What are accounting source documents?

Summary

TLDRThis script offers an insightful overview of accounting source documents, which serve as proof of economic transactions and are essential for recording and verifying transactions in accounting ledgers. It outlines the goals, content, and types of these documents, including invoices, receipts, and purchase orders, and emphasizes the importance of retaining them as per legal regulations. It also discusses the categorization of documents as internal or external and the necessity for companies to have policies for document retention and destruction.

Takeaways

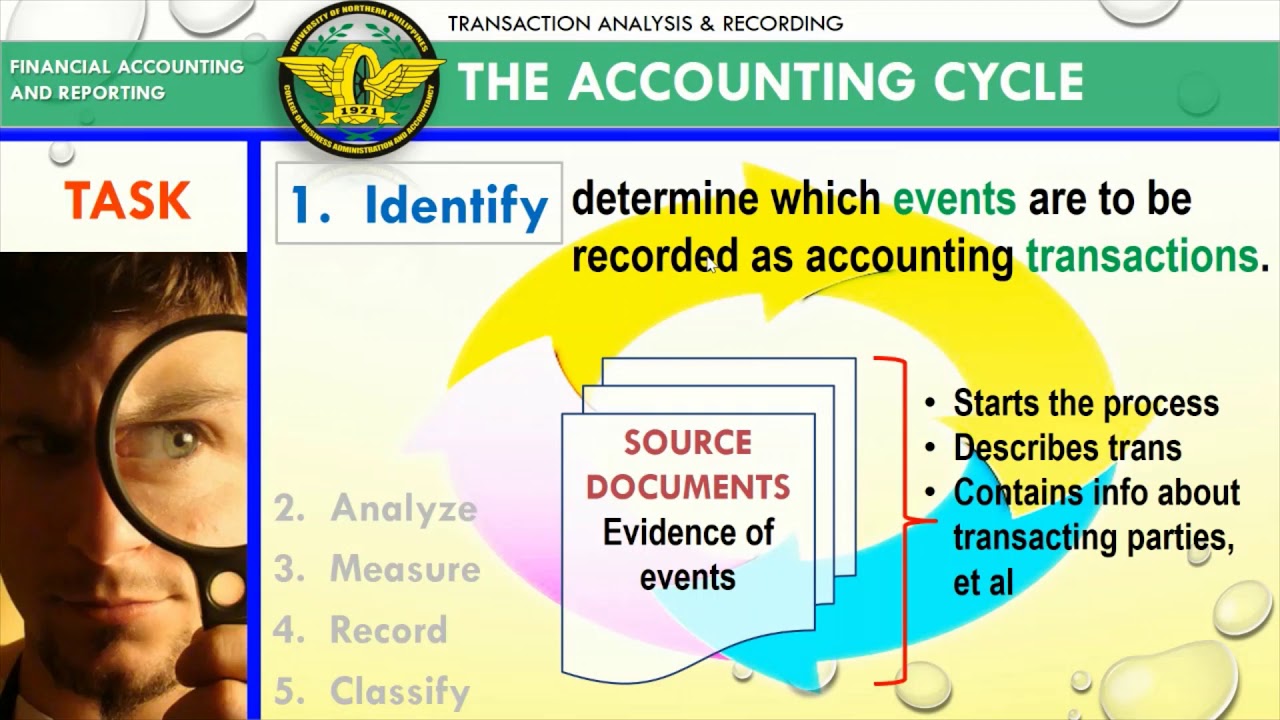

- 📑 Accounting source documents serve as proof of economic transactions and are essential for recording and verifying transactions in accounting ledgers.

- 📈 They are required to validate various transactions such as purchases of raw materials, shipping products, online sales, and service subscriptions.

- 🎯 The primary goals of these documents are to provide evidence of transactions, notify parties of economic activities, describe transactions for bookkeeping, and assist in tax calculation and reporting.

- 📝 Essential elements of accounting source documents include the transaction date, reference number, names of involved parties, transaction description, document type, and details of items or services with quantities and currency.

- 🗂 Companies must retain these documents for several years as per local legal regulations, and may choose to keep them longer for additional security or utility.

- 🔒 Each company should have a policy for the secure destruction of these documents to control their elimination over time.

- 🏢 Documents can be categorized as internal or external, with external documents often considered more crucial as they provide proof of transactions with external parties.

- 🧾 Common types of source documents include invoices, cash receipts, purchase orders, sales orders, delivery notes, goods received notes, debit and credit notes, time cards, and bank statements.

- 💼 An invoice is issued by a company when selling products or services, detailing the transaction and providing a copy for both the buyer and seller.

- 💳 A cash receipt verifies the transfer of cash between parties and includes details such as the transaction amount and currency.

- 🛒 A purchase order is a binding agreement from the buyer to the seller, specifying the items, quantities, price, delivery, and payment terms.

- 📦 A delivery note accompanies shipped goods, providing proof of delivery and including details about the transaction and the parties involved.

Q & A

What are accounting source documents?

-Accounting source documents are records that provide proof of an economic transaction. They are the basis for information recorded in accounting ledgers and are used to verify the validity of transactions.

Why are accounting source documents necessary?

-They are necessary to provide proof of a transaction's occurrence, to record and notify parties of an economic transaction, to describe the transaction for bookkeeping, and to calculate and report taxes.

What are the minimum requirements for an accounting source document?

-At a minimum, accounting source documents must contain the date of the transaction, a reference number, the names of the involved parties, a description of the transaction, the type of document, and details about the items or services, quantities, amounts, and currency.

How long must a company retain accounting source documents according to local legal regulations?

-The retention period varies according to local legal regulations, but companies must have a policy for retaining these documents for several years.

What are the benefits of keeping accounting source documents for longer than the legal requirement?

-Keeping documents longer can be useful for providing evidence in internal consultations, lawsuits, or to enhance customer service.

What is the purpose of a company's source document destruction policy?

-The policy helps organizations control the elimination of documents after a certain period, ensuring compliance and orderly document management.

How can accounting source documents be categorized?

-They can be categorized as internal or external, depending on whether they were generated within the company or received from another party.

Why are external source documents considered more important?

-External source documents are considered more important because they provide proof of a transaction with another party, which is essential for accurate accounting.

What is an example of an external source document?

-An example of an external source document is an invoice issued by a seller when a company purchases a product or service.

Can you provide an example of an internal source document used in accounting?

-An example of an internal source document is a time card, which companies use to register working hours of personnel for wage payment.

What is the role of a bank statement in accounting?

-A bank statement is used to enter payments into the accounting system and match them to invoices. It is crucial for verifying the accuracy of payments and transactions during an audit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)