Goods and Services Tax (GST) (Part-1) - Simplified | Drishti IAS English

Summary

TLDRThis video introduces the Goods and Services Tax (GST) in India, covering its key features, architecture, and reforms. GST, launched on July 1, 2017, is a comprehensive tax structure that replaced multiple indirect taxes, offering a seamless tax credit system. The video explains the different types of GST (CGST, SGST, IGST), the role of the GST Council and GST Network, and the reforms aimed at reducing the tax burden, enhancing market competitiveness, and creating a unified national market. The session provides a simplified understanding of GST's implementation and its impact on businesses and consumers.

Takeaways

- 😀 GST (Goods and Services Tax) is a value-added tax imposed on most goods and services for domestic consumption in India.

- 😀 GST was approved by Parliament in 2016 and launched on July 1, 2017, replacing several indirect taxes to create a unified tax system.

- 😀 GST is a multi-stage, destination-based tax that involves three types: CGST (Central GST), SGST (State GST), and IGST (Integrated GST).

- 😀 CGST is collected by the central government, SGST by the state governments, and IGST is levied on interstate transactions.

- 😀 Initially, GST had four tax slabs: 5%, 12%, 16%, and 28%, with rates decided by the GST Council.

- 😀 The GST Council is the key decision-making body, consisting of the Union Finance Minister, state finance ministers, and other members.

- 😀 The GST Network (GSTN) is a non-profit organization providing IT infrastructure to support GST implementation, ensuring services like registration, tax filing, and transaction tracking.

- 😀 GST aims to create a common national market by integrating state and central taxes, eliminating double taxation, and simplifying compliance.

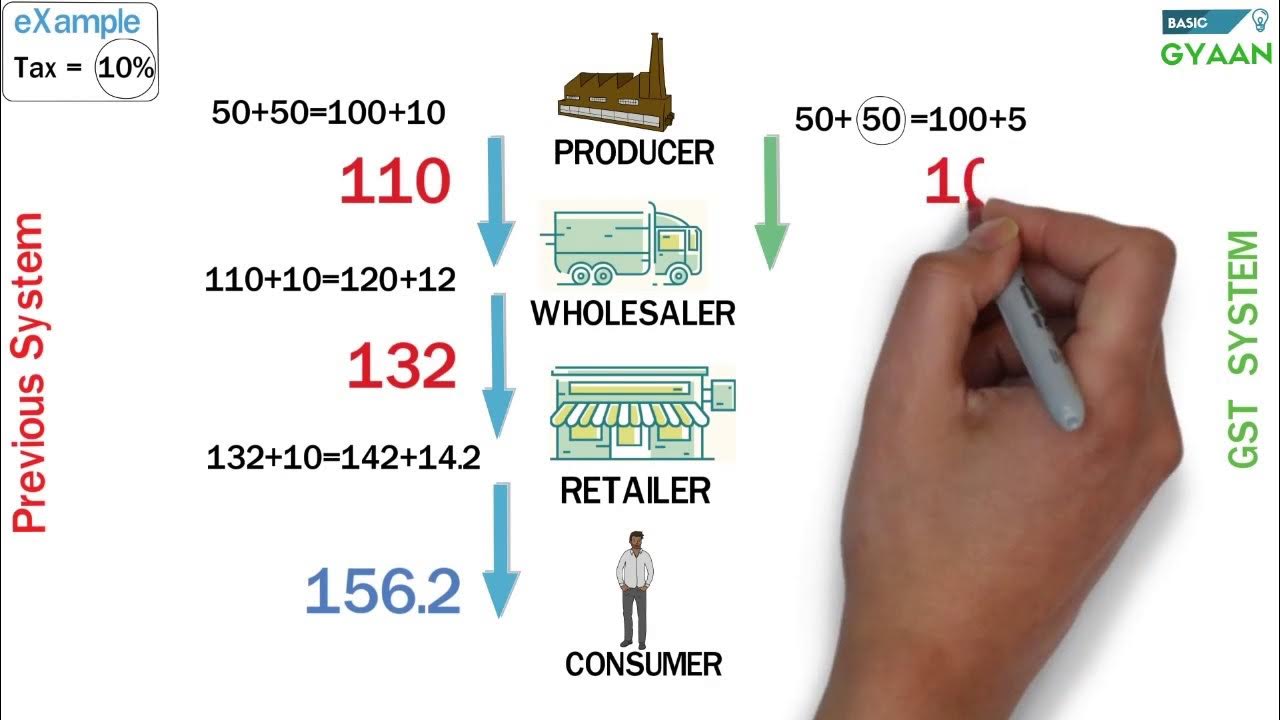

- 😀 A key reform under GST is the introduction of continuous input tax credit, which allows businesses to offset taxes paid at earlier stages in the supply chain.

- 😀 GST has reduced the overall tax burden on goods, making Indian products more competitive both domestically and internationally.

- 😀 Some exemptions under GST include alcohol for human consumption, select petroleum products, custom duties on imports, and certain state taxes like stamp duty and electricity taxes.

Q & A

What is the Goods and Services Tax (GST)?

-GST is a value-added tax applied to most goods and services sold for domestic consumption. It was introduced in India on July 1, 2017, to replace multiple indirect taxes with a unified system.

When was GST approved and implemented in India?

-GST was approved by the Indian Parliament in 2016 and came into effect on July 1, 2017, under the 101st Amendment of the Indian Constitution.

What are the different types of GST in India?

-There are three types of GST in India: CGST (Central GST), SGST (State GST), and IGST (Integrated GST), each levied by the central government, state governments, and for interstate transactions, respectively.

How does GST operate and who collects it?

-GST is a destination-based tax where the final consumer pays the tax, but businesses collect it on behalf of the government. It is paid on most goods and services, with businesses responsible for remitting the tax to the government.

What is the role of the GST Council in India?

-The GST Council is a constitutional body that makes key decisions on GST-related matters. It is chaired by the Union Finance Minister and includes state finance ministers, ensuring that both central and state governments are equally represented.

What is the GST Network (GSTN), and what is its purpose?

-The GST Network (GSTN) is a non-government, non-profit organization that provides the IT infrastructure necessary for the implementation of GST. It handles processes like taxpayer registration, tax filing, and transaction tracking.

What is meant by the 'input tax credit' in the context of GST?

-Input tax credit allows businesses to claim credit for the tax paid on inputs (raw materials, services, etc.) used to produce goods or services. This ensures that the tax burden is reduced through the value chain from manufacturer to retailer.

How does GST create a common national market in India?

-GST eliminates the cascading effect of taxes, which previously led to multiple tax layers on the same product. By subsuming various state and central taxes into one system, it creates a unified national market, reducing the overall tax burden.

Are there any exceptions to GST application in India?

-Yes, some goods and services are exempt from GST, such as alcohol for human consumption, five specified petroleum products, and certain other items like electricity and stamp duty.

What are the advantages of GST from a consumer's perspective?

-From a consumer's perspective, GST reduces the overall tax burden on goods, making products more competitively priced. It also simplifies tax administration, as GST is transparent and self-policing.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Understand GST in 10 minutes

GST Easy Explanation (Hindi)

1. Concept of Indirect Taxes - Introduction | GST Lecture 1 | CA Raj K Agrawal

Massive GST Fraud unveiled in Delhi | Know all about it | UPSC

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

The only TAX SYSTEM VIDEO you will ever need. | INDIAN TAX SYSTEM EXPLAINED | Aaditya Iyengar

5.0 / 5 (0 votes)