Market Maker Models Explained | Step By Step Approach | ICT Concepts

Summary

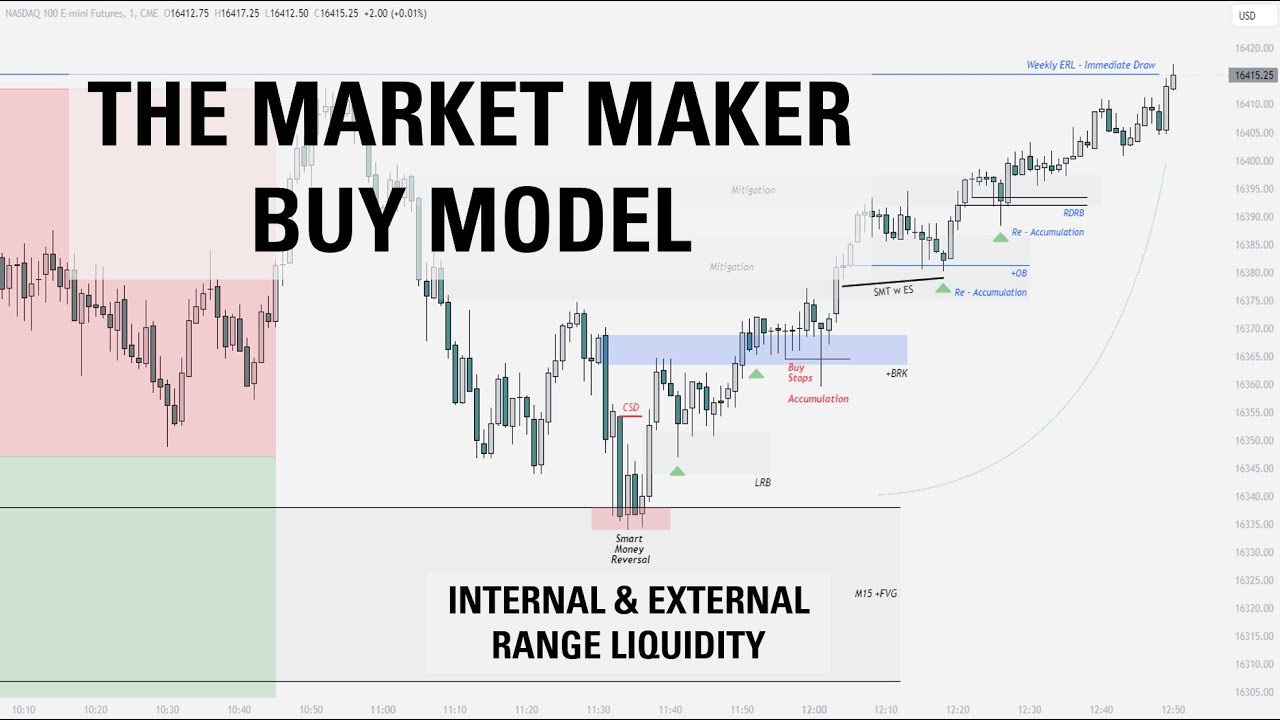

TLDRIn this video, the creator explains how they trade using Market Maker models, focusing on executing trades based on internal range liquidity pools and higher time frame order flows. They emphasize the importance of trading with the trend and highlight the significance of SMT divergence as a trigger for entering trades. The process involves waiting for price to reach key liquidity levels, identifying the smart money reversal, and using low-risk buy entries to target external range highs. The video also covers how to use mitigation blocks and accumulation stages for refining entries, providing a clear step-by-step approach to trading Market Maker models.

Takeaways

- 😀 The market operates by seeking old highs and lows, and it rebalances imbalances within internal and external range liquidity pools.

- 😀 A bullish market trend involves a sequence of impulse-retracement moves, where price seeks external range highs after retracing into an internal range liquidity pool.

- 😀 To trade in alignment with higher time frame order flow, traders should focus on executing trades within the internal range liquidity pool, not against the higher time frame trend.

- 😀 Trading reversals from external range liquidity pools into internal range liquidity pools goes against higher time frame order flow, which is generally avoided in favor of continuations.

