Bunga Tunggal dan Bunga Majemuk | Matematika SMA Kelas XI

Summary

TLDRThis video explains the concepts of simple interest and compound interest, highlighting their differences. Simple interest involves a fixed rate applied to the initial capital over time, whereas compound interest calculates interest on both the initial capital and the accumulated interest. The video uses clear examples, demonstrating how the interest is calculated monthly for both types. It also includes practical examples to compare the two systems, showing which method results in a higher return on investment. The video concludes with an explanation of how compound interest leads to greater growth over time.

Takeaways

- 😀 Simple interest is calculated based on the initial investment (mo) and remains the same for each period.

- 😀 The formula for simple interest after 'n' periods is: MN = mo * (1 + n * i).

- 😀 Compound interest differs from simple interest by compounding the interest on the accumulated balance.

- 😀 The formula for compound interest after 'n' periods is: MN = mo * (1 + i)^n.

- 😀 In simple interest, the interest amount does not change, and it is always calculated based on the initial principal.

- 😀 Compound interest, however, increases over time because the interest is added to the principal at the end of each period.

- 😀 An example shows that with a 0.2% interest rate per month, the final amount with simple interest is 204,800,000, while compound interest results in 204,800,153.58.

- 😀 For compound interest, the money grows faster due to the compounding effect, as shown in the example with 200 million invested.

- 😀 A calculation with single interest can help determine the interest rate, such as finding an interest rate of 1.2% per year from a 50 million investment over 5 years.

- 😀 Compound interest allows money to grow over time, as demonstrated by calculating how long it takes for 50 million to exceed 60 million at 4% annual interest.

- 😀 The logarithmic method can be used to solve for the number of years needed to reach a specific financial goal with compound interest.

Q & A

What is the main difference between simple interest and compound interest?

-The main difference is that in simple interest, the interest is calculated only on the initial principal throughout the investment period, while in compound interest, the interest is calculated on both the initial principal and the accumulated interest over time.

How is the interest calculated in the simple interest formula?

-In simple interest, the interest is calculated by multiplying the initial principal (mo) by the interest rate (i) and the time period (n). The formula is: MN = mo * (1 + n * i), where MN is the total amount after n periods.

What is the formula for compound interest?

-The formula for compound interest is: MN = mo * (1 + i)^n, where mo is the initial principal, i is the interest rate, and n is the number of periods. This formula accounts for interest being added to both the principal and accumulated interest.

Why does compound interest result in a higher amount compared to simple interest?

-Compound interest results in a higher amount because the interest is added to the principal every period, which causes the total interest to grow at an increasing rate, unlike simple interest which only adds interest to the initial principal.

How is the interest calculated in simple interest each month?

-In simple interest, the same amount of interest is added to the principal each month, calculated as the initial principal multiplied by the interest rate. This amount remains the same each period.

What is the pattern for calculating the amount for compound interest over time?

-In compound interest, each month or period, the interest is calculated on the previous month's balance, so the interest grows exponentially. For example, M2 = M1 * (1 + i), M3 = M2 * (1 + i), and so on, where M represents the amount after each period.

How does the formula for compound interest differ from that of simple interest?

-The compound interest formula includes an exponent: MN = mo * (1 + i)^n, which accounts for the interest being added to the principal each period. In contrast, the simple interest formula is MN = mo * (1 + n * i), where interest is added only on the initial principal.

If an investment of 200 million Rupiah has a 0.2% interest rate per month, how much will it be worth at the end of the year with simple interest?

-With simple interest, the investment of 200 million will grow by 2.4% over 12 months, resulting in a total of 204,800,000 Rupiah.

How much would the same investment be worth with compound interest at the same rate?

-With compound interest, the investment of 200 million Rupiah will grow to 204,800,153.58 Rupiah after one year.

How do you calculate the interest rate when given a final amount using simple interest?

-To calculate the interest rate in simple interest, use the formula: MN = mo * (1 + n * i). Rearrange it to solve for i: i = (MN/mo - 1) / n. For example, if the final amount is 53 million and the initial amount is 50 million over 5 years, the interest rate is 1.2% per year.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

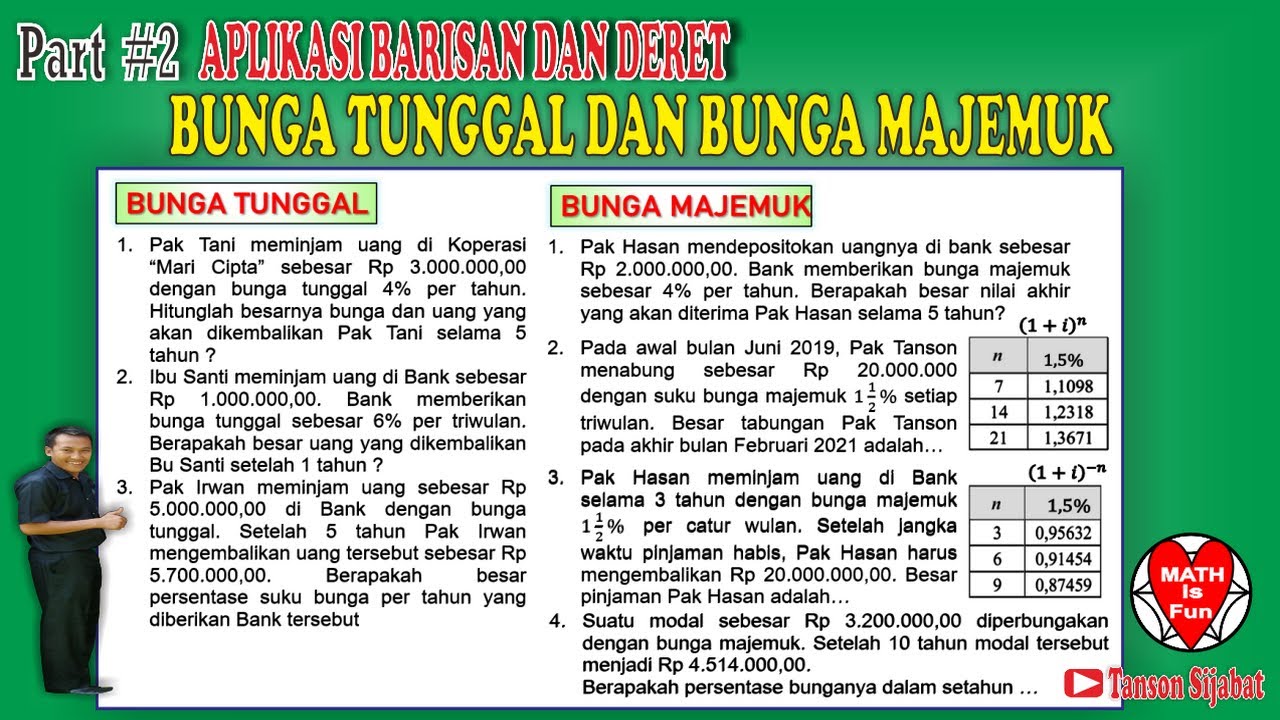

Bunga Tunggal dan Bunga Majemuk

BUNGA TUNGGAL DAN BUNGA MAJEMUK

Bunga majemuk dan anuitas kelas XI | Matematika

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

5.0 / 5 (0 votes)