7 Elements to High Probability Models

Summary

TLDRThis video delves into building a high-probability trading model based on ICT principles. It covers seven key elements: understanding market conditions, time and price alignment, the narrative behind price movements, market structure, real institutional order flow, sound money management, and rule-based entry and exit criteria. The video emphasizes a mechanical approach to trading, avoiding impulsive decisions, and focusing on disciplined execution. By mastering these principles, traders can enhance their chances of success while managing risk and emotions effectively.

Takeaways

- 😀 Market conditions and time/price theory are essential for understanding price movements, which include expansions, retracements, and consolidations.

- 😀 Knowing the market structure helps in identifying whether the market is trending or consolidating and allows traders to anticipate price movements.

- 😀 A narrative behind price movement is crucial for predicting the direction and reasons why the market behaves in a certain way.

- 😀 Real order flow reflects how institutional players behave in the market, with price either expanding or retracing toward certain key price levels (up-close or down-close candles).

- 😀 In bearish order flow, price reacts to up-close candles as resistance, while in bullish order flow, price reacts to down-close candles as support.

- 😀 High probability strategies involve recognizing the cycle of price: expansion, retracement, or consolidation, followed by another expansion.

- 😀 Sound money management is vital, including determining how much risk to take on each trade, setting limits on losses, and knowing when to stop trading after a certain number of losses.

- 😀 Every trader should have a clear, written risk management plan to avoid impulsive decisions and excessive risk during a negative state of mind.

- 😀 Trading decisions should be based on clear, mechanical entry and exit criteria rather than impulsive or emotional responses to market movements.

- 😀 Having a disciplined, rule-based system removes subjectivity from trading and helps maintain consistency and control over risk exposure.

Q & A

What is the main focus of this trading model?

-The main focus of this trading model is understanding the market's behavior, specifically the phases of market expansion, retracement, and consolidation, and applying this understanding to enter and exit trades effectively with high probability.

Why is it important to recognize market conditions before trading?

-Recognizing market conditions is crucial because it helps traders understand the likely direction of the market. Price tends to move in phases—expansion, retracement, and consolidation—and knowing these phases allows for better timing of entries and exits.

How does the concept of time and price theory impact trading strategies?

-Time and price theory suggests that not just price levels but also the timing of price movements matters. Understanding when price is likely to reach certain levels can enhance the probability of successful trades, aligning entries with key time frames and price zones.

What is the role of market structure in high-probability trading?

-Market structure provides a broader view of price movements. It helps traders understand how price typically moves in large expansions followed by retracements or consolidations. Recognizing these patterns allows for more accurate predictions about future price action.

What does 'real order flow' refer to in the context of trading?

-Real order flow refers to how institutional buying and selling orders affect the market. In bearish markets, price retraces into up-close candles, and in bullish markets, price retraces into down-close candles. These movements help identify key levels of support and resistance.

How can a trader avoid getting trapped by false price movements?

-A trader can avoid getting trapped by recognizing the underlying order flow and market structure. By understanding that price doesn't move in a straight line and anticipating retracements or consolidations, traders can avoid entering trades at the wrong time.

What is the significance of having a sound money management plan?

-A sound money management plan ensures that traders take on a controlled level of risk, which prevents emotional decision-making. It defines how much risk to take per trade, how many losses are acceptable, and when to stop trading to protect capital.

How can a risk management plan help traders stay disciplined?

-A risk management plan provides clear guidelines for how much risk to take on each trade and how to handle losses. This prevents impulsive decisions and ensures that traders maintain discipline even during periods of drawdown or negative emotions.

Why is it essential to have rule-based entry and exit criteria?

-Rule-based entry and exit criteria are essential because they eliminate the emotional aspect of trading. Having predefined rules for when to enter and exit trades ensures consistency and prevents impulsive decisions based on market fluctuations.

What is the connection between understanding market behavior and developing a trading strategy?

-Understanding market behavior, including the phases of expansion, retracement, and consolidation, allows traders to develop strategies that are aligned with the natural flow of the market. By recognizing these behaviors, traders can improve the accuracy and profitability of their trades.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

2023 ICT Mentorship - ICT Silver Bullet Time Based Trading Model

How To Predict The ICT Market Maker Model LIVE

A+ ICT Trading Checklist - ICT Concepts

Understanding The Difference Between AMD & Po3:

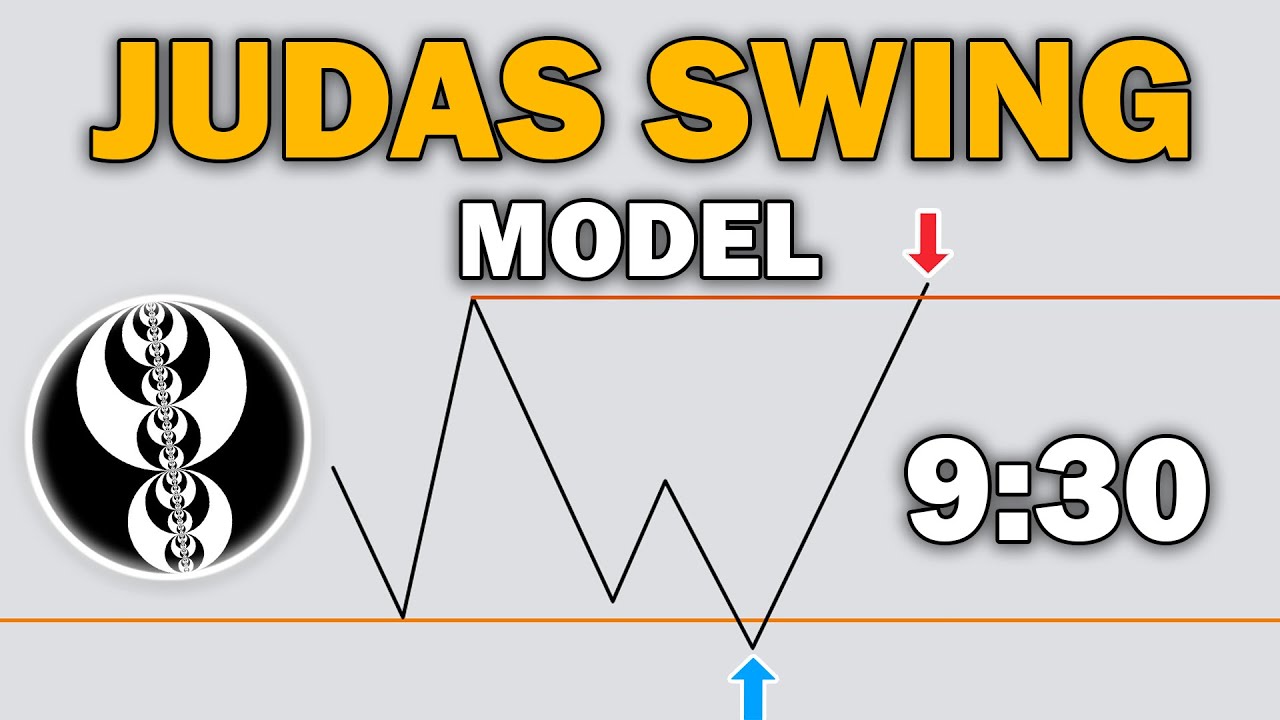

ICT 9:30am Judas Swing Model - Explained In-depth

Why You Don't Understand ICT Liquidity | Strategy + Entry Model

5.0 / 5 (0 votes)