BUNGA TUNGGAL DAN BUNGA MAJEMUK

Summary

TLDRIn this video, the concept of interest is explained, focusing on two types: simple interest and compound interest. Simple interest is calculated based on a fixed principal over a set period, while compound interest adds interest to the principal, leading to increasing amounts over time. Examples illustrate both types of interest, such as loan calculations and savings in a bank. The video also covers how to apply the formulas for each type and provides practical examples with calculations to help viewers understand the difference between simple and compound interest.

Takeaways

- 😀 Interest is the money paid for borrowing or saving, calculated based on the principal and a fixed period.

- 😀 Simple interest is calculated on the initial principal only, and remains the same across each period.

- 😀 Compound interest is calculated on the initial principal plus accumulated interest, which increases over time.

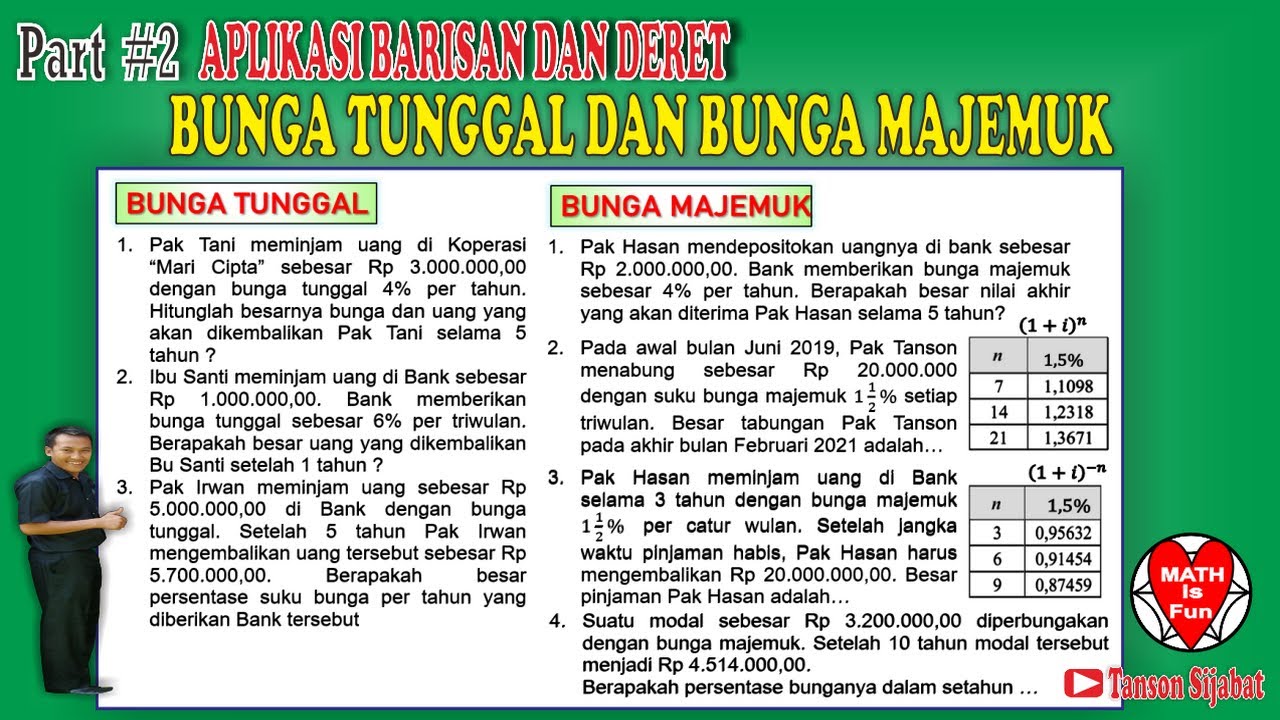

- 😀 The formula for simple interest is: B = M * I * T, where M is principal, I is interest rate, and T is time.

- 😀 The formula for compound interest is: M_N = M_0 * (1 + i)^N, where M_0 is initial principal, i is interest rate, and N is the number of periods.

- 😀 In simple interest, the interest remains constant for each period, making it predictable and straightforward.

- 😀 Compound interest leads to exponential growth, as the interest earned is added to the principal, which then earns its own interest.

- 😀 The total value of simple interest after a period is the principal plus the interest earned over time.

- 😀 In compound interest, the total value increases over time as each period’s interest adds to the base principal.

- 😀 The key difference between simple and compound interest is that simple interest is based on the original amount, while compound interest is based on the growing total, including interest.

- 😀 Example calculations help illustrate how to apply both simple and compound interest formulas in real-world scenarios, making financial concepts easier to understand.

Q & A

What is the definition of interest as described in the video?

-Interest is the service or fee paid for borrowing money or saving money, calculated at the end of a predetermined period. In the example, a trader borrows 2 million rupiah and agrees to repay 2.2 million rupiah, where the 200,000 rupiah is the interest.

What are the two types of interest discussed in the video?

-The two types of interest discussed are simple interest and compound interest. Simple interest is calculated based on a fixed principal amount, while compound interest is calculated on the principal amount and accumulated interest.

What is the key difference between simple interest and compound interest?

-The key difference is that simple interest is calculated based on the same principal each period, while compound interest includes interest from previous periods, causing the principal to grow with each calculation.

