Accurate aset tetap penyusutan

Summary

TLDRThis video explains the process of calculating depreciation at the end of an accounting period, focusing on journal entries and financial statement adjustments. It details how to check the general ledger and verify whether depreciation has been recorded correctly. The script walks through the steps of updating depreciation records, handling asset adjustments, and managing transactions in a financial system. It also touches on reviewing currency differences and asset values in reports. The session aims to guide viewers through the technical aspects of calculating and reporting depreciation, ensuring accuracy in the accounting process.

Takeaways

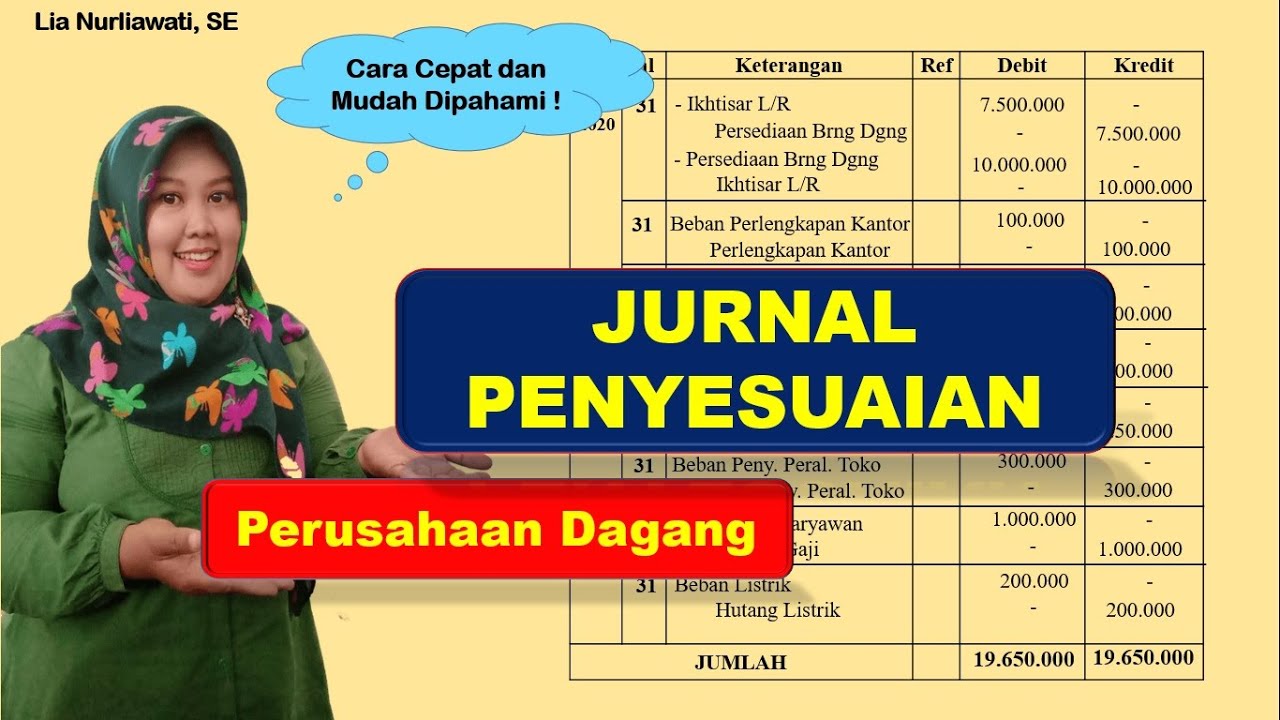

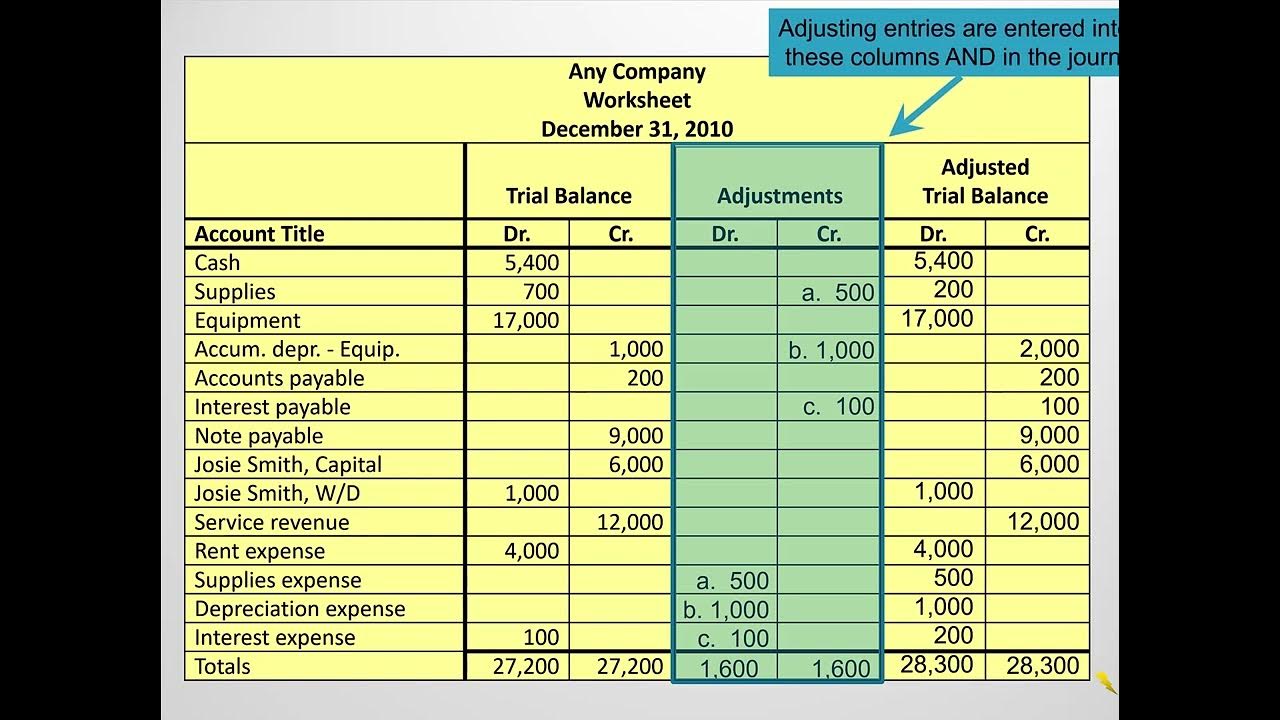

- 😀 Depreciation (penyusutan) is calculated at the end of the period and involves specific journal entries and general ledger entries.

- 😀 General ledger is a key tool for verifying whether depreciation has been properly recorded at the end of the period.

- 😀 The process of calculating depreciation requires ensuring that entries are made for each asset, such as buildings and equipment.

- 😀 The process of end-of-period calculations includes adjustments such as depreciation for buildings and equipment.

- 😀 A general ledger is used to check if depreciation has been applied correctly by reviewing journal entries for the final period.

- 😀 The journal entries for depreciation may include specific amounts for assets like buildings, equipment, and currency adjustments.

- 😀 It's crucial to verify that depreciation entries are made for each specific asset, even if the asset list is not immediately visible in the system.

- 😀 The end-of-period adjustments typically involve both depreciation expenses and currency adjustments, such as those related to exchange rates.

- 😀 The process of checking depreciation entries involves filtering out unnecessary data by adjusting the dates in the journal entry search.

- 😀 The speaker emphasizes the importance of following the correct technical steps in recording and checking depreciation at the period’s end.

Q & A

