggal, Bunga Majemuk) MATEMATIKA 12 SMA

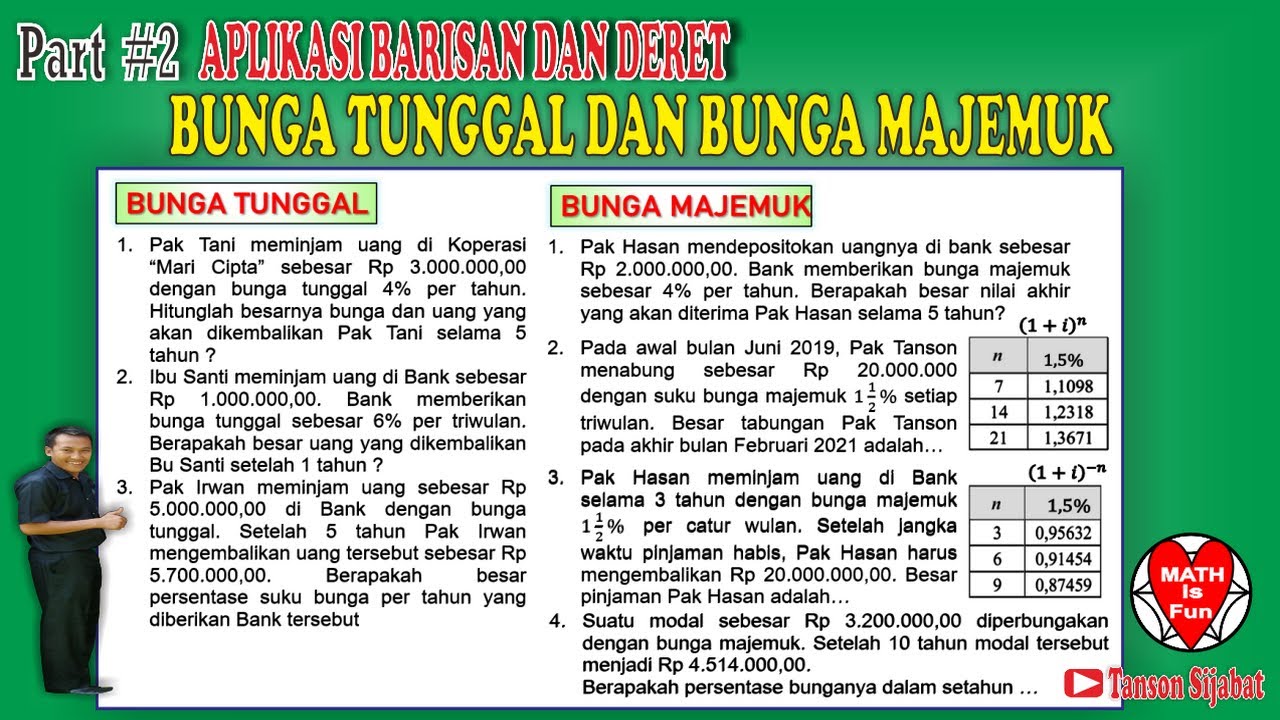

Bunga Tunggal dan Bunga Majemuk | Matematika SMA Kelas XI

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

BUNGA TUNGGAL DAN BUNGA MAJEMUK

Bunga Majemuk dan Anuitas

5.0 / 5 (0 votes)