How is simple interest calculated according to the video?

-Simple interest is calculated using the formula: B = M * I * T, where B is the interest, M is the principal (borrowed or saved amount), I is the interest rate, and T is the time period.

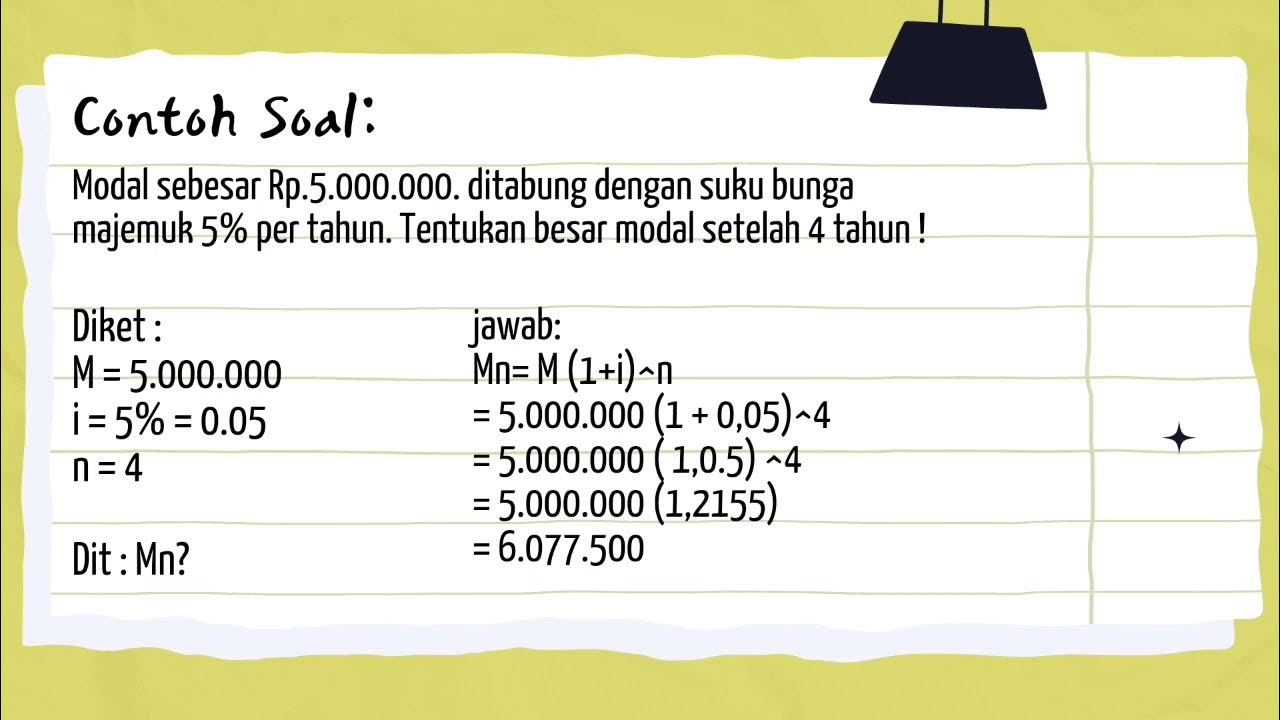

How is compound interest calculated, and what formula is used?

-Compound interest is calculated using the formula: MN = Mo * (1 + I)^n, where MN is the amount at the end of the nth period, Mo is the initial capital, I is the interest rate, and n is the number of periods.

In the example of simple interest, what was the capital and interest for a 1 million rupiah loan at 2% per month for 9 months?

-For a 1 million rupiah loan at 2% per month for 9 months, the interest calculated was 180,000 rupiah, bringing the total amount to 1,180,000 rupiah.

How is the interest rate adjusted when the period is less than a year, as shown in Siti's example?

-In Siti's example, the annual interest rate of 18% was converted to a monthly rate of 1.5% by dividing 18% by 12 (the number of months in a year), and then the interest for 4 months was calculated accordingly.

What was the total amount in Siti’s account after saving 1.6 million rupiah for 4 months at an 18% annual interest rate?

-After saving 1.6 million rupiah for 4 months at an 18% annual interest rate, Siti's total amount was 1,696,000 rupiah, with an interest of 96,000 rupiah.

How is compound interest calculated in the example of Mrs. Roni's 6 million rupiah deposit?

-Mrs. Roni's 6 million rupiah deposit was calculated using the compound interest formula. With a 10% annual interest rate over 4 years, the final amount was 8,784,000 rupiah.

What was Mrs. Roni’s interest income from her deposit over 4 years?

-Mrs. Roni’s interest income from her 6 million rupiah deposit after 4 years, at a 10% annual interest rate, was 2,784,000 rupiah (8,784,000 - 6,000,000).

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Kelas XI - Matematika Keuangan Part 1 - Bunga Tunggal dan Bunga Majemuk

Bunga Tunggal dan Bunga Majemuk | Matematika SMA Kelas XI

SImple Interest

Bunga Majemuk || Materi Mtk wajib kelas 11 ( kurikulum merdeka)

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

BUNGA TUNGGAL DAN BUNGA MAJEMUK

5.0 / 5 (0 votes)