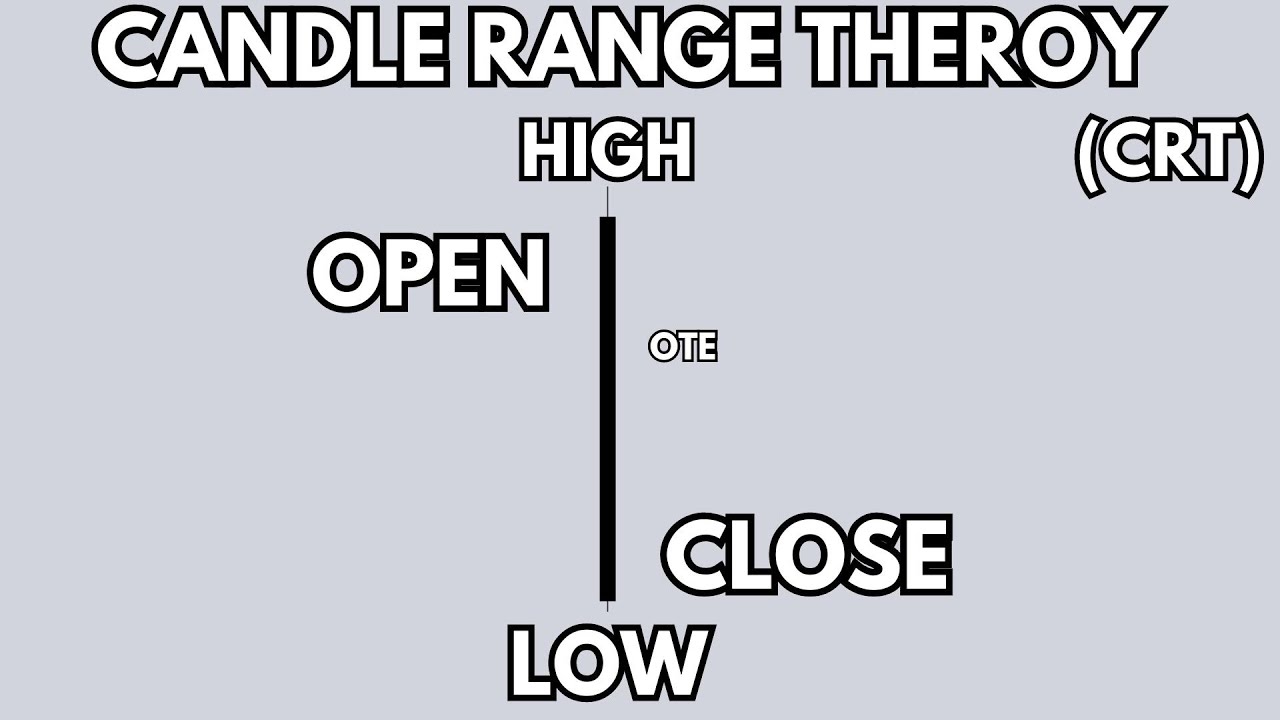

Candle Range Theory Explained

Summary

TLDRIn this video, Solomon King explains the Candle Range Theory, a popular concept in trading that rebrands the Power of Three theory. He emphasizes that each candlestick represents a range, encapsulating the market's movement within a specific timeframe. King illustrates how to spot high and low-probability candle ranges and their importance in aligning with key trading levels. The video also explores different scenarios of candle range formations and practical strategies for using this concept effectively in trading. King concludes by highlighting the significance of aligning candle ranges with key levels to optimize trading decisions.

Takeaways

- 📈 The concept of Candle Wrench Theory is introduced as a rebranded version of the popular 'Power of Three' concept in trading.

- 🕒 A candle represents the entire range of transactions that occurred within a specific time frame, such as a day or 15-minute period.

- 📊 The importance of understanding candle range is emphasized for traders to interpret market movements accurately.

- 🔍 The video aims to teach viewers how to identify high and low probability candle ranges to align with their trading strategies.

- 🌐 The theory suggests that a candle's range can be broken down into three scenarios: one, two, or three candle formations, each representing different market behaviors.

- 📉 The 'Power of Three' concept is explained through the Accumulation, Manipulation, and Distribution (AMD) model, which helps in identifying trading opportunities.

- 📍 Key levels or points of interest are crucial when applying the candle range theory to ensure trades have a high probability of success.

