FIFO Periodic & Perpetual I Pengantar Akuntansi

Summary

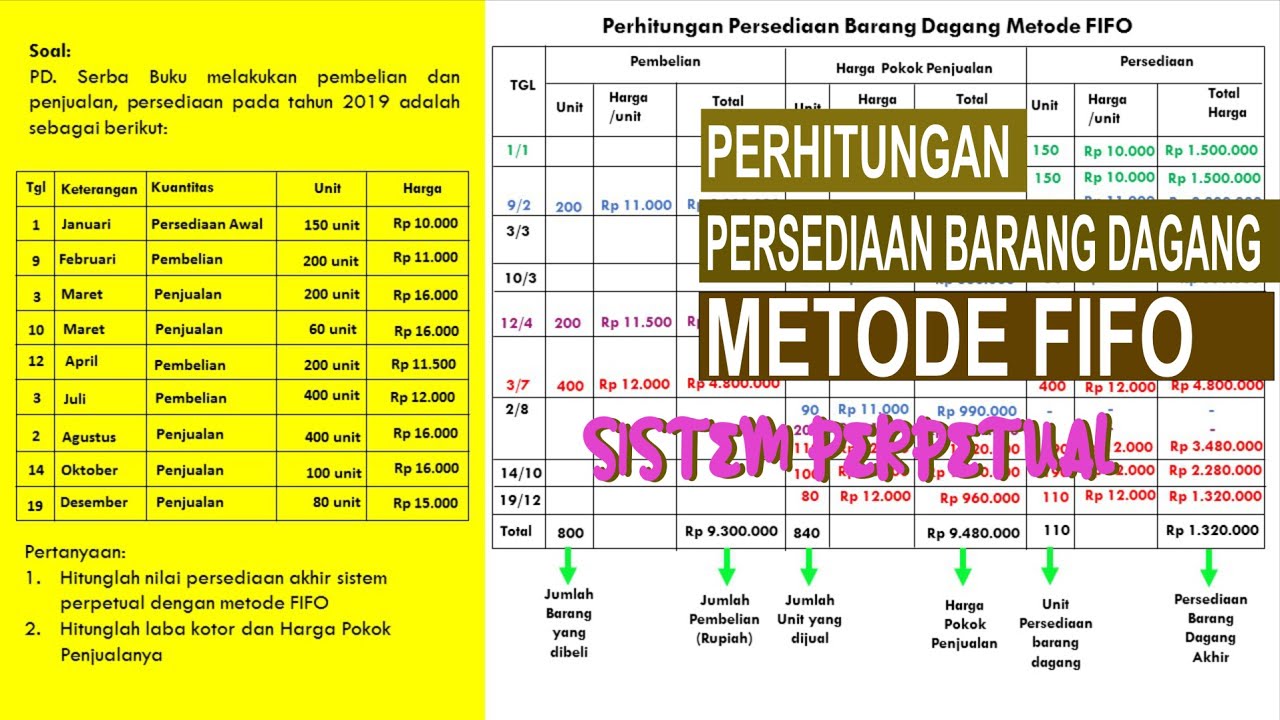

TLDRIn this educational video, Jesslyn explains the concept of inventory valuation in financial accounting, focusing on the First-In, First-Out (FIFO) method. She discusses the importance of inventory valuation in determining the value of goods a company holds. Using a practical example from 'Valencia.com', 3rd Edition, she demonstrates how to calculate inventory costs and manage transactions using the perpetual system. The video covers various transactions, including purchases, sales, and returns, illustrating how FIFO affects inventory costing and gross profit calculations. Jesslyn also compares the perpetual and periodic inventory systems, highlighting their differences and outcomes.

Takeaways

- 😀 The video is a tutorial on financial accounting, specifically focusing on inventory valuation.

- 📚 The presenter, Jesslyn, uses 'Valencia: Financial Accounting' 3rd Edition as a reference for the material.

- 📈 Two main inventory valuation methods are discussed: First-In, First-Out (FIFO) and Last-In, First-Out (LIFO), with the video focusing on FIFO.

- 🛒 FIFO assumes that the earliest inventory items are sold first, impacting cost calculations and financial records.

- 📊 Two systems for inventory tracking are mentioned: periodic and perpetual, with the latter updating inventory numbers after each transaction.

- 📋 The video provides a practical example using a list of transactions from Banana Milk Company to demonstrate FIFO implementation.

- 🔢 The presenter explains how to calculate the cost of goods sold (COGS) and ending inventory using the perpetual FIFO method.

- ⏫ The video illustrates how to handle returns and purchases at different unit prices, showing the step-by-step calculations.

- 💹 The gross profit is calculated by subtracting the total cost of goods sold from the total sales revenue.

- 📊 A comparison is made between the perpetual and periodic FIFO methods, showing that they yield the same ending inventory and gross profit figures.

- 👋 The video concludes with a reminder to stay tuned for more educational content from Jesslyn.

Q & A

What is the main topic discussed in the video?

-The main topic discussed in the video is financial accounting, specifically focusing on inventory valuation using the First In First Out (FIFO) method.

What does FIFO stand for in the context of inventory valuation?

-FIFO stands for First In First Out, which is a method of inventory valuation that assumes the items that are purchased first are sold first.

What are the two systems mentioned for inventory valuation?

-The two systems mentioned for inventory valuation are the periodic system and the perpetual system.

What is the difference between the periodic and perpetual inventory systems?

-In the periodic system, inventory is calculated at the end of an accounting period, while in the perpetual system, inventory records are updated with each transaction.

What is the importance of knowing the unit price and quantity in each transaction for FIFO calculations?

-Knowing the unit price and quantity in each transaction is important for FIFO calculations because it determines the cost of goods sold and the remaining inventory value.

How does the video explain the handling of a purchase return in FIFO perpetual method?

-The video explains that when handling a purchase return in the FIFO perpetual method, the principle of 'last in, first out' is applied, meaning the most recently purchased items are returned first.

What is the significance of the price difference between the purchase and sale in FIFO calculations?

-The price difference between the purchase and sale in FIFO calculations is significant because it affects the cost of goods sold and, consequently, the gross profit.

How does the video demonstrate the FIFO method using the example of Banana Milk transactions?

-The video demonstrates the FIFO method by walking through a series of transactions involving Banana Milk, showing how to update inventory cost and calculate the cost of goods sold at each step.

What is the impact of using the FIFO method on the ending inventory and gross profit figures?

-Using the FIFO method typically results in a higher ending inventory value and lower cost of goods sold, which can lead to a higher gross profit compared to other methods like LIFO.

How does the video compare the results of using the FIFO method in both periodic and perpetual systems?

-The video compares the results by showing that both systems yield the same ending inventory and gross profit figures, but the perpetual system provides continuous updates, whereas the periodic system updates at the end of the period.

What is the final message conveyed by the presenter regarding the FIFO method and future content?

-The presenter concludes by emphasizing that the FIFO method, whether used in a perpetual or periodic system, provides consistent results and hints at more educational content to come in future videos.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)