Source Documents

Summary

TLDRThis video explains the importance of source documents in accounting, which serve as proof for recording transactions. These documents ensure that transactions are real and provide a reference for accuracy. Different transactions have different source documents: invoices for sales on account, receipts for cash received, checks for cash purchases, and memos for unique transactions lacking other documentation. Each document plays a key role in maintaining accurate financial records. The video encourages viewers to familiarize themselves with these documents for better accounting practices.

Takeaways

- 🧾 Proof of a transaction is required to record it in an accounting system to ensure accuracy and prevent fraud.

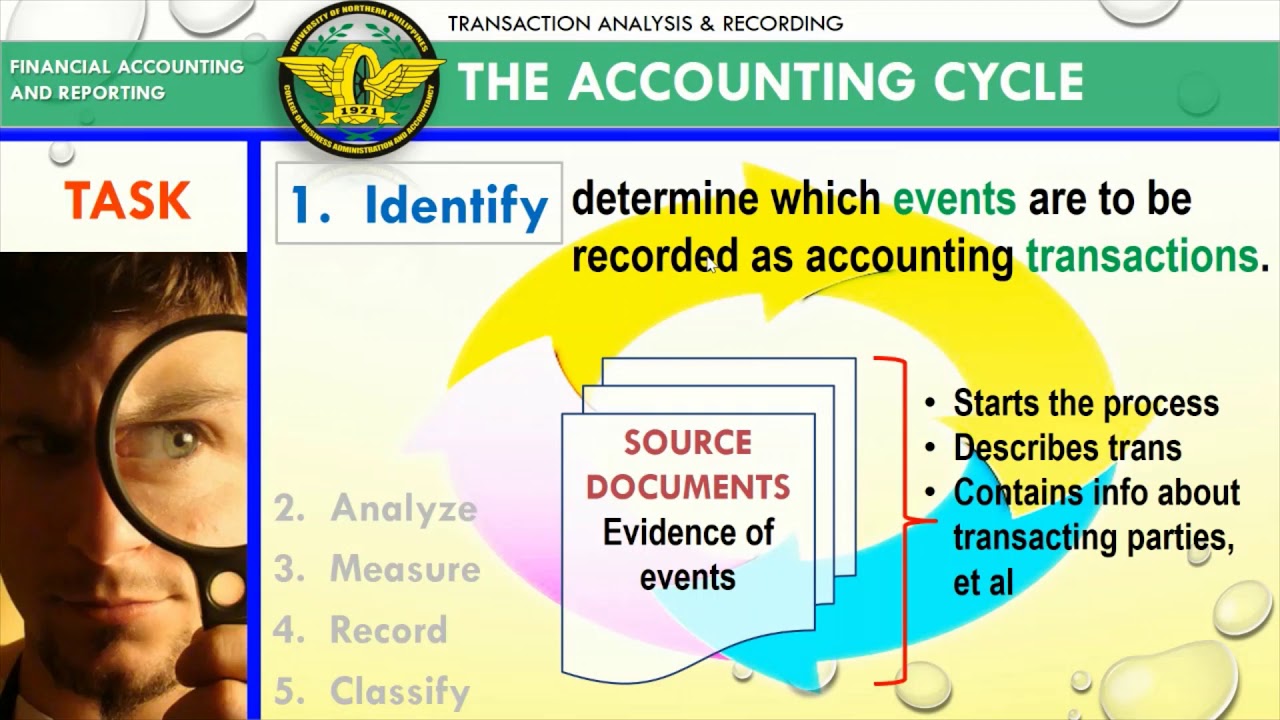

- 📄 This proof typically comes in the form of paper or electronic documents known as source documents.

- 📝 Source documents serve as the basis for all information recorded in an accounting transaction.

- 🔍 Different types of transactions require different source documents, so it’s essential to recognize the right one.

- 📧 Invoices are source documents used by businesses to detail sales on account, meaning the customer will pay later.

- 💵 Receipts serve as source documents when cash is received, contrary to the common belief that they are for money spent.

- 🏦 Checks are typically used as source documents for cash purchases and have a standardized format.

- 📝 In cases where there is no standard source document, businesses create a memorandum (memo) to record the transaction.

- 🏢 Larger corporations often use memos to handle unique transactions without any existing source document.

- 📊 The four main types of source documents covered are invoices, receipts, checks, and memos, each serving a specific purpose in accounting.

Q & A

What is the purpose of a source document in accounting?

-A source document serves as proof of a transaction in order to record it in the accounting system. It ensures the transaction is real and helps verify the accuracy of recorded information.

Why are source documents important for preventing fraud?

-Source documents provide evidence of actual transactions, which prevents unauthorized or fraudulent transactions from being recorded, thus reducing the risk of someone trying to steal money from the company.

