Lesson 030 - Accounting for Merchandising Operations 4: Periodic and Perpetual Inventory System

Summary

TLDRThis educational video script delves into the intricacies of accounting for merchandising operations, focusing on the periodic and perpetual inventory systems. It explains the lack of detailed inventory records in the periodic system, which relies on year-end physical counts, versus the perpetual system, which maintains ongoing inventory records to support management decisions. The script illustrates the differences through various transactions, emphasizing the perpetual system's real-time inventory tracking and its impact on financial reporting.

Takeaways

- 📚 The video discusses accounting for merchandising operations, focusing on two inventory systems: periodic and perpetual.

- 🔍 The periodic inventory system does not maintain detailed inventory records throughout the year, only requiring a physical count at the end of each period.

- 📈 The perpetual inventory system keeps detailed records of inventory, updating with every purchase and sale, which aids in management decision-making.

- 🛒 For purchases, both systems record the transaction, but the perpetual system also updates the inventory balance.

- 🔄 When returns occur, the periodic system adjusts accounts payable and purchase returns, while the perpetual system updates the inventory records accordingly.

- 💰 Sales transactions are recorded by debiting accounts receivable and crediting sales in both systems, but the perpetual system also records the cost of goods sold and updates inventory.

- 📉 The cost of goods sold is an important figure derived from the perpetual inventory system, representing the inventory that has been sold.

- 💡 The perpetual inventory system provides real-time inventory data, which can be crucial for businesses to manage stock levels and sales strategies.

- 💼 The script includes an example of transaction recording for both systems, illustrating the differences in handling purchases, returns, and sales.

- 📋 The video transcript mentions International Accounting Standard 2, which guides the valuation of inventory in financial statements.

- 🙏 The presenter concludes with a reminder to seek divine guidance for wisdom in understanding and applying the concepts taught.

Q & A

What are the two types of inventory systems discussed in the script?

-The two types of inventory systems discussed are the periodic inventory system and the perpetual inventory system.

What is the main difference between the periodic and perpetual inventory systems?

-The main difference is that the periodic inventory system does not maintain detailed records of inventory throughout the year, only requiring a physical count at the end of each period, while the perpetual inventory system maintains detailed records of inventory with every purchase and sale, updating the inventory balance in real-time.

How does the perpetual inventory system support management decision-making?

-The perpetual inventory system supports management decision-making by providing real-time information on the actual amount of inventory on hand, which can be used to make informed decisions about buying or purchasing inventories.

What is the significance of recording inventory transactions in the perpetual system?

-Recording inventory transactions in the perpetual system is significant because it allows for continuous tracking of inventory levels, which is crucial for accurate financial reporting and operational planning.

What is the initial transaction recorded on May 1st according to the script?

-The initial transaction on May 1st is a purchase of merchandise from Ryu Merchandising amounting to thirty thousand three hundred fifteen, with terms two over ten and over thirty.

How does the script describe the handling of a purchase return in the perpetual inventory system?

-In the perpetual inventory system, a purchase return is recorded by debiting accounts payable for the amount of the return and crediting merchandise inventory for the same amount, reflecting the reduction in inventory and accounts payable.

What is the entry recorded for a sale on account in the periodic inventory system?

-In the periodic inventory system, a sale on account is recorded by debiting accounts receivable for the selling price and crediting sales for the same amount, without adjusting the inventory records at the time of sale.

What additional entry is required in the perpetual inventory system when recording a sale?

-In the perpetual inventory system, an additional entry is required to record the cost of goods sold and to update the merchandise inventory, debiting cost of goods sold and crediting merchandise inventory for the cost of the merchandise sold.

How does the script illustrate the recording of a sales discount in the perpetual inventory system?

-The script illustrates the recording of a sales discount by debiting cash for the amount received after the discount, crediting accounts receivable for the original amount, and noting the discount taken.

What is the purpose of the handout 030 mentioned in the script?

-The purpose of handout 030 is to provide additional information related to the periodic and perpetual inventory systems, which is meant to enhance understanding of the concepts discussed in the script.

What does the script suggest for further learning after discussing inventory systems?

-The script suggests that the next lesson will be about special journals and subsidiary ledgers, indicating a continuation of the accounting topic.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Accounting for Merchandising operation

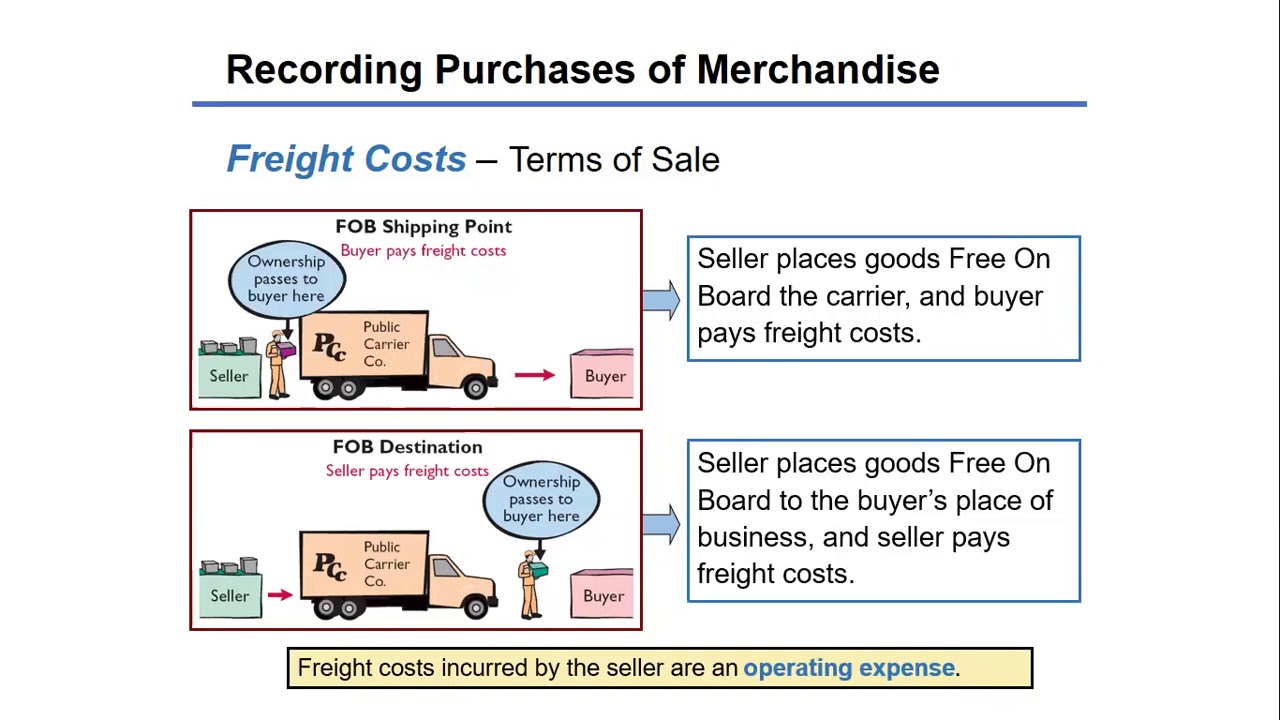

Accounting for Merchandising Operations Recording Purchases of Merchandise

Lesson 027 - Accounting for Merchandising Operations 1: Sales and Purchases

Grade 11 Accounting Term 3 | Inventory System | Part 1 of 2024

7. Gr 11 Accounting - Inventories - Theory Presentation

FIFO Periodic & Perpetual I Pengantar Akuntansi

5.0 / 5 (0 votes)