GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

Summary

TLDRThe video discusses the implementation of Goods and Services Tax (GST) in India, which came into effect on July 1st, 2017. It highlights the various taxes that were replaced by GST, such as central excise duty, service tax, and additional duties on customs. The video also touches on the broader impact of GST on the Indian economy, emphasizing its role in simplifying the tax system and promoting economic growth. The presentation includes music and references to related events, with a focus on the government's efforts to streamline tax processes for businesses and consumers alike.

Takeaways

- 😀 GST (Goods and Services Tax) was introduced in India on July 1, 2017.

- 😀 The GST is a unified tax system that replaces multiple taxes such as central excise duty, central sales tax, service tax, and duties on customs.

- 😀 GST aims to streamline India's tax system and create a 'one nation, one tax' policy.

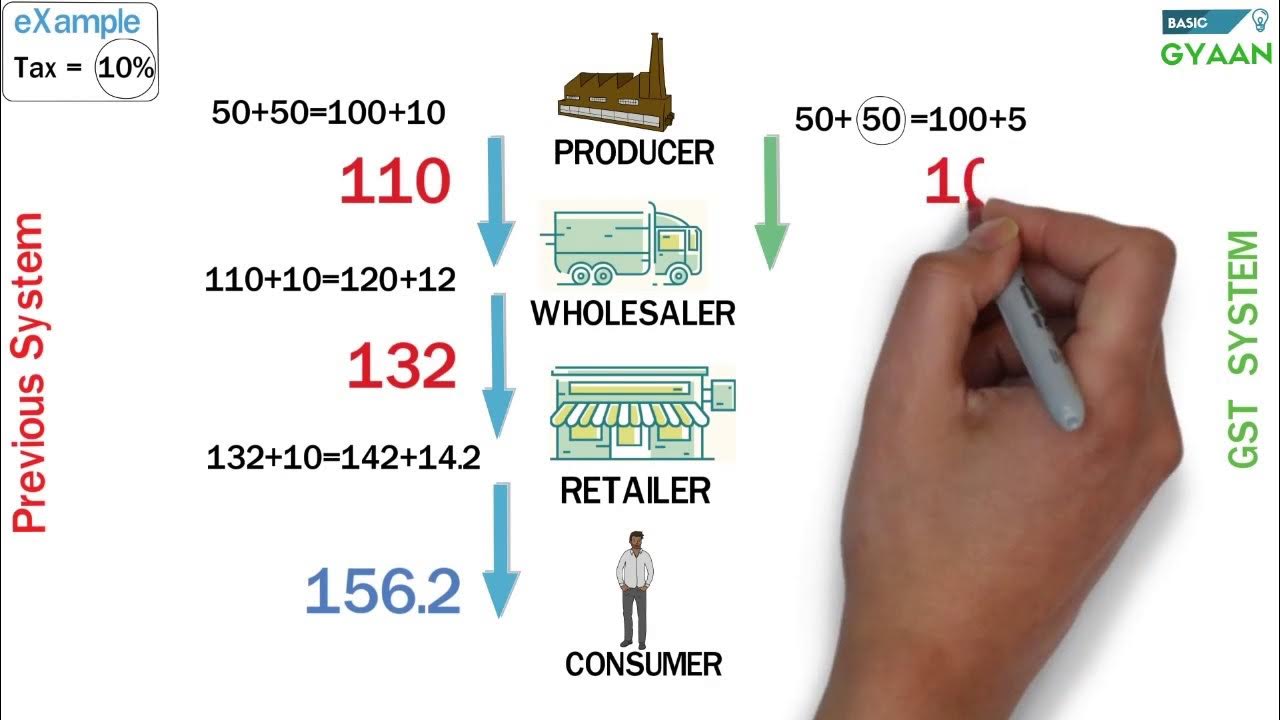

- 😀 The government highlights the benefits of GST in simplifying tax compliance and reducing the cascading effect of taxes.

- 😀 GST is designed to boost the Indian economy by making businesses more competitive and encouraging investment.

- 😀 The introduction of GST marks a significant shift in India's taxation framework, impacting both businesses and consumers.

- 😀 On National GST Day, various events were organized to educate the public and promote the benefits of GST.

- 😀 The event featured discussions on the positive impact of GST on free education and infrastructure development, such as roads.

- 😀 The central government has been working to ensure smooth GST implementation and its role in improving India's economic landscape.

- 😀 The event also featured some foreign perspectives on the success of similar tax reforms globally.

Q & A

What is the significance of July 1st in the context of this script?

-July 1st is recognized as National GST Day in India, marking the implementation of the Goods and Services Tax (GST) on this date in 2017.

What is GST and why was it introduced in India?

-GST, or Goods and Services Tax, is a unified indirect tax system introduced to replace various complex taxes like central excise duty, service tax, and state-level taxes, aiming to simplify the tax structure in India.

What taxes did GST replace in India?

-GST replaced several taxes, including central excise duty, central sales tax, service tax, and additional duties on customs and excise.

What are the benefits of GST for India?

-GST aims to streamline the tax system, reduce tax cascading, and foster economic growth. It also enhances tax compliance and provides a more efficient way to collect and administer taxes.

What kind of event is mentioned in the script?

-The script references an event that celebrates the implementation of GST in India, which might include public addresses and celebrations marking its impact on the country's economy.

What does the phrase 'free education free roads' imply in the script?

-'Free education free roads' refers to the government's initiatives that are likely linked to the revenue generated from the GST system, which can be allocated to social welfare programs like education and infrastructure development.

Why is there music mentioned multiple times in the transcript?

-The music mentioned in the transcript likely sets the tone for the event or broadcast, making it more engaging and impactful for the audience.

How is the global aspect connected to the GST implementation?

-The mention of 'foreign' likely refers to the international perspective on India's economic reforms, including the adoption of GST, and its integration into global trade and commerce.

What is the role of the government in the GST implementation as per the script?

-The government plays a central role in implementing GST, ensuring compliance, and managing the collection and distribution of tax revenue to various sectors and states.

What are the additional duties on customs mentioned in the transcript?

-Additional duties on customs refer to taxes imposed on imported goods, which were previously separate from GST but are now integrated into the broader GST system to reduce complexities in tax administration.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

Massive GST Fraud unveiled in Delhi | Know all about it | UPSC

GST Easy Explanation (Hindi)

Session 5 - 08 What is a BAS

Why are Cars so expensive? | Truth about Indian Car Prices

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

5.0 / 5 (0 votes)