Order Block Strategy Prints 1K/Week | Full SMC Trading Course

Summary

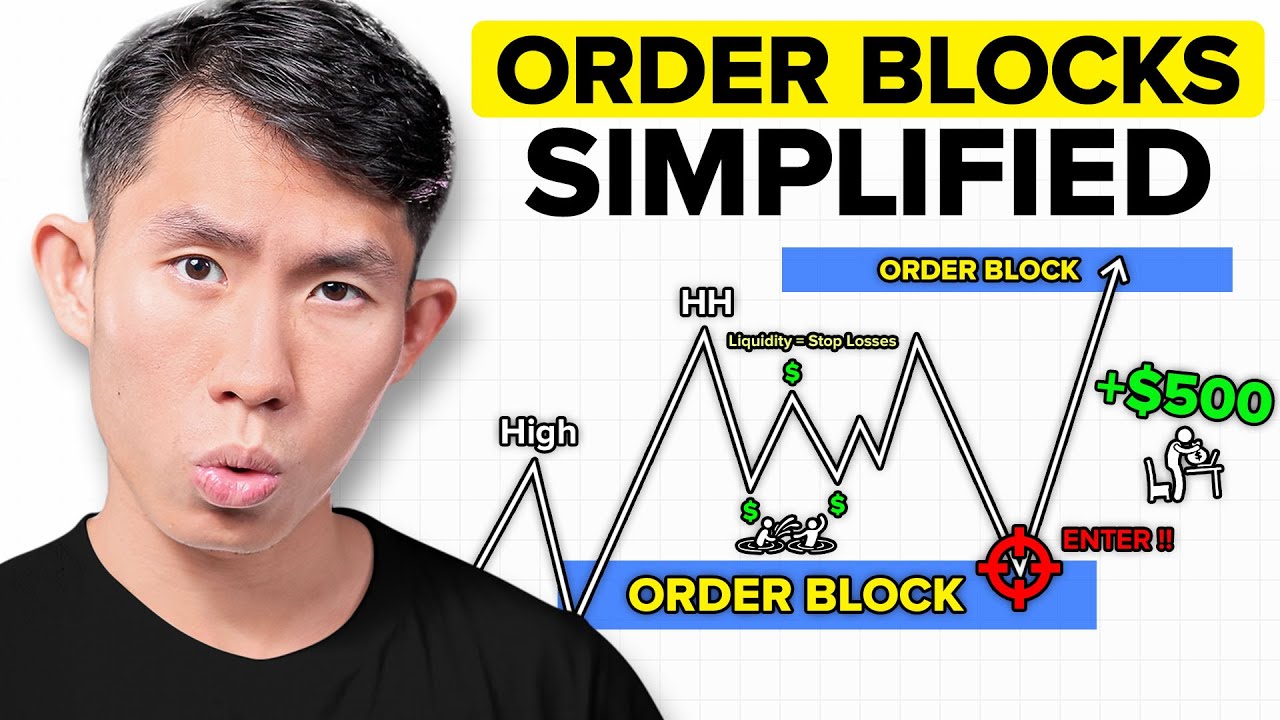

TLDRThis video outlines an effective trading strategy based on order blocks and liquidity pools. It emphasizes identifying key order blocks on higher time frames and refining entry points on lower time frames. The strategy focuses on aligning market structure, using technical indicators like Fibonacci levels and trend lines, and spotting liquidity grabs. Proper risk management is crucial, with stop losses placed below recent swing lows and take profits targeting logical high points. By analyzing liquidity pools and the commitment of price action, traders can increase their chances of successful trades.

Takeaways

- 😀 Order blocks are key price zones formed by institutional orders, indicating potential market reversals or continuations.

- 😀 Identifying liquidity pools above or below an order block helps to predict price movements and potential targets.

- 😀 Price action near order blocks should show strength and commitment to the move, such as breaking market structure.

