Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

Summary

TLDRThis script offers an in-depth exploration of the mathematics of investments, focusing on the concept of interest. It explains the difference between simple and compound interest, detailing the formula for calculating simple interest (I = P * R * T) and how to determine the future amount of a loan or investment. The script provides several examples to illustrate the calculation of interest, the rate of interest, and the original loan amount, making the topic accessible and practical for learners.

Takeaways

- 📚 The course 'Mathematics of Investments' is structured into four main parts: interest, depreciation, and bonds, with a focus on the first part about interest.

- 💰 Interest is defined as the money paid for the use of borrowed money, highlighting the concept of simple and compound interest.

- 🔢 Simple interest is calculated only on the principal amount, with the formula being \( I = P \times R \times T \), where \( I \) is the interest, \( P \) is the principal, \( R \) is the rate, and \( T \) is the time.

- 🚀 Compound interest is calculated on the initial principal plus any accumulated interest, making it a more complex concept than simple interest.

- 🌐 The future amount (\( F \)) is the total sum when interest is added to the principal at the end of a stipulated time, calculated as \( F = P + I \).

- 📝 The formula for the future amount considering simple interest is \( F = P \times (1 + RT) \), which can also be rearranged to solve for the principal amount.

- 💼 An example is given where Venus deposited 5000 at a 6.5% simple interest rate for two years, illustrating the calculation of simple interest earned.

- 📉 Another example involves calculating the interest rate for an investment that earned 6500 after three years, using the simple interest formula.

- 📈 The length of time for which money is borrowed can be determined using the simple interest formula, as shown in an example where Lena borrowed 10,000 at a 12% simple interest rate.

- 📊 The original loan amount can be calculated if the total interest paid is known, demonstrated with Rachel's loan example where she paid 7400 in interest over four years.

- 🏦 Vincent's example of borrowing 35,000 at a 12.5% simple interest rate for five years shows how to calculate the total amount to be paid back, including interest.

- 📋 The final example involves calculating the original loan amount when the total amount paid back is known, using the simple interest formula to find the principal.

Q & A

What is the definition of interest according to the script?

-Interest is defined as the money paid for the use of borrowed money or deposited money.

What are the two types of interest mentioned in the script?

-The two types of interest mentioned are simple interest and compound interest.

What is the formula for calculating simple interest?

-The formula for calculating simple interest is I = P * R * T, where I is the interest, P is the principal amount, R is the rate of interest, and T is the time period.

What is the future amount in the context of simple interest?

-The future amount is the total sum of the principal amount plus the interest earned when the interest is added to the principal at the end of the stipulated time.

How can you find the principal amount if you know the future amount, rate, and time?

-You can find the principal amount by dividing the future amount by (1 + R * T).

In the example, how much interest did Venus earn after depositing 5000 at a 6.5% simple interest rate for two years?

-Venus earned 650 pesos in interest after two years.

What rate of interest did Christian's investment earn if it guaranteed an interest of 6500 after three years with a principal of 30,000?

-Christian's investment earned at a rate of 6.22%.

If Lena borrowed 10,000 at a 12% simple interest rate and paid 4500 at the end of the term, how long did she use the money?

-Lena used the money for 3.75 years.

What was the original loan amount if Rachel paid 7400 in interest at a 14.5% rate for a four-year loan?

-The original loan amount was 12,758.62 pesos.

How much will Vincent pay the bank after five years if he borrowed 35,000 at a 12.5% simple interest rate?

-Vincent will pay a total of 56,875 pesos after five years.

If the total amount paid on a loan is 84,000 pesos for two years at a 9% simple interest rate, what was the original loan amount?

-The original loan amount was 71,186.44 pesos.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Writing and City Life class 11 full chapter | 11th history chapter 1 | Easy summary

LWEO Havo 4 jong en oud Hoofdstuk 5 5e druk

Peta (Jenis, Komponen & Proyeksi).

Orthographic Projection_An Introduction_Engineering Drawing_Engineering Graphics_English

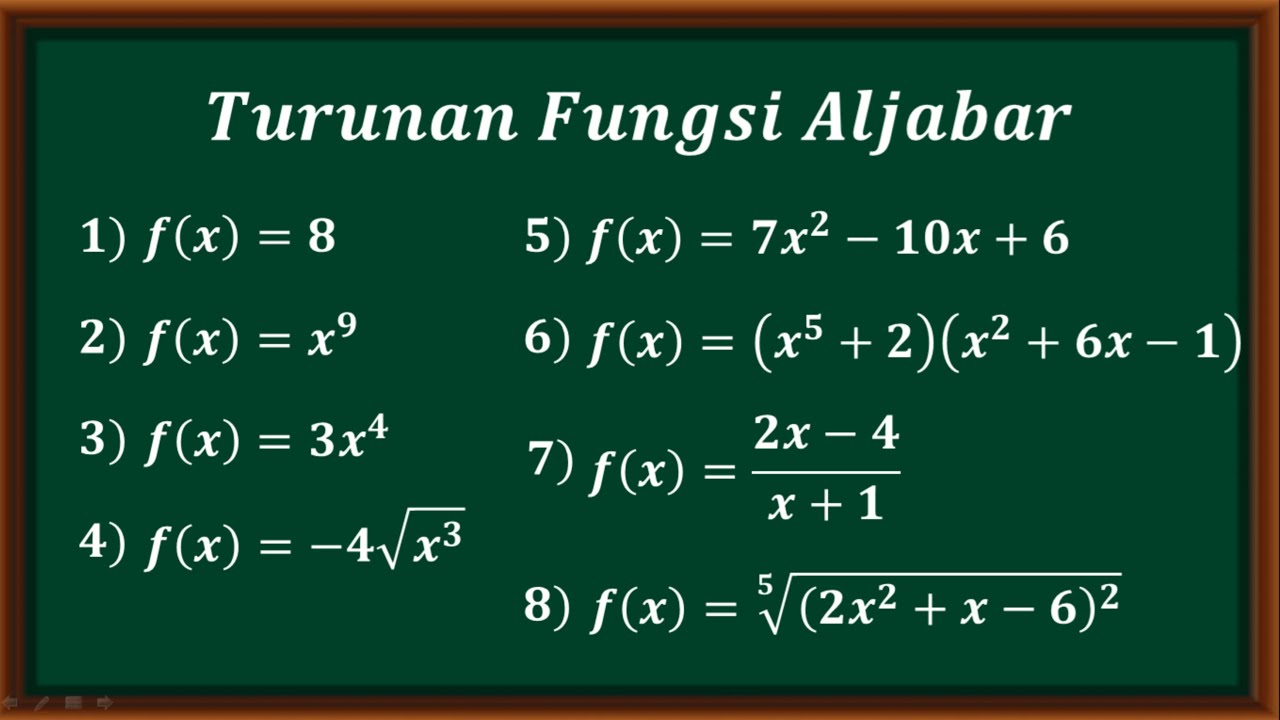

Turunan fungsi aljabar

Pertumbuhan,Peluruhan,Bunga,dan Anuitas Kelas X SMK

5.0 / 5 (0 votes)