What Is Compound Interest? | Investopedia

Summary

TLDRThis script explains the concept of compound interest, contrasting it with simple interest. With simple interest, an investment of $10,000 at 5% yields $500 annually for three years, totaling $1,500. Compound interest, however, calculates interest on the initial investment plus accumulated interest, resulting in $1,576.25 over the same period. The script emphasizes the power of compounding, especially over longer durations, as interest earnings grow exponentially.

Takeaways

- 📈 Compound interest is calculated on the initial principal and all accumulated interest.

- 🔢 To grasp compound interest, it's helpful to compare it with simple interest first.

- 💼 Simple interest is calculated only on the original principal amount.

- 💵 If you deposit $10,000 at a 5% simple interest rate for three years, you earn $500 per year, totaling $1,500 in interest.

- 📊 With compound interest, the interest for the second year is calculated on the original principal plus the interest from the first year.

- 🌐 In the third year, compound interest is calculated on the total amount including interest from the first two years.

- 💹 Over three years, $10,000 at 5% compounded annually yields $1,576.25 in interest, compared to $1,500 with simple interest.

- 🚀 The difference between compound and simple interest grows larger over time due to the compounding effect.

- 🌟 The power of compounding becomes more significant as time periods extend and the interest earned grows.

- ⏳ The longer the investment period, the more the compound interest will accumulate, highlighting the importance of starting to invest early.

Q & A

What is compound interest?

-Compound interest is the interest earned on the original investment plus all the interest earned on the interest that has accumulated over time. It can be thought of as 'interest on interest'.

How does simple interest differ from compound interest?

-Simple interest is calculated only on the original principal, whereas compound interest is calculated on the principal and the accumulated interest.

How much interest is earned on $10,000 with a 5% simple interest rate over 3 years?

-The interest earned is $500 per year, for a total of $1,500 over 3 years.

What is the interest earned in the first year if $10,000 is invested at 5% interest compounded annually?

-The interest earned in the first year is $500.

How is the interest calculated in the second year for compound interest?

-In the second year, interest is calculated as 5% of $10,500 (the original $10,000 plus $500 from year one), resulting in $525.

What is the total amount of interest earned by the end of the third year with compound interest?

-The total interest earned by the end of the third year is $1,576.25.

How much more interest is earned with compound interest compared to simple interest over 3 years?

-With compound interest, $76.25 more is earned compared to simple interest over 3 years.

Why does compound interest result in a larger amount of earned interest compared to simple interest?

-Compound interest results in a larger amount because it includes interest on previously earned interest, which increases the total interest earned over time.

How does compounding become more powerful over time?

-Compounding becomes more powerful over longer periods because the interest earned grows larger as it accumulates on both the principal and the previously earned interest.

What would be an example of the principal in a compound interest scenario?

-In the example provided, the principal is the original $10,000 investment.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

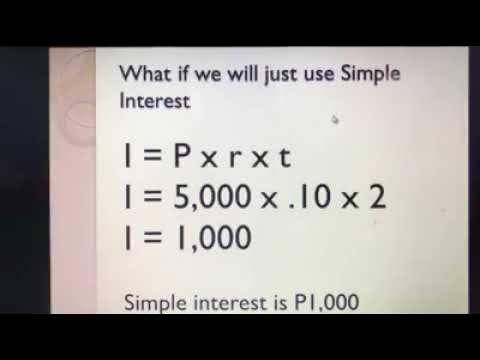

COMPOUND INTEREST LONG METHOD PERSONAL FINANCE L3 Video2

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

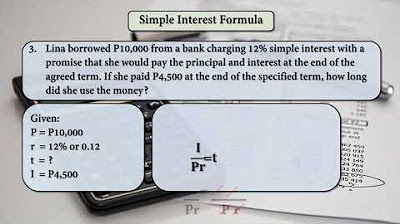

Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

BUNGA TUNGGAL DAN BUNGA MAJEMUK

5.0 / 5 (0 votes)