Types of Source Documents

Summary

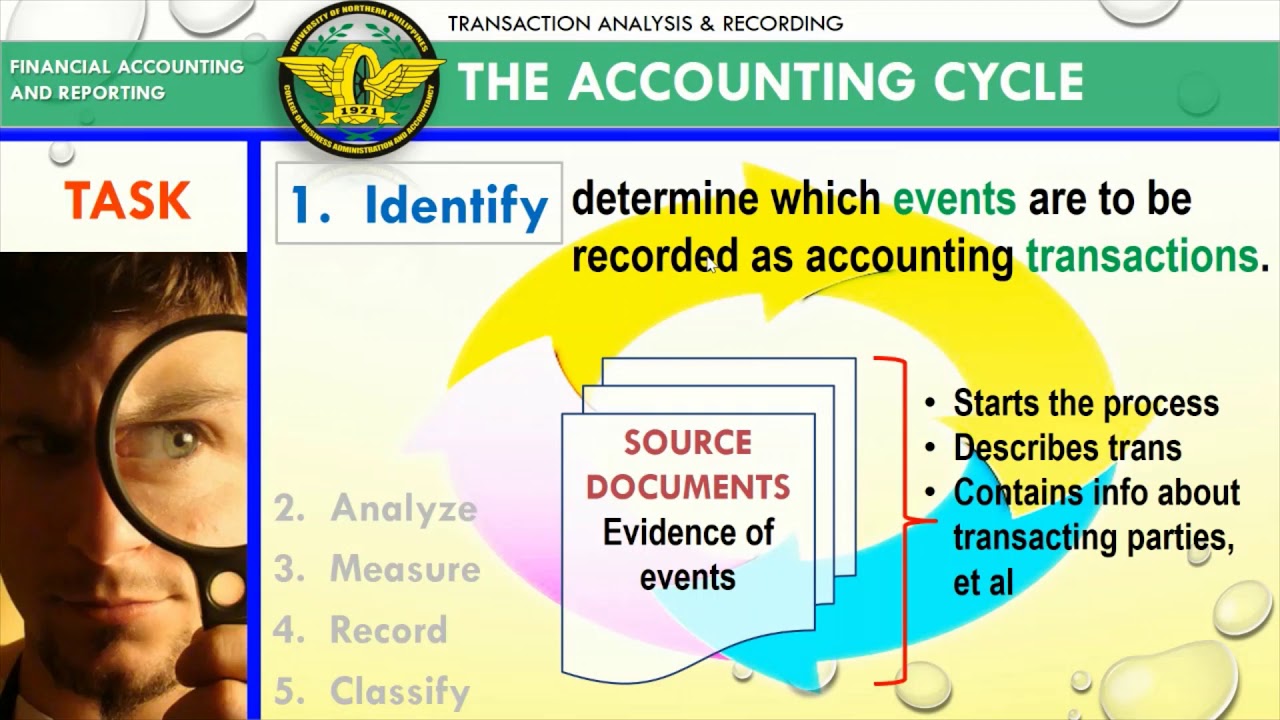

TLDRThis script outlines the fundamental business transactions involving suppliers and customers, emphasizing the importance of source documents in recording these interactions. It explains the concept of original documents given to the recipient and copies retained by the issuer, such as businesses. The script covers various transaction types, including cash payments, electronic funds transfers, checks, purchase invoices, sales invoices, and credit notes, illustrating how businesses maintain records for both cash and credit transactions.

Takeaways

- 📚 Basic Business Transactions: The script explains the simple concept of business transactions involving suppliers, the business itself, and customers.

- 🛒 Suppliers and Inputs: Suppliers provide necessary inputs to the business such as inventory, labor, and materials.

- 💵 Payment Methods: Transactions can occur through cash payments or on credit, where payment is deferred.

- 📝 Source Documents: Source documents are essential to prove that transactions have taken place, whether they are for cash or credit.

- 📑 Original vs. Copy: In a transaction, there is typically an original document for the customer and a copy kept by the business.

- 👢 Customer's Original: The customer usually receives the original document, such as a receipt, after a purchase.

- 💻 Digital Copies: Copies of documents can be digital and stored within a business's computer system.

- 💳 Cash Receipts: When a business pays suppliers in cash, the source document is a cash receipt, with the business receiving the original.

- 📬 Purchase Invoices: For credit purchases from suppliers, a purchase invoice is issued, with the business holding the original document.

- 📦 Sales Transactions: When selling to customers, whether for cash or credit, the business issues receipts or invoices, keeping a copy.

- 🔄 Credit Sales and Invoices: Sales on credit to customers are documented with a sales invoice, with the customer receiving the original.

Q & A

What are the three main components in the basic business transaction cycle mentioned in the script?

-The three main components are suppliers, the business itself, and customers.

What types of inputs do suppliers provide to a business?

-Suppliers provide inputs such as inventory, labor, and materials, which are essential for running the business.

How are transactions typically conducted between a business and its suppliers?

-Transactions can be conducted either for cash, where payment is made immediately, or on credit, where payment is made at a later date.

What is the significance of source documents in business transactions?

-Source documents serve as proof of transactions, helping to record and verify the details of business activities.

What is the difference between the original document and a copy in the context of business transactions?

-The original document is typically given to the customer or client, while the issuer of the document, such as the business, keeps a copy for their records.

Why is it important for a business to maintain a copy of the transaction documents?

-Maintaining a copy allows the business to refer back to the transaction details if needed in the future, ensuring accurate record-keeping and facilitating audits or disputes resolution.

What is the purpose of a cash receipt in a business transaction?

-A cash receipt serves as proof of a cash transaction, documenting the payment made by the business to a supplier.

What types of transactions are associated with electronic funds transfers (EFT) and checks?

-EFT and checks are used for transactions where payment is made electronically or through a written order to a bank to pay a certain amount from the payer's account to the payee's account.

What is a purchase invoice and why is it used?

-A purchase invoice is used for credit transactions where goods or services are bought from a supplier but payment is not made immediately; it serves as a document for the transaction and a record of the obligation to pay at a later date.

How are sales transactions to customers for cash handled in terms of documentation?

-For cash sales, the business provides the customer with a receipt, which serves as proof of the transaction, and the business retains a copy for its records.

What is the difference between a purchase invoice and a sales invoice?

-A purchase invoice is issued by a supplier to a business for goods or services bought on credit, while a sales invoice is issued by a business to a customer for goods or services sold on credit.

What is a credit note and when is it issued by a business?

-A credit note is issued by a business when a customer returns a product or when a discount is applied; it serves as a document to adjust the amount owed or to provide a refund.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)