7. Gr 11 Accounting - Inventories - Theory Presentation

Summary

TLDRThis educational video script delves into the differences between perpetual and periodic inventory systems, focusing on their impact on financial record-keeping and decision-making. It highlights the importance of understanding inventory movements, cost of sales, and gross profit calculations, which are crucial for business performance evaluation. The script also emphasizes the need to distinguish between various inventory-related costs and how they are accounted for in each system, setting a foundation for further study in grade 12.

Takeaways

- 📈 The video focuses on the theory of inventory systems, specifically comparing Perpetual (continuous) and Periodic inventory systems.

- 📑 Under a Perpetual inventory system, all movements of trading stock are recorded, providing real-time data on stock levels and sales.

- 🛒 In a Perpetual system, the inventory quantities are updated after each transaction, allowing for precise tracking of items sold and remaining stock.

- 📚 For Periodic inventory systems, updates occur at the end of the accounting period with a physical count, which is necessary to determine remaining stock.

- 🔢 The script emphasizes the importance of understanding the differences between Perpetual and Periodic systems for financial analysis and decision-making.

- 💡 Key financial indicators discussed include cost of sales, gross profit, stock holding period, and stock turnover rate.

- 📋 The opening stock is the unsold stock from the previous financial year and is considered an expense in a Periodic inventory system.

- 🛍️ Purchases of stock during the year are also considered an expense, whether paid for in cash or on credit.

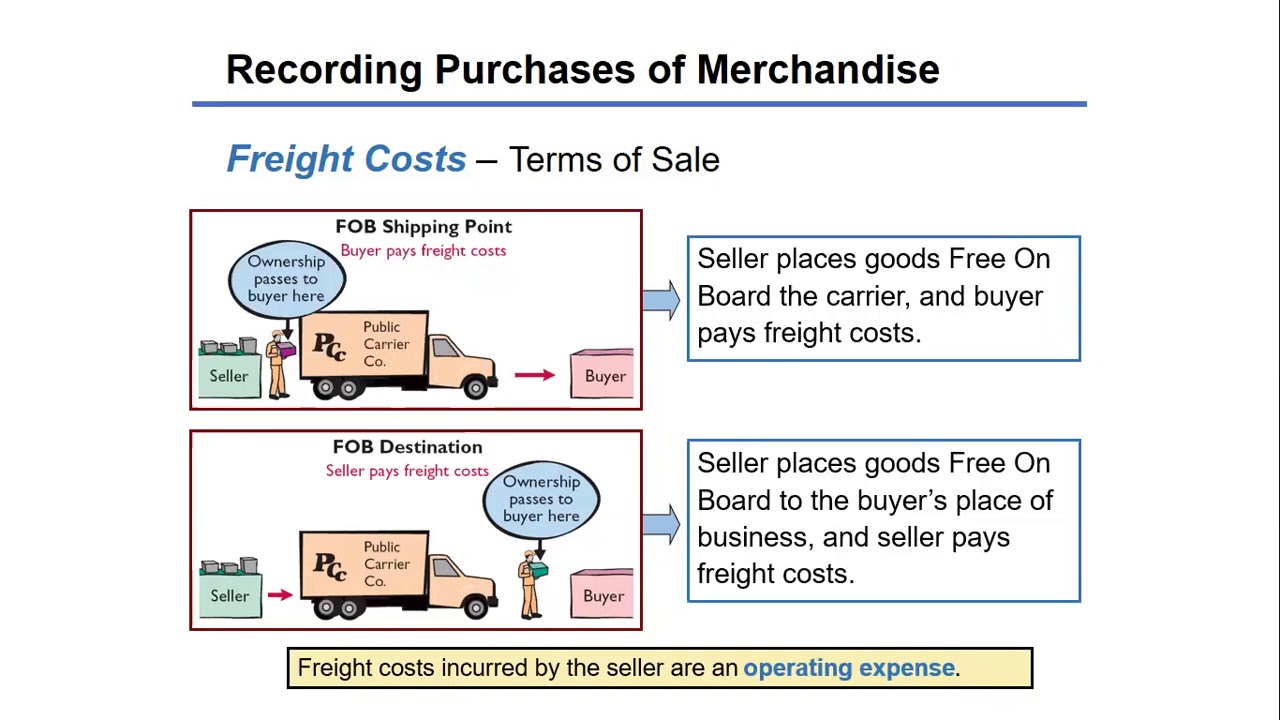

- 🚚 Additional costs such as Carriage on purchases, import duties, and other expenses related to acquiring trading stock must be accounted for separately.