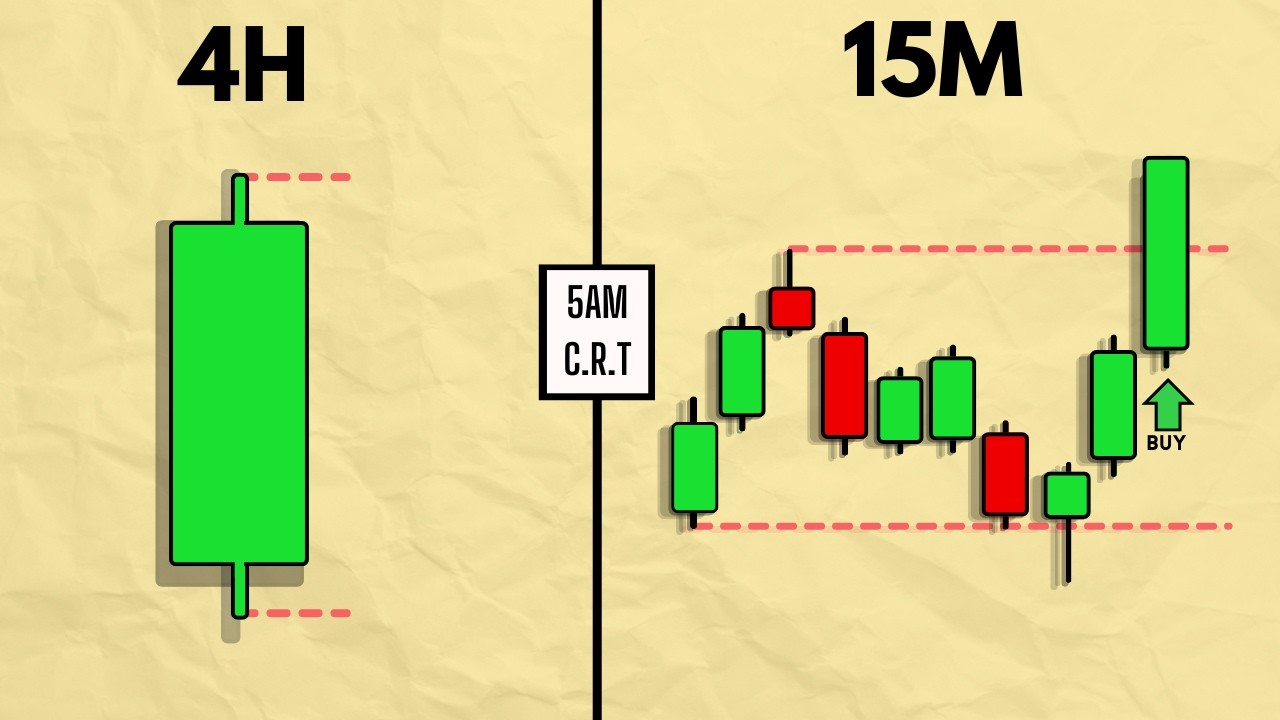

- 📈 The video provides practical examples of how to spot candle range formations and how they align with market sessions like the Asian, London, and New York sessions.

- 📝 The presenter shares insights on how to blend the candle range theory with the Kill Zone strategy for better trading outcomes.

- 🔗 The video concludes by emphasizing the need for confirmation and a key level when applying the candle range theory to trading decisions.

Q & A

What is the main topic of Solomon King's video?

-The main topic of Solomon King's video is the concept of Candle Range Theory, which he aims to explain in a way that is understandable to all viewers.

Why is Candle Range Theory important for traders according to the video?

-Candle Range Theory is important for traders because it helps them interpret price movements and identify high and low probabilities of candle ranges, which are crucial for making informed trading decisions.

What is the significance of the daily candle in the context of Candle Range Theory?

-The daily candle represents the entire transaction that happened in a 24-hour period, encapsulating the overall bullish or bearish sentiment for a particular currency pair within that timeframe.

How does Solomon King relate Candle Range Theory to the Power of Three concept?

-Solomon King suggests that Candle Range Theory is essentially a rebranded version of the Power of Three concept, as both involve understanding the dynamics of price movement within a candle's range.

What are the three scenarios in which Candle Range Theory can be observed?

-The three scenarios in which Candle Range Theory can be observed are: 1) within a single candle, 2) in two-candle price action, and 3) in three-candle price action.

What does the acronym 'AMD' stand for in the context of the video?

-In the context of the video, 'AMD' stands for Accumulation, Manipulation, and Distribution, which are stages in the price action that can be identified within the Candle Range Theory.

Why is it important for the Candle Range Theory to align with a key level?

-Aligning the Candle Range Theory with a key level is important because it helps traders identify high-probability trading areas where price is likely to react or reverse, increasing the chances of successful trades.

How does Solomon King demonstrate the practical application of Candle Range Theory?

-Solomon King demonstrates the practical application of Candle Range Theory by analyzing charts and showing how price movements align with the theory's principles, especially in relation to key levels and market sessions.

What role do market sessions play in the Candle Range Theory according to the video?

-Market sessions play a role in Candle Range Theory by providing specific timeframes, such as Asian, London, and New York sessions, where different stages of Accumulation, Manipulation, and Distribution can occur within a day's trading.

What is the advice given by Solomon King for traders using Candle Range Theory?

-Solomon King advises traders to ensure that the Candle Range Theory formations align with their trading concept and strategy, and to look for confirmations before taking trades based on the theory.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

Every ICT Trading Strategy Explained in 13 Minutes!

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

Trading one candle is easy, actually | Determine Market Direction and Daily bias

How To Select CRT Candles Perfectly - Full In Depth Guide - ICT Concepts

5.0 / 5 (0 votes)