What is the purpose of the final period process in the script?

-The final period process is used to calculate depreciation at the end of the period, particularly for assets like buildings and equipment.

What is the role of 'General Ledger' in checking depreciation?

-The General Ledger is used to track and verify whether depreciation has been recorded by referencing financial statements and journal entries.

What is mentioned about depreciation in the context of buildings?

-Depreciation for buildings is calculated as an expense based on the building's value, which in this case is stated to be 10.45 million.

How does the script explain the process of checking depreciation transactions?

-Depreciation transactions are checked by filtering journal entries by date, specifically selecting those around the end of the month, like November 30th.

What are the types of assets mentioned in the depreciation calculation?

-The assets mentioned include buildings and equipment, with specific references to depreciation expenses for both.

What does the script mention about currency exchange rates in relation to depreciation?

-The script briefly refers to exchange rate differences, noting that the depreciation process also takes into account fluctuations in currency values, like US Dollars.

How is depreciation expense handled in the script?

-Depreciation expenses are recorded in the journal and associated with specific assets such as buildings and equipment.

Why is it important to check the journal entry for November 30th?

-Checking the journal entry for November 30th ensures that the depreciation calculations are accurately recorded and aligned with the end of the period.

What is the significance of the 'financial statement general ledger' mentioned in the script?

-The financial statement general ledger is important for verifying and analyzing the overall financial data, including depreciation entries.

What is the final message or recommendation provided in the script?

-The final message encourages learners to understand the technical aspects of depreciation calculation and recording, wishing them success in their learning.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)