2. Gr 11 Accounting - Inventories - Activity 2

Summary

TLDRThe script discusses the Periodic Inventory System used by Pro Sport Clothing, comparing its advantages and disadvantages with the Perpetual Inventory System. It covers the accounting equation's effects, ledger accounts completion, cost of sales calculation, markup percentage achievement, and stock turnover rate. The focus is on understanding inventory management and its impact on financial reporting.

Takeaways

- 📚 The focus of Activity 2 is on the Periodic Inventory System used by Pro Sport clothing, contrasting with the Perpetual Inventory System discussed in Activity 1.

- 🔍 Advantages of the Periodic Inventory System include being less time-consuming, potentially cheaper to administer, and suitable for businesses where individual item costs are hard to determine.

- ⚠️ Disadvantages include less control over stock, difficulty in determining available trading stock without a physical count, and challenges in detecting stock discrepancies.

- 💼 The accounting equation is affected by transactions, with increases shown as positive (+), decreases as negative (-), and no effect as zero (0).

- 🏦 A favorable bank balance is crucial in accounting, as it determines how payments and receipts are recorded in the equation.

- 📈 The general ledger accounts for trading stock, purchases, and carriage on purchases are essential in tracking financial activities.

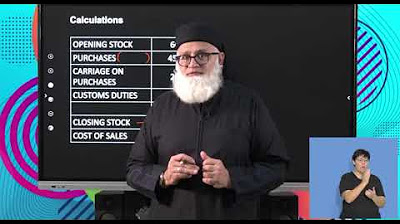

- 📅 The cost of sales on September 30, 2022, is calculated by considering opening stock, purchases, carriage on purchases, and import duties, minus the closing stock.

- 📊 The markup percentage achieved is calculated by dividing gross profit by cost of sales and comparing it to the intended markup percentage of 65%.

- 💡 Possible reasons for achieving or not achieving the markup percentage include trade discounts, sales control, source document accuracy, and stock management.

- 💸 The stock turnover rate is calculated by dividing cost of sales by the average inventory (opening stock + closing stock / 2), indicating how quickly stock is converted into cash.

Q & A

What is the main focus of Activity 2 in the transcript?

-The main focus of Activity 2 is on the Periodic Inventory System used by Pro Sport clothing business, which sells sports items and uses a markup of 65% on cost.

What are the advantages of using a periodic inventory system as mentioned in the transcript?

-The advantages of using a periodic inventory system include being less time-consuming, potentially cheaper to administer, and suitable for businesses where it's difficult to determine the cost of individual items.

What are the disadvantages of a periodic inventory system according to the transcript?

-The disadvantages include less control over stock, difficulty in determining available trading stock without a physical count, and the inability to easily detect stock discrepancies because no movement of trading stock is recorded in the trading stock account.

How does a favorable bank balance affect the accounting equation in a periodic inventory system?

-A favorable bank balance means that any payments made or money received is regarded as an asset. If it were unfavorable, the bank would have been regarded as a current liability.

What is the purpose of completing the general ledger accounts for trading stock, purchases account, and the trading account in Activity 2.3?

-The purpose is to record and organize all financial transactions related to trading stock, purchases, and sales, which will help in understanding the business's financial position and performance over the period.

What is the formula to calculate the cost of sales on 30 September 2022 as per the transcript?

-The formula to calculate the cost of sales is Opening Stock + Purchases + Carriage on Purchases + Import Duties - Closing Stock.

What does calculating the markup percentage achieved tell us about the business's pricing strategy?

-Calculating the markup percentage achieved provides insight into whether the business is meeting its intended profit margins on sales and can indicate if the owner should be satisfied with the current pricing strategy.

How can the owner determine if they should be satisfied with the markup percentage achieved?

-The owner should compare the achieved markup percentage with the intended markup percentage. If the achieved percentage is higher, it indicates better than expected profit margins, and the owner should be satisfied.

What is the significance of calculating how quickly Pro Sport clothing converts stock into cash?

-Calculating the speed at which stock is converted into cash, or the stock turnover rate, is significant as it indicates the efficiency of the business in managing its inventory and generating cash flow from sales.

What is the formula to calculate the stock turnover rate as mentioned in the transcript?

-The formula to calculate the stock turnover rate is Cost of Sales divided by the Average Inventory (which is the sum of Opening Stock and Closing Stock divided by two).

What is the importance of understanding the accounting equation effects for each transaction in a periodic inventory system?

-Understanding the effects of each transaction on the accounting equation is crucial for accurate financial recording and analysis. It helps in determining the impact on assets, liabilities, equity, expenses, and revenues, ensuring the business's financial health is properly reflected.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Lesson 030 - Accounting for Merchandising Operations 4: Periodic and Perpetual Inventory System

Perhitungan Persedian Barang Dagang | Metode FIFO | Sistem Perpetual

FIFO Periodic & Perpetual I Pengantar Akuntansi

Perbedaan METODE PERPETUAL VS METODE PERIODIK | Belajar Kilat IAI JATIM

Grade 11 Accounting Term 3 | Inventory System | Part 1 of 2024

Accounting Grd 11 Introducing Inventory Systems S3

5.0 / 5 (0 votes)