What are some common forms of source documents?

-Source documents can be in paper or electronic format. Common examples include invoices, receipts, checks, and memorandums.

What is an invoice and when is it typically used?

-An invoice is a source document that a business sends to its customers detailing the terms, products, and services of a sale. It is typically used for sales on account, meaning the customer will pay in the future.

What is the difference between a receipt from the customer's perspective versus the business's perspective?

-From the customer's perspective, a receipt serves as confirmation of a purchase. From the business's perspective, it is a source document proving the receipt of cash and why it was received.

What source document is used by businesses for cash purchases?

-Businesses typically use checks as source documents for cash purchases, unlike invoices or receipts.

What is a memorandum, and when is it used in accounting?

-A memorandum, or memo, is a simple document used to describe a unique transaction when no other source document is available. It provides a record of why the transaction is being recorded in the accounting system.

Do small businesses commonly use memorandums as source documents?

-Memorandums are rarely used by small businesses in a formal sense, but larger corporations often use them for unique transactions without other source documents.

What are the four main types of source documents discussed in the script?

-The four main types of source documents mentioned are invoices (for sales on account), receipts (for cash received), checks (for cash purchases), and memorandums (for transactions without other source documents).

Why might the format of invoices vary, while checks have a defined look?

-Invoices have no set format, so they come in different shapes and styles depending on the business. Checks, however, have a fairly standard format across businesses.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

What are accounting source documents?

source documents in accounting - part 1 an overview - VCE Accounting

Transaction & Analysis Recording, Part I

3.2 Source Documents

CBSE/NCERT Class 11 Accounts Chapter - 1, Accounting as a Source of Information, Lecture - 3

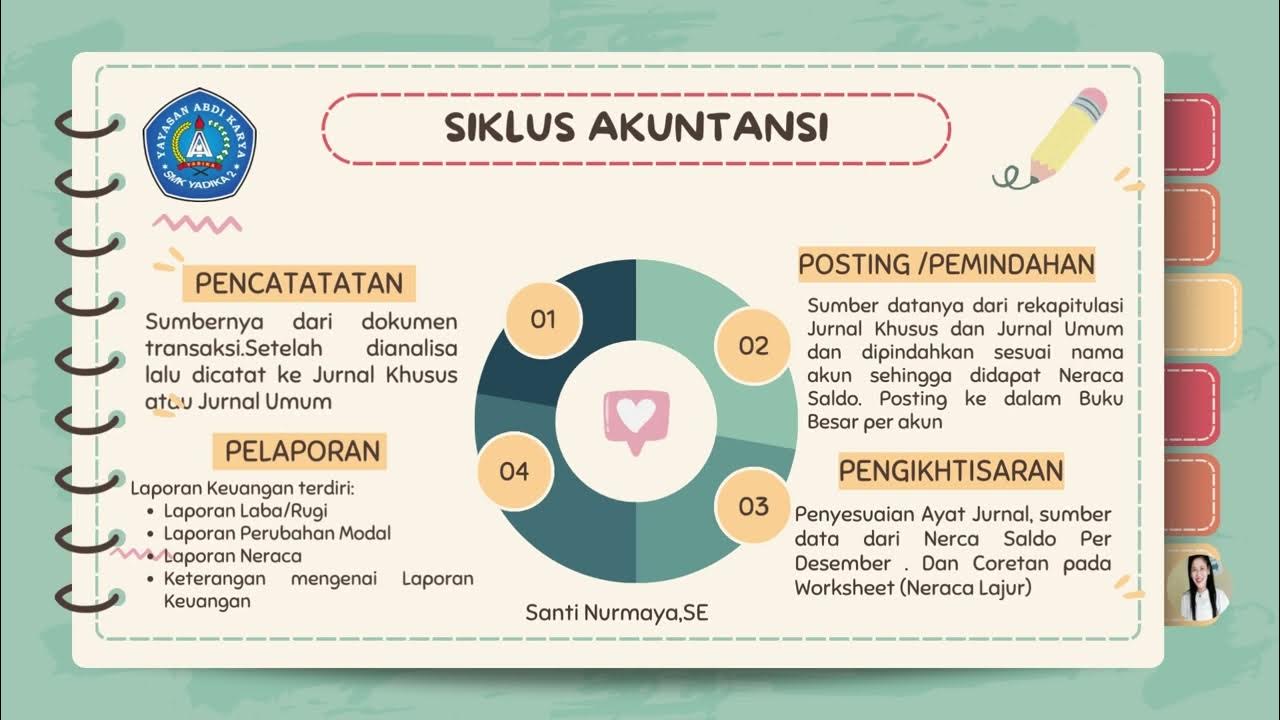

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

5.0 / 5 (0 votes)