- 🧾 In a Periodic system, the trading stock account only records opening and closing stock, with all other transactions affecting the purchase account.

- ⚖️ Cost of sales can be calculated by adding opening stock, purchases, Carriage on purchases, and other costs, then subtracting the closing stock.

- 📘 The video script lays a foundation for further study in inventory systems, particularly in evaluating stock within the two systems, which is crucial for Grade 12 studies.

Q & A

What is the primary difference between a Perpetual and a Periodic inventory system?

-The primary difference lies in the timing of inventory updates. In a Perpetual inventory system, inventory quantities are updated after each transaction, allowing for real-time tracking of items sold and remaining. In contrast, a Periodic inventory system updates inventory quantities only at the end of the accounting period, requiring a physical count to determine the remaining stock.

How does a Perpetual inventory system record the movement of trading stock?

-A Perpetual inventory system records all movements of trading stock in the trading stock account, which allows for the immediate reflection of sales and the remaining stock without the need for a physical count.

What is the significance of understanding the difference between Carriage on purchases and Carriage on sales in inventory management?

-Understanding the difference is crucial because Carriage on purchases is an expense related to the cost of acquiring inventory and is recorded in the purchase account, while Carriage on sales is an expense related to delivering goods to customers and is recorded separately in the profit and loss account. They affect the business's financial statements differently.

What are some examples of additional costs that might be associated with acquiring trading stock?

-Examples of additional costs include import duties, freight, harbor dues, and any other costs incurred in getting the trading stock before it is added to the inventory.

How is the cost of sales calculated in a trading account?

-The cost of sales is calculated by adding the opening stock, purchases, Carriage on purchases, and any other additional costs, then subtracting the closing stock from this total.

What is the role of opening stock in the context of inventory management?

-Opening stock represents the unsold stock from the previous financial year and is the stock balance at the beginning of the financial year. It is considered an expense to the business, especially in a Periodic inventory system.

How does the purchase of stock affect the trading stock account in a Periodic inventory system?

-In a Periodic inventory system, the purchase of stock, whether paid for in cash or on credit, is recorded in the purchase account rather than the trading stock account. The trading stock account only records the opening stock and the closing stock after the physical count.

What is the purpose of calculating the cost of sales?

-Calculating the cost of sales is essential for determining the gross profit and for financial reporting. It helps businesses understand the cost associated with producing or purchasing the goods they sell.

What is the relationship between sales and cost of sales in calculating gross profit?

-Gross profit is calculated by subtracting the cost of sales from the total sales. It indicates how much profit is made from sales after covering the direct costs of the goods sold.

Why is it important for students to understand both inventory systems when preparing for exams?

-Understanding both inventory systems is important because it provides a solid foundation for more advanced studies in grade 12 and helps students to be prepared for various problem-solving questions and scenarios they may encounter in exams.

What are some financial indicators that can be derived from inventory management?

-Financial indicators derived from inventory management include the cost of sales, gross profit, stock holding period, and stock turnover rate, which help in evaluating the efficiency of inventory management and the financial health of the business.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Lesson 030 - Accounting for Merchandising Operations 4: Periodic and Perpetual Inventory System

Accounting for Merchandising operation

Perbedaan METODE PERPETUAL VS METODE PERIODIK | Belajar Kilat IAI JATIM

FIFO Periodic & Perpetual I Pengantar Akuntansi

Accounting for Merchandising Operations Recording Purchases of Merchandise

Accounting for Merchandising Operations

5.0 / 5 (0 votes)