- 😀 Larger order block candles tend to be more significant, indicating more trader involvement and a stronger potential move.

- 😀 Look for confirmation of the order block's effectiveness by observing price action after it forms, especially if it leads to a fair value gap.

- 😀 Not every order block will lead to a profitable trade; focus on finding high-quality opportunities rather than trading every signal.

- 😀 Order blocks are more reliable when they align with other technical factors, such as Fibonacci levels, trend lines, or moving averages.

- 😀 To enter a trade, zoom into lower time frames and check for realignment with the overall trend, confirming bullish or bearish signals.

- 😀 A smaller order block within a larger one on the lower time frame can provide an ideal entry point in the direction of the main trend.

- 😀 Timing your entry is crucial: wait for confirmation of price movement within the order block before placing the trade.

- 😀 Set your stop loss below the recent swing low, allowing enough room for price to breathe, and aim for a take profit at least three times the risk.

- 😀 Liquidity pools are magnets for price, so identifying them near order blocks can provide valuable targets for potential trades.

Q & A

What is the significance of order blocks in trading?

-Order blocks are key price levels where large institutional orders are placed. They represent areas where significant price action occurred, and when price revisits these zones, it can indicate a potential shift in market direction. They are used to identify potential entry points for trades.

How does liquidity run affect an order block?

-A liquidity run occurs when price dips to trigger stop losses before quickly reversing in the expected direction. When this happens near an order block, it strengthens the order block's potential to break the market structure, signaling a strong commitment to the move.

Why is the size of the order block candle important?

-The size of the order block candle reflects the amount of market activity and the number of traders involved. A larger order block indicates a higher level of participation, which generally makes it more significant and impactful.

What should traders observe after an order block forms?

-Traders should observe how the price reacts after the order block forms. If price quickly moves away and forms a fair value gap, it signals a strong potential for a profitable trade. However, not every order block will lead to a good trade, so it's important to focus on the best opportunities.

How can other technical indicators strengthen the validity of an order block?

-When an order block aligns with other technical indicators like Fibonacci levels, trend lines, or moving averages, it strengthens the validity of the trade setup. The more technical factors supporting the order block, the higher the probability of success.

How do you use a lower time frame to refine your entry after identifying an order block?

-Once you’ve spotted an order block on a higher time frame, you switch to a lower time frame for a more detailed view of price action. This allows you to fine-tune your entry, ensuring that the trend on the lower time frame matches the overall trend on the higher time frame.

What is realignment, and why is it important when trading with order blocks?

-Realignment refers to the price action on a lower time frame aligning with the trend observed on a higher time frame. This is crucial as it ensures that the smaller time frame trend supports the larger time frame trend, confirming the strength of the order block setup.

What is a liquidity grab, and how can it signal a potential trade?

-A liquidity grab occurs when price dips to trigger stop losses before reversing in the desired direction. It is often seen as a mini version of a larger liquidity run and can be used as a sign that price is likely to continue in the intended direction after triggering stops.

What is the recommended risk-to-reward ratio when trading with order blocks?

-The recommended risk-to-reward ratio is at least 3:1. This means the potential profit should be three times the risk taken. Traders should calculate their take-profit levels based on logical high points within the higher time frame trend.

Why are liquidity pools important when trading order blocks?

-Liquidity pools are areas where stop losses or pending orders accumulate, acting as magnets for price. When trading an order block, identifying clear liquidity pools above or below the order block helps target areas where price is likely to move once the order block is triggered.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Best Order Block Trading Strategy of All Time!

Master Order Blocks to Trade like Banks (no bs guide)

2022 ICT Mentorship Episode 26 - Example Of Tape Reading Practice

Simple ICT London Killzone Strategy No Daily Bias (GET FUNDED)

Orderblocks Simplified - ICT Concepts

Market Maker Models Explained | Step By Step Approach | ICT Concepts

5.0 / 5 (0 votes)