- 😀 In a Market Maker Buy Model, the intermediate term perspective reveals that after a retracement into an internal range liquidity pool, the market maker forms a buy model to target the external range high.

- 😀 Step 1: Wait for price to reach an internal range liquidity pool (monthly, weekly, or daily). Step 2: Drop to the aligned time frame and look for SMT Divergence at the liquidity pool to signal a reversal and potential trade entry.

- 😀 SMT (Smart Money Technique) Divergence is a key signal that a price reversal is imminent, and trades should only be executed if SMT is present at the internal range liquidity pool.

- 😀 After confirming SMT, traders should wait for a change in state of delivery, marked by a candle closing above the body of the lowest down-close candle that tagged the internal range liquidity pool.

- 😀 A low-risk buy entry occurs when price closes above the last down-close candle that tagged the liquidity pool. This signals a bullish order block and the start of the market maker buy model.

- 😀 If an initial entry is missed, traders should look for mitigation blocks in the sell-side curve of the market maker buy model during the accumulation phase, refining entries based on PD arrays and further SMT confirmation.

- 😀 The final stage of the market maker buy model involves price expanding from the mitigation block and respecting bullish PD arrays as price reaches the external range target. This completion signals a successful buy model trade.

Q & A

What is the main focus of the video?

-The main focus of the video is teaching viewers how to trade using market maker models, specifically focusing on identifying price movements in relation to higher time frame key levels and executing trades based on smart money techniques.

What is the difference between internal and external range liquidity?

-Internal range liquidity refers to imbalances within a price range, while external range liquidity involves price levels outside the current range, such as previous highs and lows that the market seeks to rebalance.

How do higher time frame order flows impact trading decisions?

-Higher time frame order flows, like those on the monthly, weekly, or daily charts, indicate the overall trend. Traders align their entries based on these larger trends, typically trading in the direction of the trend, such as buying in a bullish market.

Why is trading with the trend preferred over trading reversals?

-Trading with the trend is preferred because it aligns with the higher time frame order flow, which increases the likelihood of success. Reversals are riskier as they go against the main market trend, making them less reliable.

What is the significance of SMT Divergence in the trading strategy?

-SMT (Smart Money Technique) Divergence is used as a confirmation signal that a reversal or continuation is likely to occur. It indicates that a stronger asset is moving in one direction while a weaker asset is showing opposite price action, signaling a potential shift in market sentiment.

How do you identify a market maker buy model on a chart?

-A market maker buy model can be identified by the sequence of price actions: a retracement into an internal range liquidity pool followed by price action that creates a smart money reversal and a low-risk buy setup that targets the external range high.

What is a 'high probability bullish order block'?

-A high probability bullish order block is a key level on the chart that signals a strong buying opportunity. It is formed after a change in the delivery state, where a candle closes above a previous down-close candle, confirming an area of support.

What is the role of mitigation blocks in the trading process?

-Mitigation blocks are used to identify potential reversal points within the market maker buy model. These blocks form when price action moves in a way that mitigates previous price movements, providing traders with another opportunity to enter trades.

What is the importance of PD Rays in the accumulation phase?

-PD Rays (Price Delivery Rays) are significant in the accumulation phase because they help identify areas where price may respect and continue moving in the intended direction. Traders use these areas to position themselves for further market movements.

How do you manage risk once an entry has been made in a market maker buy model?

-Once an entry is made, the trader can set a stop loss at break-even once the price reaches a certain level (such as a 1:2 risk-to-reward ratio), ensuring that the position is risk-free while still allowing for potential profit if the trade continues to the external range target.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Market Maker Buy Model | Full Trade Breakdown $NQ

How To Use Balanced Price Range with IPDA Times

Trading Against Order Flow Using MMSM (Trade Breakdown)

Intraday Bias Simplified | ICT 2022 Mentorship + MMXM = 🤯

EXPOSED - ICT’s Favorite Trading Strategy (Hear it From ICT Himself)

The only ICT MMXM video you'll ever need

5.0 / 5 (0 votes)