ICT 9:30am Judas Swing Model - Explained In-depth

Summary

TLDRIn this video, the trader walks viewers through the Judah Swing model, explaining their analysis and execution process in a live trade. The trader anticipates price movement based on ICT concepts, focusing on key levels such as 930, midnight, and 830 open, to identify manipulation and liquidity targets. By buying at a discount, they aim for a bullish price expansion, utilizing market structure shifts, fair value gaps, and the manipulation of sell-side liquidity. The trader shares personal insights on trading psychology, probability, and risk management, offering practical advice for those following ICT strategies.

Takeaways

- 😀 The trader is using the '930 Judah Swing' model, focusing on market manipulation around specific times to anticipate price movement.

- 😀 Key levels like midnight, 8:30, and 9:30 are marked to track price manipulation and identify entry and exit points for trades.

- 😀 Price consolidation and liquidity levels, such as sell-side and buy-side, play a crucial role in setting trade expectations.

- 😀 The trader looks for a market structure shift, such as a change in state delivery, to indicate that smart money is entering the market.

- 😀 The strategy anticipates a price drop to take out sell-side liquidity before pushing higher toward a bullish target.

- 😀 A fair value gap is identified on the 15-minute chart, and the trader expects price to break through and retest this gap as support before moving higher.

- 😀 Risk management is emphasized through trailing stops, moving them to break-even once certain price levels (like 9:30 open) are reached.

- 😀 The trader's analysis includes the concept of a 'Judah Swing,' where price briefly moves against the expected direction before resuming the main trend.

- 😀 The trader actively monitors price speed and aims for quick movement through key levels, avoiding retracements that would signal a wrong bias.

- 😀 The strategy involves using the 9:30 open to manipulate beneath earlier levels (midnight and 8:30), targeting liquidity before resuming the bullish trend.

- 😀 The trade ultimately aims for a liquidity target at 16,999, based on previous analysis, with trade updates shared with Discord members in real-time.

Q & A

What is the '930 Judah Swing' model mentioned in the script?

-The '930 Judah Swing' model refers to a specific trading strategy based on market manipulation, targeting liquidity around the 9:30 AM opening. The strategy involves identifying price manipulation beneath key price levels, such as the midnight and 8:30 AM open, to execute trades with the expectation that price will move in a specified direction.

What does the trader mean by 'manipulation' in this context?

-In this context, 'manipulation' refers to the price movement designed to trigger stop-losses (liquidity) from traders who are positioned incorrectly. The trader expects that after manipulation, smart money will step in and push the price in the anticipated direction.

What role do fair value gaps (FVG) play in the strategy?

-Fair value gaps (FVG) are used to identify potential areas where price might retrace or reverse. In this strategy, a fair value gap indicates a level where the trader expects price to test before moving in the anticipated direction, often acting as a support or resistance zone.

How does the trader use the concept of market structure shifts?

-The trader looks for market structure shifts, such as when price breaks above a previous high or low, indicating a potential reversal or continuation. A shift in market structure, especially in consolidation phases, helps the trader identify potential buy or sell opportunities.

What is the significance of the 'sell-side liquidity' in the script?

-Sell-side liquidity refers to areas where traders have set sell orders, such as stop-losses. The strategy involves targeting these areas for manipulation, where smart money steps in to buy from those forced to sell, with the expectation that price will reverse and continue in the trader's preferred direction.

Why does the trader monitor specific time levels like midnight, 8:30 AM, and 9:30 AM?

-The trader monitors these specific time levels because they mark key price points where significant market movement can occur, particularly related to institutional trading behavior. These time levels help identify potential zones of price manipulation and reversal, aiding in the timing of trade entries.

What is the trader’s target for this specific trade?

-The trader's target for the trade is the level at 16,979. This level is identified as a key buy-side liquidity target that price is expected to reach, based on the trader's analysis of market manipulation and structure shifts.

How does the trader manage risk during the trade?

-The trader manages risk by trailing the stop loss as the price moves in their favor. Once the price reaches certain milestones, such as breaking above fair value gaps, the trader adjusts the stop to break even to ensure that the trade cannot turn into a loss. The goal is to lock in profits while protecting against unexpected reversals.

