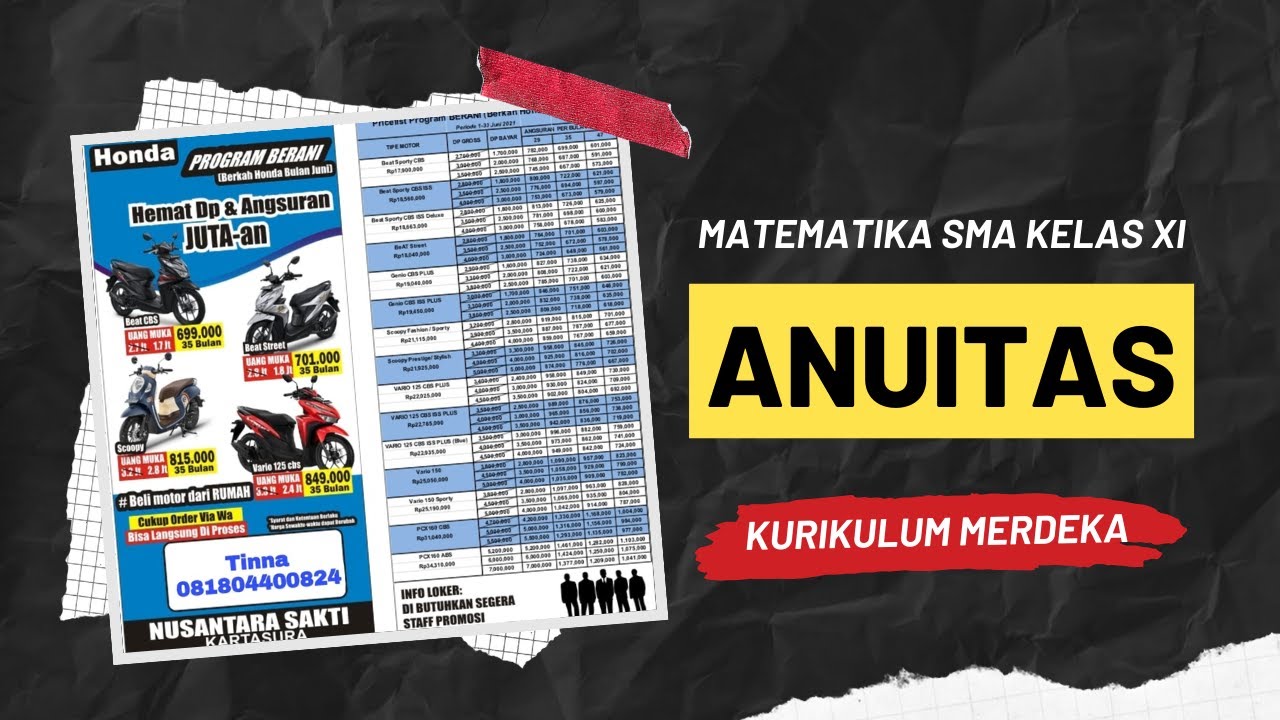

ANUITAS

Summary

TLDRThis video explains how to calculate annuity payments for a home loan without requiring a down payment. Using a practical example of a home priced at IDR 300 million with a 6% annual interest rate, it details the steps to compute monthly installments, breaking down each payment into principal and interest components. The tutorial emphasizes using formulas for accurate calculations and illustrates how the outstanding loan balance decreases over time. The second part promises further exploration of different payment scenarios, making it a comprehensive guide for potential homeowners.

Takeaways

- 🏠 The housing loan is for a property priced at 300 million IDR with a 6% annual interest rate.

- 📅 The loan repayment period is set at six months, resulting in monthly payments.

- 💰 The monthly interest rate is calculated by dividing the annual rate by 12, resulting in 0.005.

- 🔍 The annuity formula is essential for calculating the monthly payment amount.

- 📊 Each monthly payment consists of both principal repayment and interest.

- 💸 The first month's payment includes 1.5 million IDR in interest, with the remainder reducing the principal.

- 📉 As payments continue, the outstanding loan balance decreases with each installment.

- 🔄 The script explains iterative calculations for subsequent months to show changes in interest and principal.

- 📽️ Future videos will cover different payment structures, such as a monthly payment of 2.2 million IDR.

- 📖 Understanding the breakdown of payments helps borrowers comprehend their loan repayment process.

Q & A

What is the main topic discussed in the transcript?

-The transcript primarily discusses how to calculate annuities for housing loans, including monthly payment structures and the breakdown of principal and interest.

What is the monthly payment amount mentioned for the housing loan?

-The transcript mentions a monthly payment of around 2.2 million IDR for a housing loan.

How is the interest rate for the housing loan calculated?

-The interest rate is provided as 6% per year, which is converted to a monthly interest rate of 0.005 by dividing by 12.

What is the total loan amount discussed in the video?

-The total loan amount discussed is 300 million IDR.

How long is the loan term mentioned in the transcript?

-The loan term mentioned in the transcript is 6 months.

What formula is used to calculate the monthly annuity payment?

-The monthly annuity payment can be calculated using the formula that includes the initial loan amount, the monthly interest rate, and the loan term.

What components make up the monthly payment?

-The monthly payment consists of both principal repayment and interest payment.

How is the principal amount for each installment calculated?

-The principal amount for each installment is calculated by subtracting the interest from the total monthly payment.

What happens to the remaining loan balance after each payment?

-After each payment, the remaining loan balance is reduced by the amount of principal paid.

Will there be a follow-up video, and what will it cover?

-Yes, there will be a follow-up video that will attempt to calculate the annuity or monthly payment amount of 2.2 million IDR.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)