SIA - Sistem Buku Besar dan Pelaporan

Summary

TLDRThe script discusses the general ledger and reporting system, presented by Group 6 members. It covers four key activities: updating the general ledger, posting adjusting entries, preparing financial statements, and producing managerial reports. The presentation also outlines potential threats like inaccurate data, unauthorized financial disclosures, and data loss, along with corresponding control measures. Topics include the importance of accurate record-keeping, regulatory compliance, and modern financial reporting methods such as XBRL. The presentation concludes with a focus on managerial reporting and decision-making based on reliable financial data.

Takeaways

- 📚 The general ledger and reporting system consists of four key activities: updating the general ledger, posting adjusting entries, preparing financial statements, and producing managerial reports.

- 📊 The system's data flow diagram (DFD) includes four main processes: updating the general ledger, posting entries, preparing financial statements, and producing managerial reports.

- 💼 The general ledger data store is centralized and supports both internal and external information needs, with managers requiring detailed and timely reports, and investors and creditors expecting regular financial updates.

- ⚠️ Key threats to the system include inaccurate or untimely updates to the general ledger, unauthorized disclosure of financial information, and the loss or destruction of master data.

- 🔑 Controls for these threats include data integrity checks, restricted access, encryption, and backup procedures.

- 💾 The update process for the general ledger includes posting journal entries from the accounting subsystem and treasury, with a journal voucher file used to store all journal entries.

- 📈 Adjusting journal entries are classified into five categories: accruals, deferrals, estimates, revaluations, and corrections, and are crucial for accurate financial reporting.

- 🔐 Controls for adjusting journal entries focus on preventing unauthorized entries and ensuring accuracy through processing integrity checks and strong access controls.

- 🧾 The financial statement preparation process includes closing journal entries to zero out income and expense accounts and moving net income or loss to retained earnings.

- 📊 The system also supports managerial reporting, with ERP systems helping managers plan and evaluate performance through tools like flexible budgets, balanced scorecards, and well-designed graphs.

Q & A

What are the four basic activities of the general ledger and reporting system?

-The four basic activities are: 1) Updating the general ledger, 2) Posting adjusting journal entries, 3) Preparing financial statements, and 4) Producing managerial reports.

What are the primary data storage systems mentioned in the general ledger process?

-The primary data storage system is the general ledger, while journal vouchers are used to record journal entries.

What is the purpose of a centralized database in the general ledger and reporting system?

-A centralized database is used to meet the information needs of both internal and external users, such as managers, investors, and creditors, by providing timely and accurate reports.

What is the main risk associated with inaccurate or untimely updates to the general ledger?

-Inaccurate or untimely updates can lead to misleading financial reports, which may result in poor decision-making by managers and other stakeholders.

How can unauthorized disclosure of financial information be controlled?

-Unauthorized disclosure can be controlled through access controls and encryption to protect sensitive financial data.

What are some examples of adjusting journal entries, and what purpose do they serve?

-Examples include accruals, deferrals, estimates, revaluations, and corrections. These entries ensure that financial statements accurately reflect the company's financial status by adjusting accounts at the end of the accounting period.

What is the role of the controller's office in the adjusting journal entry process?

-The controller's office provides the original adjusting entries after the initial trial balance is prepared, ensuring the accuracy of the financial statements.

What steps are involved in preparing financial statements?

-Steps include closing temporary accounts, such as revenue and expense accounts, and moving net income to retained earnings. This is followed by preparing the income statement, statement of changes in financial position, and cash flow statement.

What is XBRL, and how does it impact financial reporting?

-XBRL (eXtensible Business Reporting Language) is a programming language designed for the consumption and interpretation of financial data. It allows for the standardization and efficient exchange of financial information.

What are some of the threats associated with managerial reporting, and how can they be mitigated?

-One major threat is poorly designed reports and graphs, which can lead to incorrect decisions. This can be mitigated by using responsibility accounting techniques, such as flexible budgets, balanced scorecards, and understanding proper graph design principles.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

SIKLUS BUKU BESAR DAN PELAPORAN - SISTEM INFORMASI AKUNTANSI

2. Gr 11 Accounting - Inventories - Activity 2

Sistem Informasi Akuntansi_Romney_Siklus Buku Besar dan Pelaporan.

Overview of Accounting Information System (AIS)

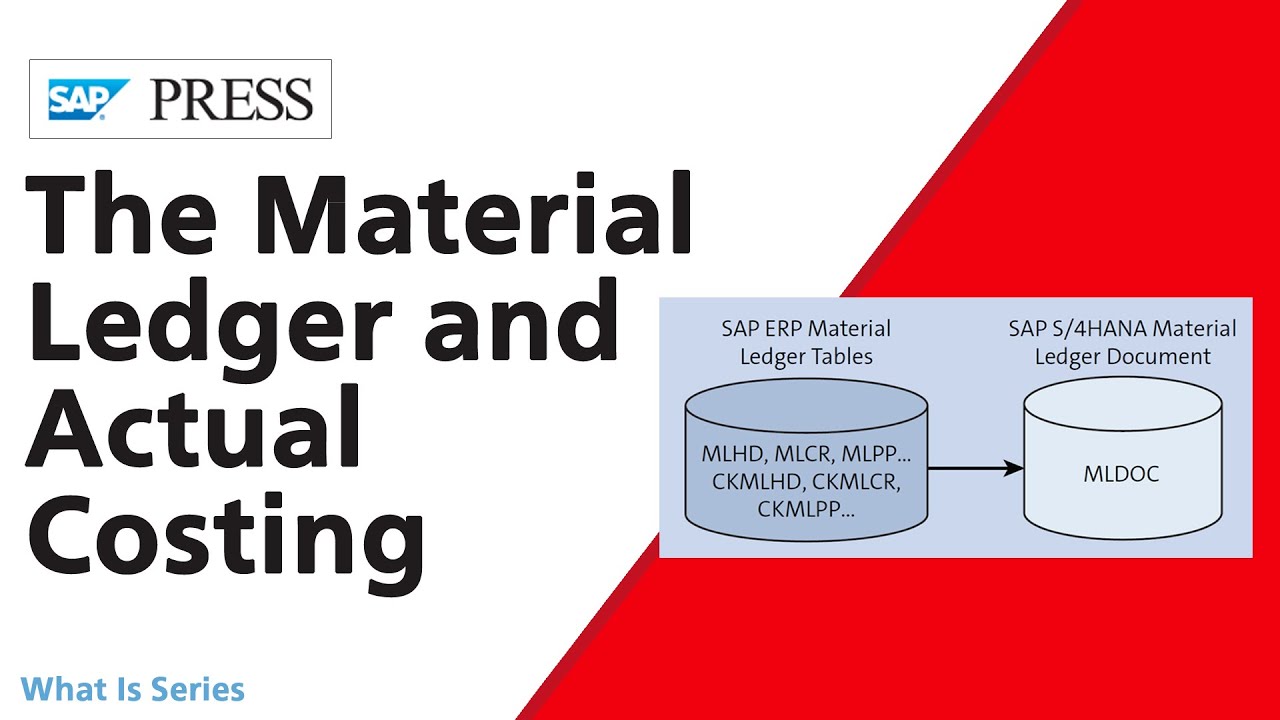

What Is the Material Ledger and Actual Costing with SAP S/4HANA?

Accurate aset tetap penyusutan

5.0 / 5 (0 votes)