What is the purpose of marking out the 9:30 open in the strategy?

-Marking out the 9:30 open serves as a reference point for potential price manipulation. The trader anticipates that price will manipulate beneath or around the 9:30 open before continuing in the intended direction, which helps in determining when to enter and exit trades.

What does the trader mean by 'Judah swing' and how does it relate to this strategy?

-The 'Judah swing' refers to the expected price move that manipulates liquidity in the opposite direction of the trader’s bias. In this case, the trader expects a price drop (a 'Judah swing') at 9:30 to trigger sell stops, after which the price will move higher to hit the buy-side liquidity target.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

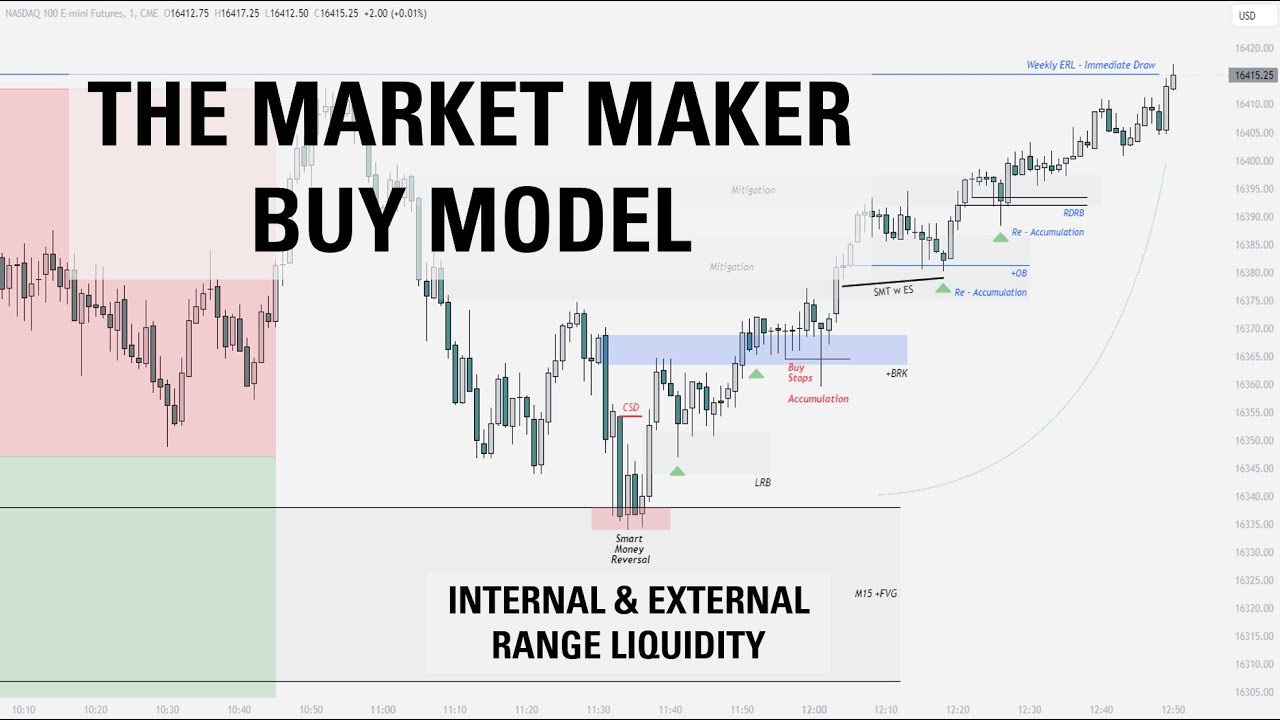

The Market Maker Buy Model | Full Trade Breakdown $NQ

Smart Money NY Session Trade | ICT Concepts + FVG + Order Block Precision | BREAKDOWN

Day Trading NQ Market Maker Model Review - ICT Concepts

How to Trade Profitably like a Professional - EURUSD Trade Breakdown 3/3/25 - ICT Concepts

How to Trade the ICT Market Maker Model (LIVE)

Using a Mitigation Block For Trade Entry

5.0 / 5 (0 votes)