GST on sales of used and old vehicles | GST on sales of old vehicles | GST on sales of old car

Summary

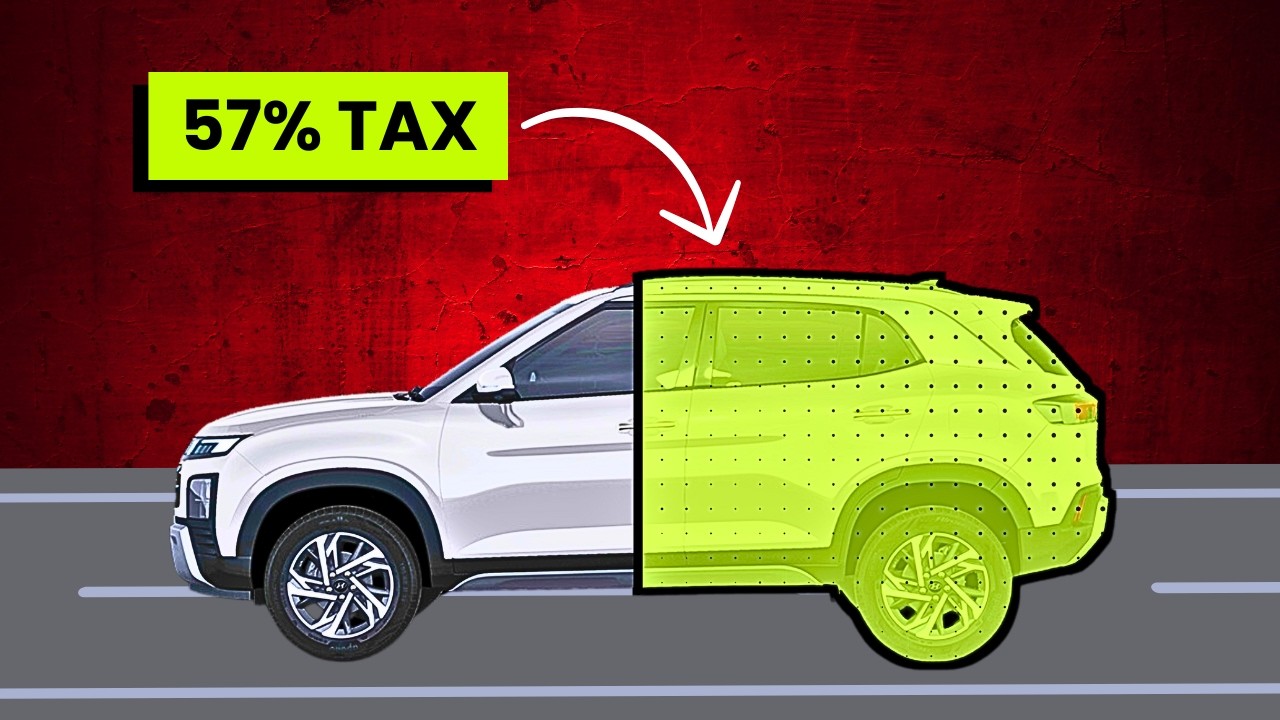

TLDRThis video discusses the GST (Goods and Services Tax) applicable on the sale of old and used vehicles in India. It explains the different GST rates—18% for certain petrol and diesel vehicles based on engine capacity and length, and 12% for others. The calculation of GST is based on the margin of supply, with specific cases for depreciation claims and reverse charge mechanisms when purchasing from the government. Additionally, the video outlines the obligations for dealers and how GST applies when vehicles are sold for scrap, providing a clear understanding of GST compliance in the used vehicle market.

Takeaways

- 🚗 GST is applicable at 18% for old or used vehicles with a petrol or LPG engine capacity of 1200cc or more and length over 4000mm.

- 🚙 Diesel vehicles with an engine capacity of 1500cc or more and length over 4000mm also attract 18% GST.

- 🛻 SUVs with engine capacities exceeding 1500cc will incur an 18% GST rate.

- 🧾 Vehicles not covered by the above specifications are subject to a 12% GST rate.

- 📉 The GST calculation for selling old vehicles is based on the margin of supply rather than the total sale value.

- 📊 Two methods exist for calculating the margin: one where depreciation is claimed and one where it is not.

- 💰 If depreciation is claimed, GST is applied to the difference between the selling price and the WDV (Written Down Value).

- 📉 If no depreciation is claimed, GST is calculated based on the difference between the selling price and the purchase price.

- 🔄 If the old vehicle is purchased from the government, reverse charge mechanism (RCM) GST needs to be paid.

- 🗑️ Selling old vehicles as scrap also incurs GST, based on the applicable rates for the vehicle's specifications.

Q & A

What is the GST rate for selling old and used petrol vehicles?

-The GST rate for selling old and used petrol vehicles with an engine capacity of 1200 cc or more and a length of 4000 mm or more is 18%.

How is GST calculated on the sale of old vehicles?

-GST on old vehicles is calculated based on the margin of supply, which is the difference between the sale price and either the purchase price or the written down value (WDV) of the vehicle.

What is the GST rate for old diesel vehicles?

-The GST rate for old diesel vehicles with an engine capacity of 1500 cc or more and a length of 4000 mm or more is 18%.

What are the two scenarios for GST calculation on old vehicles?

-The two scenarios are: 1) When depreciation has been claimed, GST is calculated on the difference between the sale price and the WDV after depreciation. 2) When depreciation has not been claimed, GST is calculated on the difference between the sale price and the original purchase price.

What GST rate applies to SUVs?

-Old and used SUVs with an engine capacity exceeding 1500 cc are subject to an 18% GST rate.

What happens if a dealer buys an old vehicle from the government?

-If a dealer buys an old vehicle from the government, they must pay GST under the reverse charge mechanism (RCM), as specified in Notification No. 4/2017.

What is the GST rate for vehicles not categorized under the specified engine capacities?

-For vehicles that do not fall under the specified categories for 18% GST, a rate of 12% applies.

What should a person engaged in the business of old vehicle sales do if they have not claimed input tax credit (ITC)?

-If they have not claimed ITC, the GST is calculated on the difference between the purchase price and the sale price of the old vehicle after any minor processing or repairs.

Is GST applicable when selling old vehicles as scrap?

-Yes, GST is applicable on the sale of old vehicles sold as scrap, calculated based on the applicable GST rate.

Where can one find the relevant notifications regarding GST rates on old vehicles?

-Relevant notifications regarding GST rates can be found in Notification No. 8/2018 for GST rates and Rule 32(5) of the CGST rules for special calculation scenarios.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Goods Transport Agency under GST | What is GTA | Taxability | Exemptions | RCM for GTA | POS

Why are Cars so expensive? | Truth about Indian Car Prices

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

GST on Society maintenance charges | GST on Housing society maintenance | % of GST Applicable

5.0 / 5 (0 votes)